|

Monday November 16 | Weekly market update |

| Focused on the health crisis which is not losing intensity, European markets experienced a historic week last week after the announcement by the laboratory Pfizer of a vaccine in phase 3, 90% effective against Covid-19. Today, Moderna's announcement of a vaccine that is 94.5% effective against Covid adds to markets' good mood. Sectors that have been particularly badly hit since the beginning of the year (banking, land, oil, airlines, etc.) have experienced violent rebounds, as operators have temporarily abandoned technology, health and "containment" stocks, which had recently made strong gains. |

| Indexes All stock markets experienced positive performances last week, but it is Europe that stands out very clearly. The CAC40 was up 8.4%, the Dax by 4.8% and the Footsie by 7%. For the peripheral countries of the euro zone, Spain rose by 13.5%, Portugal by 8.1% and Italy by 6.4%. In Asia, the Nikkei stood out with a weekly performance of 4.3%, returning to levels not seen since 1991 (see graph). The Hang Seng won 1.8%, while the Shanghai Composite fell by 0.06%. As for American indices, the U.S. S&P500 broad index took advantage of the situation on Friday to set a new closing record at 3,585 points. Strong push of the Nikkei  |

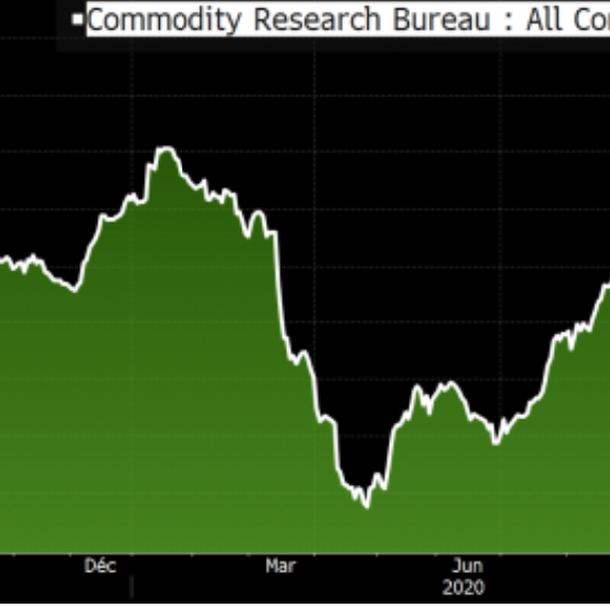

| Commodities Indications that OPEC+ would move closer to an agreement to postpone production increases supported prices, which rose more than 10 percent between Monday and Wednesday. Still far from sharing the enthusiasm of the markets, the International Energy Agency (IEA) warned that the emergence of a vaccine will not quickly revive demand for oil, pointing to the damage caused by the second wave of coronavirus in Europe and the United States. Brent and WTI are trading around US$44 and US$41, respectively. The renewed appetite for risky assets has weighed on gold and silver prices. Gold is trading at 1880 USD, against 24.2 USD for silver. Industrial metals recorded a positive weekly sequence, like nickel and lead, which rose by 2.2% and 1.8% respectively to USD 1796 and USD 1868 per metric ton. Graph of the CRB, the world raw materials index, which has shown a strong recovery in the last 6 months.  |

| Equities markets Applied Materials Inc. is a major equipment manufacturer in the semiconductor industry. The company is active in the design and marketing of equipment for the production of integrated circuits, as well as in the manufacturing of equipment for the production of integrated circuits. The products are likely to be present in almost all new electronic chips and display technologies. (82% of revenues and mainly in Asia). Lockdowns played an unexpected catalytic role. This led to a significant increase in cloud computing and demand for chips for data centers. In the longer term, the digitization of the economy is expected to significantly increase the demand for semiconductors and foster the growth of companies in this sector. Revenue is expected to grow to 2022, from $17 billion at the end of 2020 to $19.8 billion in 2022. The same trend is expected for EBITDA with an operating margin of 26.3% in 2020. The stock market performance shows a 17.4% increase since January and more than 26% year-on-year. The stock is part of our selection of American stocks. Upward path of the Applied Materials share  |

| Bond market Against a backdrop of euphoric equity markets, bond yields in the euro zone generally declined. After all, other variables in the market risk equation are still in the dark, such as Brexit, whose course appears to be quite opaque. Treasury yields have thus reached levels not seen since the beginning of the pandemic in March. The German bund is trading at a rate of -0.55%, down a few points, as is the French OAT at -0.31%. This downward trend can be seen in the countries of southern Europe, such as Italy, where the debt pays 0.65% to creditors. In the United States, the trajectory is rather upward, with the 10-year yield reaching a peak of 0.97%, 15 points higher than the previous week, a movement driven by the euphoria of Biden's victory and future support measures. |

| Forex market Faced with an intensive return for risky financial assets, safe-haven currencies are being cleared by currency traders. Thus the yen and the Swiss franc are retreating against all their major counterparts. At the same time, the more volatile currencies of the southern hemisphere are back on the rise. The strong surge of the Australian dollar, which gained 300 basis points against the Swiss franc (at 0.67 CHF) proves this, as does the surge of the New Zealand dollar against the euro at 1.781 (+500 basis points) and against the dollar at USD 0.69 (+300 basis points). In Europe, the euro continues its hesitation against the dollar and has been evolving in its horizontal trend for 5 months between 1.17 and 1.950. Across the Channel, the pound regains some color a few days before the brexit, which is nevertheless engulfed in the London fog. The increases of 400 basis points to 139.4 against the yen and 300 points against the greenback at JPY 132 remain surprising in this regard. In Asia, the hegemony of the yuan is confirmed with a new progression against the greenback at CNY 6.62. |

| Economic data Last week was not very busy in terms of statistics, which were relegated to the background with the health crisis. In China, the CPI and PPI indices disappointed, coming out respectively at +0.5% and -2.1% (against +0.8% and -1.9% expected). In Germany, data remained mixed. The Zew missed the consensus (39 vs. 45 expected), the CPI index was in line with expectations at +0.1% while the trade balance was slightly better than expected at 17.8B. For the Euro zone, industrial production fell by 0.4% (consensus +0.6%), GDP grew by 12.6% (consensus 12.7%) and the trade balance recovered to 24B (21B previously). In the United States, the CPI index was stable (consensus 0.1%), oil inventories rose by 4.3M (-2M expected). The PPI index, on the other hand, rose 0.3% (consensus 0.2%) and weekly unemployment registrations fell to 709K (730K expected and 757K last week). Michigan's confidence index fell to 77 (previously 81.1). |

| Vaccine announcements boost latecomers The violent upward reaction of the stock markets after announcements related to vaccines against Covid has helped to establish a hierarchy in investors' expectations. Indeed, the volatility observed last week and accompanied by a rotation of style, from "growth" to "value" very late, is a sign of the financial community's extreme sensitivity to this theme of hope. This medium-term perspective is overweighted in market attitudes, faced with short-term uncertainties characterized by the scale of the pandemic and its economic consequences. At the same time, in the United States, "post-election" fiscal policy will be watched with great attention, even though vaccine news could lead to a downward revision of the stimulus plan estimates. This would not necessarily be well received by the markets. |

By

By