Atmosphere: The hawks are out in numbers. Western central banks seem ready to do whatever it takes to curb inflation. The markets are afraid that this will lead to a recession. The latest statistics are still relatively strong, but some of the richest countries may find it hard to escape a sharp downturn. There is also a lot of uncertainty about the side effects of rate hikes, for example on the housing market or on the speculative corporate debt market.

Rates: Bond yields calmed down, despite offensive speeches from central bankers. Ninety-three percent of investors believe that the Fed will raise rates by half a point at its June 15 meeting, and then at the same pace on July 27. The U.S. 10-year is at 2.84% (2.92% last week), the German Bund at 0.95% (0.92%) and the French OAT at 1.47% (1.43%). Greek and Italian debt, on the other hand, remain fairly high, at 3.69% and 2.99% respectively.

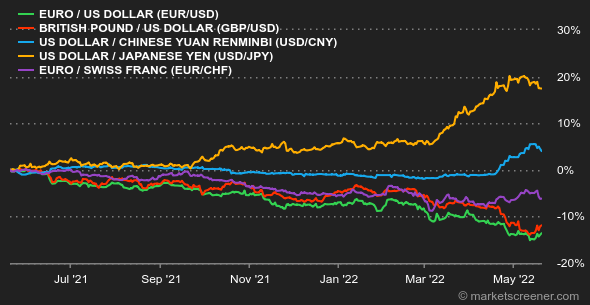

Currencies: The euro has regained some ground against the dollar, at USD 1.0562. The European currency is trading at CHF 1.0286 and GBP 0.8463. The comments of some ECB members in favor of a more or less pronounced monetary tightening as early as July have weighed in the balance. Moreover, Christine Lagarde reportedly asked some members of the central bank's executive board, including its chief economist Philip Lane, to "talk less and listen more" to the comments of central bankers from each member state.

Cryptocurrencies: For its part, bitcoin is just about even on the week, trading around the $30,000 mark as of writing. Its the seventh consecutive week of historic declines. Without any real bullish catalysts, crypto investors' nerves may be tested for some time to come.

Calendar: May PMI activity indicators will be released next Tuesday, with the challenge of gauging whether the current turmoil is undermining business sentiment in the major economies. In the US, the week will be dominated by durable goods orders (Wednesday), a new estimate of Q1 GDP (Thursday) and PCE inflation (Friday). The minutes of the last Fed meeting will be released on Wednesday.

|

By

By