|

Monday August 24 | Weekly market update |

| Stocks continue to show divergent paths. The multiple records on Wall Street are in sharp contrast with the lethargy of continental equities. The FED's recent message does not help to spread real optimism, but this caution finds little echo on the course of technology stocks, which are crushing the charts. |

| Indexes After a strong increase in Asian indices last week, the Nikkei corrected by 1.6% and the Hang Seng by 0.3%. Only the Shanghai Composite is in positive territory with +0.6%. We can also note a strong correction of the Kospi index, the Seoul Stock Exchange which dropped 5.5%. The trend of the stock markets is also moving downwards in Europe. The Euro Stoxx 50 dropped 1.5%. The CAC 40 evolves on the same trajectory (-1.5%). Italy (-1.7%) and the Footsie 100 (-1.6%) are experiencing a slightly sharper decline. But it is Spain that is taking the hit, down 2.5%, while the country is already lagging behind its neighbors in 2020. Only the DAX seems to stand out (-1%) and, as usual, the OMX Nordic 40, which is up 0.3%. In the U.S., it is no longer a surprise now, the Nasdaq continues its rally and is up 2.6%, while the S&P 500 is close to break even (+0.5%). As for the DowJones, it is in the red at -0.5% over last week. The outperformance of Scandinavian indices  |

| Commodities Oil prices continue their long sequence of stabilization. Weekly performance is virtually nil, a dull week in the image of the last OPEC+ meeting. This one took place on Wednesday by videoconference and exchanges focused on the compliance rates of the organization's members. On the contrary, the price of gold fluctuated this week and is now trading close to USD 1915 per ounce. Silver is also lagging behind USD 26. Copper prices reached their highest level in more than two years, still driven by declining production (the consequence of an overall decline in capital spending by mining companies), low inventories, against the backdrop of a weak US dollar. This buying pressure is evident throughout the compartment, as evidenced by the increases in aluminum (to USD 1755), nickel (to USD 14666) and zinc (to USD 2466). |

| Equities markets Xiaomi is celebrating its 10th anniversary this year, a decade that has seen the cell phone manufacturer climb to fourth place in global sales with 8% market share, behind Samsung, Huawei and Apple. The Chinese company is now diversifying into other products such as PCs, accessories, televisions? With its slogan "Innovation for everyone", this player clearly shows its ambition to offer prices that tend to be lower than its competitors and intends to flood stores around the world with its products that could be described as "good value for money". Listed on the Hong Kong Stock Exchange, Xiaomi is valued at CNY 383 billion, close to $50 billion. Over 2020, the share is on an upward trend with a 68.5% increase, which allows it to approach its IPO levels. Its turnover has evolved by 80% between 2017 and 2019 and the dossier shows equivalent growth prospects between now and 2022. Moreover, the Chinese company is in a healthy financial situation with a negative financial leverage (-2.3x) underlining a cash surplus and has a free cash flow of CNY 20.4 billion or USD 2.7 billion. On the other hand, the company is trading on high earnings multiples: 38.1x its estimated net earnings per share for the current year. But from another point of view, the valuation remains interesting, especially if growth confirms its trend, which is what analysts seem to think. Xiaomi is one of the components of the MarketScreener ASIA portfolio. Xiaomi share  |

| Bond market The slightly positive tenor of the ECB's remarks did not intimidate the 10-year Bund yields, which on the contrary continued to fall sharply (-0.55%). The Bund's yield spreads on public debt instruments of other eurozone countries widened slightly, proving that risks are regaining the upper hand. The French OAT returned to a yield of -0.2%. The path is duplicated on the Italian (0.91%) and Spanish (0.28%) rates. On the other side of the Atlantic, US debt yields 0.64%, a benchmark that is therefore back to its low point. |

| Forex market The upward trend of the euro against the dollar allowed the company to symbolically quote USD 1.20. The major parity then suffered profits to come back to USD 1.18 after the disappointment of the PMIs. For a deeper rally of the G10 currencies excluding the USD, a rebound in economic activity would be needed. Without this glimmer of hope, it will remain difficult to engage more strongly in the EUR, GBP, AUD and many other growth-oriented currencies. Technically, speculative long positions in the single currency are reaching record highs, which argues for a further breakout and thus a decline in the European currency. At the same time, forex traders have also taken initiatives on the yen, with the Japanese currency gaining 100 basis points against the Swiss franc at CHF 0.865. Japan's leaders have pledged major government assistance to revive growth after the historic drop in GDP. The course was duplicated against the greenback, against which the yen traded at JPY 126. |

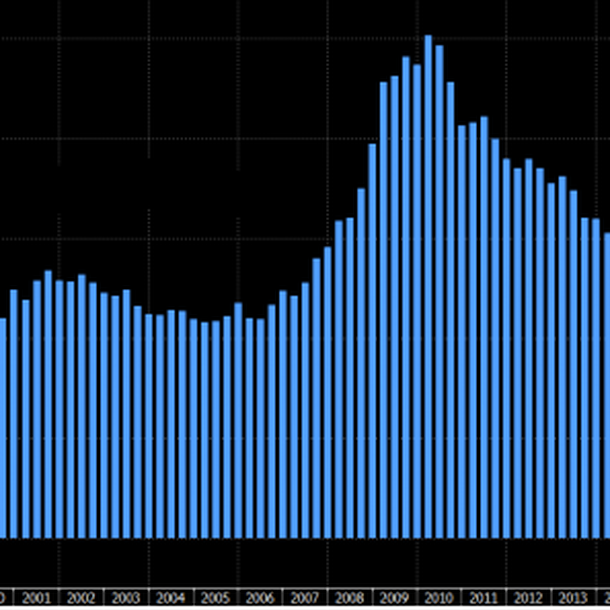

| Economic data This week the statistics have shown their fragility. In Asia, Japanese GDP (preliminary) contracted by 7.8% in the second quarter (QoQ). In the United States, weekly unemployment registrations showed that the improvement was only temporary, rising again to 1,106,000 new claims. The consequences of the vagaries of employment are beginning to be felt. In the second quarter, mortgage defaults rose to 8.22%, against 4.36%. These figures are comparable to those of 2009. This morning, the August Flash PMIs also show the fragility of the economic recovery. Overall, the figures were rather disappointing, down compared to last month. Australia saw the services indicator fall to 48.1, and French manufacturing activity to 49. Only the British data showed a real improvement in services and manufacturing, at 60.1 and 55.3 respectively. As for monetary institutions, the FED minutes underlined the word caution. A caution that concerns both the economic recovery and the developments of its support. The European institution for its part showed more restraint, leaving open the possibility of new measures if necessary. Nevertheless, it seemed that some members were opposed to an increase in the PEPP (Pandemic Emergency Procurement Program). Sharp rise in mortgage defaults (in %)  |

| The back-to-school season will be complex It is difficult not to feel the heaviness hanging over financial markets. Several elements contribute to this increasingly uncomfortable feeling. On the one hand, the distortion of valuations between technology companies and the rest of the stock market is becoming extravagant and raises many questions as to its sustainability. On the other hand, the umpteenth records recorded on Wall Street contrast with the latest macroeconomic statistics, which are much more mixed in Europe and the United States, rekindling fears of a slow global economic recovery. Against this backdrop, the next autumn season for managers, investors and other financial professionals promises to be a complex one. |

By

By