|

Monday November 23 | Weekly market update |

|

Another week of growth for financial markets, which are benefiting from good vaccine news but also from the resumption of negotiations on the vast American recovery plan. In contrast to previous weeks, volatility was somewhat reduced, as operators remain concerned about peaks in contamination, particularly in the United States, and new restriction measures that are expected to have a significant impact on the economy. |

| Indexes On this last weekly sequence, the Nikkei reaped 0.5%, with profit taking having reduced the gains in the last two days. The Hang Seng gains 1.1% and the Shanghai Composite 2%. In Europe, the CAC40 recorded a weekly performance of 2.1%, returning to levels of late February. The Dax grabs 0.4% as does the Footsie. For the peripheral countries of the euro zone, Portugal gained 1%, Spain climbed 2.6% and Italy 3.8%. In the U.S., despite new historical records at the beginning of the week, the Dow Jones fell by 0.5% over the last five sessions. The S&P500 is down 0.4% and the Nasdaq100 is down 0.5%. |

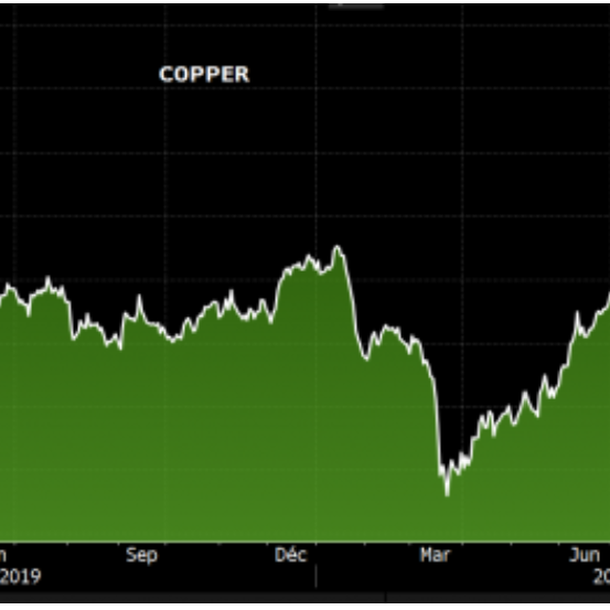

| Commodities Market conditions are improving for oil, supported by favorable news on the coronavirus vaccine front and the hope that OPEC+ will postpone its planned production increase in January. Risk appetite has weighed on the precious metals compartment last week. Gold thus returned to test its August and September levels at USD 1850. Silver is a little more resilient and is trading at USD 24.2 per ounce. Base metals had a positive week, supported by good economic data from China. Aluminum and lead continued to rise to USD 1983 and USD 1951 respectively, while copper reached a new annual high last week (see chart). Strong recovery of copper  |

| Equities markets JD.com, also known as Jingdong Mall, has a business model very similar to Amazon. It buys products, stores them in large warehouses and then redistributes them. This way of working allows the Chinese group to check the quality of the products in a country often criticized for weak quality controls. Founder and CEO Liu Qiangdong understands this, and is banking on his slogan "Zero tolerance for counterfeiting" to attract customers. It can be said that the group's strategy has worked perfectly since, with more than 300 million users in 2019, the distributor is Alibaba's main rival (700 million). It has partnered with technology giant Tencent, owner of WeChat, the most widely used social network in China, to set up a system for purchasing food products. The Beijing-based company has achieved a turnover of 577 billion yuan (74 billion euros) and analysts predict a 30% growth in 2020, a year that is particularly favorable for online commerce players. This strong growth is reflected on the stock market with a 144% increase in the share price since January 1st. This dynamism driven by the global pandemic is reflected in international rankings, JD.com is ranked 102nd among the largest companies in the world. Return of the stock on a relevant support  |

| Bond market Risk premiums on euro area government bonds appear to have stabilized. Even the report that Italy may have to release up to an additional 50 billion euros to at least partially cushion the negative economic impact has hardly triggered any movement in the market. The Italian 10-year yield is trading on a 0.63% basis. The spread does not change much with the Bund, which remains at -0.57%, and the OAT, which always generates a negative rate of -0.37%. It seems that investors still have almost unshakeable confidence in the power of ECB bond purchases. The southern countries are taking advantage of this, with Spain and Portugal currently engaged in a race to see which country on the Iberian Peninsula will be the first to post a negative yield on its 10-year government bonds. In the United States, where the political imbroglio may not be over, the Tbond is trading at a yield of 0.88%. |

| Forex market In a climate more dedicated to risk-taking, traders arbitrate their forex positions by shedding safe havens. The greenback is losing ground against all the G10 currencies, like the EUR/USD pair at USD 1.188 (see chart). The euro is, in fact, one of the main beneficiaries of the weakness of the U.S. dollar, despite difficulties in implementing the continental recovery plan. A month and a half before the official exit of the United Kingdom from the European Union, discussions between London and Brussels on future trade relations have stalled. This does not prevent the pound from appreciating against the dollar to USD 1.326 and against the Swiss franc to CHF 1.21. Still in Europe, it is worth noting the strong recovery of the Turkish lira, regaining about 1000 basis points against the dollar at TRY 7.54. On the Asian side, the yuan continues its hegemony by trading at 6.55 against the greenback, a high since June 2018. This appreciation comes from the strong Chinese economic recovery in recent months. In the southern hemisphere, the currencies of countries sensitive to the evolution of raw material prices are recovering. This is the case of the Australian dollar against the greenback at USD 0.73 (+300 basis points) as well as the Brazilian real at BRL 5.3 against the dollar. The Euro advances against the greenback  |

| Economic data Over the past week, the statistics were mixed. Japan is emerging from recession after three consecutive quarters of decline. GDP rebounded by 5% (-7.9% in the previous quarter). Industrial production rose by 3.9% (4% expected). In China, the figures were broadly in line with the consensus. Industrial production remained at +6.9%, the unemployment rate fell to 5.3% (5.4% previously) and retail sales were up 4.3% (compared with 5.1% expected and 3.3% last month). For the euro zone, few figures were on the agenda. The CPI index declined by 0.3% and the balance of payments showed a surplus of 25.2B (consensus 18.1B). In the United States, the Empire State Manufacturing Index fell to 6.3 (13.8 expected and 10.5 last month), retail sales rose only 0.3% (consensus 0.5%) and import prices fell 0.1%. Weekly unemployment registrations also disappointed at 742K (707K expected). On the other hand, housing data was above expectations, as were housing starts (1.53M) and sales of existing homes (6.85M). The PhillyFed index came out at 26.3 while the market expected 22. |

| The year-end rally comes early Index performances since the end of October can make you dizzy. The so-called "value" stocks are clearly recovering with indicators that are turning green. A new administration in Washington, a vaccine for next summer, new measures to make central banks more flexible, government aid as well as massive investments in infrastructures in the United States are pillars encouraging investors to take risks. On the stock market, the new month of December, often synonymous with the year-end rally, could lose some of its traditional brilliance, as the road traveled for a few weeks is already proving to be of high quality. |

By

By