|

Friday July 3 | Weekly market update |

| Improved macroeconomic data in Europe and the US helped financial markets recover this week and US technology stocks set new all-time records. The prospect of an accelerated economic recovery will therefore have fuelled traders' risk appetite, with the latter relegating to the background the health fears that are still very present, particularly in China and across the Atlantic. |

| Indexes Over the past week, all financial markets have recovered except for the Nikkei, which fell by 0.9%. For other Asian indices, despite the National Security Law, the Hang Seng recovered 3.2% and the Shanghai Composite 5.8%. In Europe, at the time of writing, the CAC40 recorded a weekly performance of 2.5%, while the Dax gained 4.3% and the Footsie 0.9%. For the peripheral countries of the euro zone, Spain picked up 3.7%, Portugal 0.9% and Italy 3.8%. In the United States, Wall-Street being closed this Friday for Independence Day, the balance sheet is particularly positive, especially for the Nasdaq100, which gained 5.6%, with Tesla (+22.6), Amgen (+9.8%) and Microsoft (+3.5%). The S&P500 gained 4% and the Dow Jones, only 3.2%, was weighed down by the financials sub-fund. |

| Commodities Crude Oil has stabilized this week at last month's high, continuing to benefit from expectations of lower U.S. production and improved global demand. The significant drop in U.S. inventories also reassured markets, which are anxious to see the supply/demand imbalance resolve. Brent is trading around USD 42 per barrel, while WTI is trading close to USD 40. After setting a new annual record at USD 1,789, the gold ounce stabilized at around USD 1,775. Silver, on the other hand, had a near-zero weekly performance, ending the week close to USD 18. The Industrial Metals sub-fund recorded significant gains over the last five days, partly supported by good data from China. Copper rose above USD 6,000 per metric ton, returning to the levels seen at the beginning of the year. Copper Rebound  |

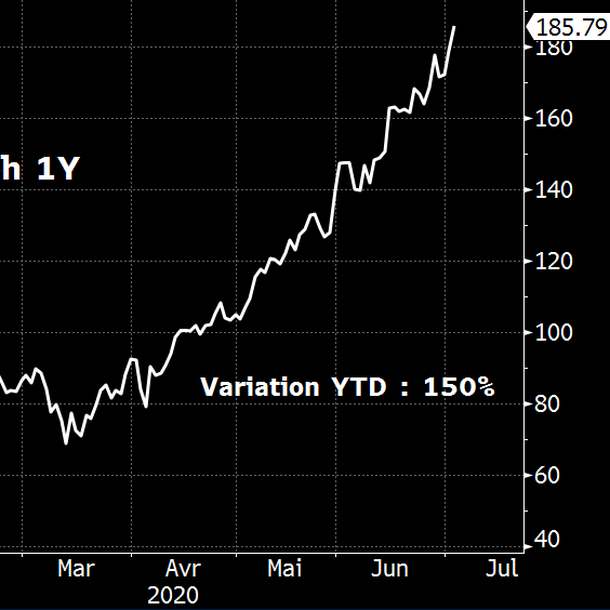

| Equities markets DocuSign The provider of electronic signatures, based in San Francisco, offers its customers such as banks the possibility to fill out forms, contracts or loan documents remotely, including on mobile phones, with its own customers. This makes it possible to avoid printing contracts that can sometimes be several hundred pages long. With the global Lockdown, more companies have used DocuSign as their remote legal partner. The Silicon Valley-based company now has more than 200 million users worldwide and is a $31 billion company on the Nasdaq. The DocuSign stock is on a great rally, rising 141% since January 1, 2020 and 253% year-on-year, setting new historical records that continue to climb higher and higher. Looking at the fundamentals, DocuSign's valuation levels remain tight with a P/E of less than 0 and a negative net income of $426 million for the 2019 fiscal year. Net cash is $330 million. Docusign  |

| Bond market Spreads between the Bund and bonds issued by other euro area Member States narrowed during the week. This surge in interest rates on Southern European debt was mainly triggered by press reports stating that the European Commission will soon present a compromise proposal on the design of the European support fund. The German benchmark is trading at a yield of -0.44% while the French OAT is trading at a negative -0.13%, a four-month low. This bearish rate path is duplicated for the yield on Italian (1.19%), Spanish (0.42%) and Portuguese (0.40%) debt. The auction of Italian government securities attracted strong demand and has become one of the most oversubscribed since 2012. Switzerland saw its 10-year rate rise to -0.45%, while stabilization is more characteristic of the yield path in the United States, with a Tbond generating 0.66%. Increase in the Swiss 10-year interest rate  |

| Forex market On the currency market, the pound has regained some colour since Boris Johnson's announcement and his promise inspired by the American "New Deal" to revive an economy hit hard by the new coronavirus pandemic. The GBP/JPY parity is traded at 133.80, tracing an upward slant. The British currency is also recovering against the Swiss franc at CHF 1.18 and against the dollar at USD 1.25. The euro is stabilising against its counterparts like the EUR/USD at 1.1230. The ECB could take a summer break after having multiplied support measures on several axes including credit support and the extension of bond purchases on the markets until June 2021. The single currency is nonetheless giving up a little ground against the Swiss franc at CHF 1.06. Despite the latest encouraging figures, the dollar is falling. Forex traders are focusing on the development of the pandemic. Graphically, the greenback against the Swiss franc seems to have found support between CHF 0.9420 and 0.9450. USD/CHF  |

| Economic data Few statistics this week. They have mostly reassured operators. Whether it was the official indices or the Caixin indexes, the manufacturing and services PMIs exceeded expectations in China, all remaining above the 50 mark, reflecting an expansion of activity. In the euro zone, they came out at 47.4 and 48.3 respectively, while the unemployment rate edged up slightly to 7.4%. Also noteworthy was the strong rebound in retail sales in Germany (13.9% compared to -6.5% last month) or the 36.6% surge in consumer spending in France (-19.1% previously). In the United States, in addition to the reassuring manufacturing ISM or the 44.3% jump in home sales pledges, it was the employment figures that really sparked enthusiasm, with an unemployment rate of 11.1% and 4,800K new jobs created. Next week in the U.S., the ISM Service and then the PPI index will be unveiled next Friday, not to mention the other weekly figures. In Europe, traders will take note of the Retail Sales, Industrial Orders, Industrial Production and Trade Balance for Germany. |

| The path remains uncertain 2020 entered its second half after a historic six-month stock market performance. This is evidenced by the fact that the average level of the volatility indicator (VIX) has averaged more than 40% since the end of February. Never before has this "stress benchmark" remained at these heights for so long, despite the violent rebounds of indices. Investors remain focused on the recovery of macroeconomic indicators, which are signs of a gradual return to normalcy. Reading the various manufacturing PMIs, followed by US employment, confirmed the recovery underway in all regions of the world. However, the recent speech by the head of the FED highlights what he calls the economy's "extraordinarily uncertain trajectory", hence the combined persistence of monetary and fiscal policies. This is enough to regenerate a buyer's current on each marked index decline. |

By

By