|

Monday May 10 | Weekly market update |

| After a turbulent first few days last week, amid fears of a forthcoming tightening of US monetary policy, financial markets quickly regained their footing, thanks to a significant improvement in the global economic outlook and good corporate results on both sides of the Atlantic. The appetite for risky assets remains high for the time being, as the end of the quarterly reporting season approaches. |

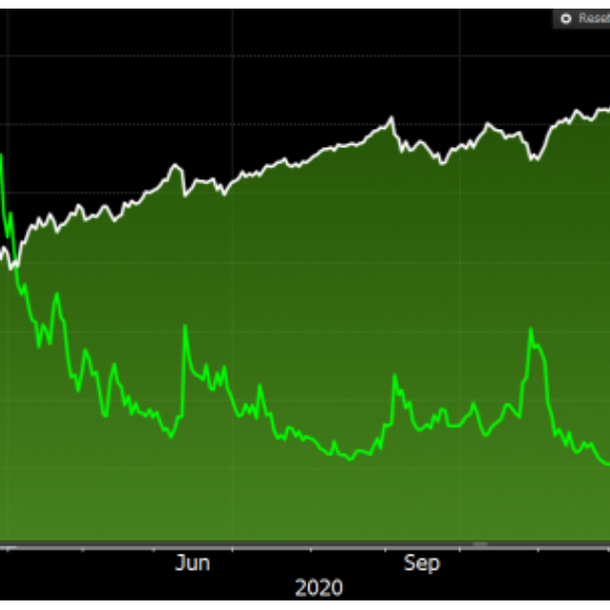

| Indexes Over the past week, most of the major indexes were positive. In Asia, after a shortened week, the Nikkei rose by 1.9% but the Shanghai Composite lost 0.6% and the Hang Seng 0.2%. In Europe, the CAC40 made good progress, with a weekly performance of 1.7%, reaching new annual records. Its German counterpart, the Dax, also gained 1.7%. The Footsie, for its part, gained 2.4%. In the peripheral countries, Spain rose by 2.8%, Portugal by 2.1% and Italy by 2%. In the U.S., the Dow Jones is up 2.5% over the last five days, setting a succession of all-time records. The S&P500 is up 1.2% and the Nasdaq100 remains down 0.6%. Upward movement of the S&P500 in conjunction with the decline of the VIX  |

| Commodities The surge in commodities is raising concerns about the trajectory of inflation in the coming months. Short-lived peak or not, all segments are moving higher, with annual rallies of over 20% for many commodities. Oil remains well oriented, despite some declines at the end of the week. The price of Brent crude oil approached the USD 70 mark. Gold and silver continued their rebound, leading to a reversal of the trend towards a more positive dynamic. The main catalyst is the easing of bond yields which is supporting precious metals. Gold reached USD 1840 per ounce, compared to USD 27.5 for silver. In industrial metals, new highs were reached in copper (at USD 10,200 per tonne) and iron ore (at USD 200). The rest of the compartment also had a positive week. Gold lags behind CRB  |

| Equities markets Signify N.V. The Dutch company is the world's leading lighting company. It designs and sells products for professionals and private individuals, notably under the Philips brand, throughout the world. The latest figures show, however, that it is in the United States that sales have grown the most, where 30% of turnover is achieved. The company, valued at more than 6 billion euros, has made great progress over the last year: 190% increase. Since the beginning of the year, it is a 50% increase. The company has been part of our European portfolio since November 2020. It is perfectly in line with the players who will be able to benefit from the megatrend of "smart-cities" (intelligent cities). With 127 years of experience, Signify provides lighting for public roads, shops and sports facilities. It is a pioneer in intelligent lighting: remotely controllable and less energy consuming. The company's fundamentals are solid and stable. The company has been generating a constant free cash flow of over 300 million euros for the past four years. Its profit margin is growing healthily, and if analysts are to be believed, this should continue over the next few years. Acceleration of the Signify share  |

| Bond market On the bond market, sovereign bonds are generally showing a rise in yields. Admittedly, this trend is continuing in a latent manner, a characteristic that has the advantage of not damaging investor morale. We know that the speed of upward adjustments in the interest rate market is more feared by market participants than the intrinsic level of rates. We know that the "inflation" variable, if it persists, could trigger sharp movements. In the United States, the 10-year is trading at 1.52%, which is a balanced performance over the weekly sequence. On the other hand, European benchmarks are slightly tense, with the Bund (-0.23%) and the French OAT permanently in positive territory at 0.13%. Similar trajectories are emerging for yields on southern debt such as Italy (0.91%) and Spain (0.44%). Even the Swiss bond is approaching the symbolic zero level at -0.25%. |

| Forex market With commodities hitting a new high, it is not surprising to see the Canadian dollar hit a three-year high. The Loonie traded a 0.815 basis against the greenback and this surge is being verified against all its G10 counterparts. In the southern hemisphere, the Australian dollar is seeing its advance halted by the diplomatic and economic dispute between China and the island nation. In Europe, the British pound recovered and on Friday traded against the single currency at EUR 1.16 (+100 basis points). In a euphoric climate on the financial markets, the so-called safe-haven currencies are moving in a disorderly fashion. The majority of market participants are interested in more cyclical currencies. The euro is therefore gaining ground against the dollar, as well as against the yen. CAD surges against the greenback  |

| Economic data In China, statistics exceeded expectations, such as the Caixin services PMI (56.3 against 54.2 expected) or the trade balance at 277B (consensus 130B). In the euro zone, the manufacturing and services PMI indices came out at 62.9 and 50.5 respectively (compared to 63.3 and 50.3 last month). Retail sales rose by 2.7% and the producer price index was in line with expectations, up 1.1%. In the U.S., the data was more mixed. The ISM manufacturing index fell to 60.7, the services index to 62.7 and industrial orders were up by only 1.1%. The highlight of the week was the monthly employment report, which showed the unemployment rate rising to 6.1%, with only 266K jobs created (consensus 990K) and hourly earnings up 0.7%. |

| The momentum keeps going European indices are maintaining their direction, driven by the positive winds of economic recovery. Over the week, volatility has dropped another notch and the evanescent declines do not affect the underlying trend. Expectations of a return to growth are complemented by company results, the vast majority of which exceeded analysts' expectations. However, fears of a legitimate consolidation are transpiring in the speeches of investors, who do not systematically validate an extension of the current upturn. As a result, they appear to be relatively protected against a decline by hedging strategies on derivatives, thus limiting any selling pressure on index references. This precautionary tactic undoubtedly explains part of the current serenity. |

By

By