|

Monday October 26 | Weekly market update |

| With new restrictive measures in Europe against Covid-19, uneven quarterly results and no compromise yet on a US stimulus plan, investors are nervous. |

| Indexes Over the past week, the major indices have evolved in scattered order. In Asia, the Nikkei recorded a weekly performance of 0.45% and the Hang Seng rose by 2.1%, while the Shanghai Composite fell by 1.7%. In Europe, the CAC40 lost 0.6% over the week, the Dax 2.1% and the Footsie down 1.1%. For the peripheral countries of the euro zone, Spain grabs 0.3% while Portugal gives up 2.3% and Italy 0.7%. In the United States, the Dow Jones recorded a weekly loss of 0.9%, as did the S&P500, while the Nasdaq100 deteriorated by 2.2%. |

| Commodities The week ended better than it started for oil markets. Due to a sluggish world demand, prices recovered, thanks to the intervention of Vladimir Putin, ready to postpone the increase in production in his country if necessary. A consensus seems to be taking shape with Saudi Arabia, where votes have already been raised on this subject. Brent is still trading close to USD 43, against USD 40.7 for a barrel of WTI. Gold and silver have stalled this week. This flat development contrasts with the forecasts of Goldman Sachs, which is particularly optimistic for these precious metals next year. The American bank is indeed targeting average prices of USD 2300 for gold and USD 30 for silver. In the meantime, an ounce of gold at USD 1910 and an ounce of silver at USD 24.7 will be sufficient. Copper is at the USD 7000 per metric ton mark and is therefore progressing by almost 50% since its March low. Supply shortages in Chile and strong demand from China are the factors driving prices higher. |

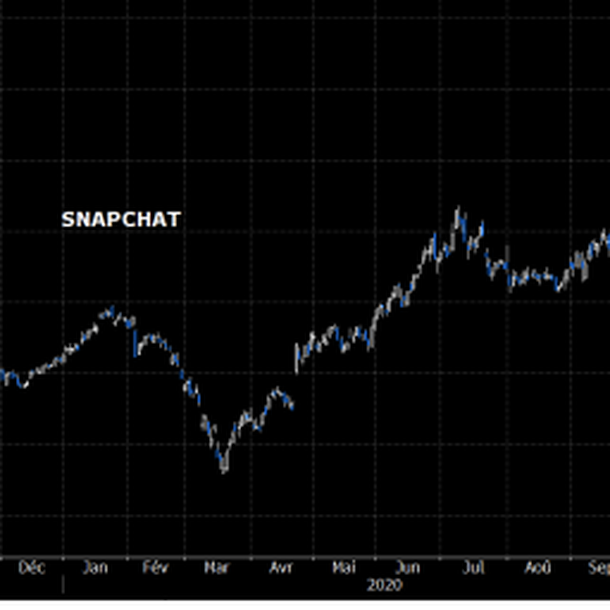

| Equities markets Snap is especially known among young people for its flagship social network, Snapchat, which allows them to share photos and videos with their friends and family. The company also offers mini-games, creative tools to personalize content, the ability to communicate via chat, make voice and video calls, and follow news. Recently, Snap's stock rose 39% in the space of two trading sessions, following the release of its third quarter results, which surprised analysts. Indeed, Snap's revenues increased 52% to $679 million, compared to the consensus expectation of $557 million, resulting in a small adjusted earnings per share of $0.01 per share. On an annual basis, Snap remains in a deficit position. One of Snap's main problems is monetizing its users. To date, the company is paid through advertising on its Discover channel as well as in-app purchases. Its future cash flow, and therefore its viability, is highly dependent on the number of users and their time spent on the app. In the last quarter, the company recorded an 18% growth in the number of daily active users, to 249 million compared to the expected 243 million. This is a promising sign even if there is still a long way to go. The average revenue per user increased from $0.59 in 2015 to $8.29 in 2019, an annualized growth of 251%. This trend is expected to continue as Snap expands its content and diversifies its feature set. On a stock market level, investors applaud Snap's global strategy. The share price rose more than 123% over the year. Strong push of the Snap stock  |

| Bond market Sentiment across government bond markets turned slightly against risk, although consumer confidence figures were clearly negative, remaining below their levels of the previous month. The German bund is trading on a negative return of -0.58%, up slightly, as is the French OAT which is up to -0.3%. This has allowed the yield of the Italian 10-year construction bund to reach a new low of 0.63%. Historic levels were also affected for the rates associated with Portuguese and Spanish debt, close to symbolic zero. News of an exponential increase in the number of new infections and subsequent lockdowns could spontaneously reinvigorate the bull market on the fixed income front. Switzerland sees its major ten-year loan still sought after by investors, stabilizing its yield at -0.55%. As for the United States, it is the rise that characterizes the course of rates on the TBond, with a benchmark of 0.85%, a high of several months (see graph), while operators are keeping an eye on the saga of negotiations on the American recovery plan. New progression of the TBond  |

| Forex market On the Brexit front, trade negotiations between the United Kingdom and the European Union are about to resume. In this bounce-back atmosphere, the pound sterling has the luxury of a rebound against its counterparts. The cable is trading at USD 1.31 (+100 basis points), as is the GBP/CHF pair at 1.19. Speculation therefore remains intensive on all pairs with the British currency. The euro remains in its horizontal consolidation corridor, despite the risk of recession in Europe in the last quarter. The single currency is trading within its technical corridor at USD 1.185, while the greenback is experiencing headwinds, with uncertainties about the U.S. stimulus plan. Among emerging currencies, the Turkish lira could extend its losses, following the surprise decision of the central bank to leave its reference interest rate unchanged, despite high inflation. The USD/TRY exchange rate is trading at an all-time high of TRY 7.97 (see chart). New historical record for the Turkish Lira  |

| Economic data In addition to "robust" growth but slightly below expectations (GDP at 4.9% against 5.5% expected), Chinese macroeconomic data has reassured last week. Industrial production grew by 6.9%, retail sales by 3.3% and the unemployment rate fell to 5.4% (5.6% previously). Few statistics were on the agenda in the euro zone. Manufacturing activity is accelerating (PMI index at 58 against 56.4 last month) while service activity is contracting further, with a PMI index at 46.5 against 47.5 previously. In the U.S., data concerning housing was mixed. Building permits and existing home sales exceeded expectations at 1.55M and 6.54M respectively, but housing starts disappointed at 1.42M. Weekly unemployment registrations were a pleasant surprise (787K) while the Flash PMI indices were against the European trend. The Flash PMI manufacturing index stagnated at 53.3 and the Flash PMI services index stood out, rising to 56 (54.6 last month). |

| The economic outlook depends on Covid-19 It's coming... this second wave that stood out in the distance. To avoid sanitary overflows, Europe is going back into some form of curfews or lockdowns, depending on the region. At this point in the outlook, the last quarter of 2020 is likely to be marked by an "administrative" recession (recent SMMEs are still disappointing), giving way to a potential rebound in 2021. In any case, the resilience of equity markets shows that investors prefer this scenario. The good results already published add to this optimism, the latter being less bad than expected. Tech giants' results are alone are capable of setting the trend. |

By

By