|

|

| This week's gainers and losers |

Gainers: Regeneron (+22.1%) The biotech announced Thursday that two pivotal clinical trials with aflibercept met their primary endpoints in diabetic macular edema and AMD. SolarEdge (+17.6%) Rising energy costs in the U.S. are benefiting SolarEdge and its peers in the renewable energy industry, which are recovering from a major summer slump. Rivian Automotive (+15%) is partnering with Mercedes-Benz Vans to jointly produce electric vans at a plant in Europe over the next few years. The groups also say they are seeking other synergies.

Ubisoft (-17.6%): The consolidation of Tencent in the capital of Ubisoft will be done indirectly via the holding of the Guillemot family. In doing so, the Chinese firm confirms that it will not take control of the group in the coming years. Bilibili (-14.9%) The Chinese streaming group, deepened its losses in the second quarter. At the same time, forecasts are below market expectations for the current quarter. Associated British Foods (-9.4%) The British multinational food company, has warned of a likely drop in profits next year, especially for its Primark brand. Demand is slowing down.

|

|

| Commodities |

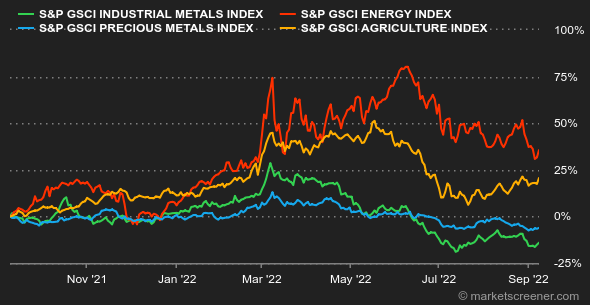

| Energy: Oil gave up some ground this week, pushing Brent crude prices momentarily below the USD 90 line. These price levels may prompt OPEC member countries to take more action to support prices, as currently the expanded cartel has agreed to cut production by 100,000 barrels per day. This is a symbolic measure to show that the cartel can intervene at any time to support the market. Another major fact this week was the surprise increase in U.S. inventories, which rose by 8.8 million barrels while the consensus was for a contraction of 2 million. This increase is linked to a decline in U.S. exports but also to a decrease in refining activities. In terms of prices, Brent crude oil is trading near USD 90 per barrel, while the US benchmark, WTI, is trading around USD 85. As for the European gas market, where prices remain volatile, European Union ministers are meeting this weekend to agree on a series of measures aimed at curbing the rise in gas prices. Metals: Industrial metals prices have generally stabilized on the LME, with the exception of copper, which has risen sharply for four sessions to $7,810 per metric ton. Workers at the world's largest mine, Escondida in Chile (operated by BHP Group), are set to go on strike to demand better safety measures. Operators recall a similar episode in 2017, which severely tightened global supply. Finally, gold regained some height at USD 1720. Agricultural Products: The Ukrainian grain export deal took another twist this week as Vladimir Putin questioned it, saying that the deal benefits Europe more than poor, famine-ridden countries. According to data compiled by Bloomberg, half of the shipments went to Asia, the Middle East and Africa. Wheat is trading at 840 cents in Chicago, compared with 673 cents for corn. |

|

| Macroeconomics |

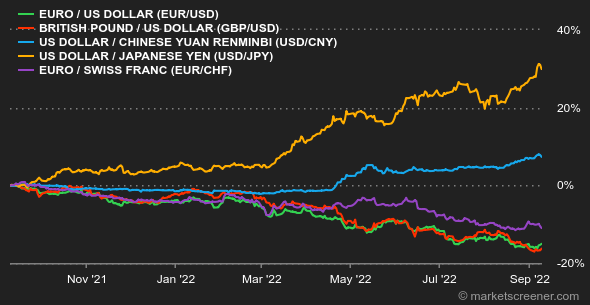

| Atmosphere: Europe is getting into the swing of things. The ECB raised rates by 75 basis points this week, after having raised them by 50 points in July. A tightening cycle that started in the worst possible context, as the energy crisis is creating turmoil not seen in a decade in the Eurozone and more broadly in the EU. On a global scale, macroeconomic indicators are deteriorating in the Western economies, but there is no air pocket yet. In Asia, the Chinese economy is still struggling to get out of its rut. In any case, it is still not taking on the role of stimulating activity that some investors hope it will. Rates: The continued tough talk from Fed boss Jerome Powell this week helped firm up U.S. bond yields, with the 10-year yielding 3.31%, slightly above last week's level. The ECB rate hike led to a logical adjustment in the Bund (1.71%), the OAT (2.28%) and all other European signatures. Italian and Greek debts have risen above 4% over 10 years. Currencies: The European Central Bank has joined the camp of the "75", i.e. the world's central banks that have decided to apply a strong remedy to counter inflation by raising their key rates in waves of 75 basis points. The euro hesitated a bit at this announcement before opting for the increase. The single currency was thus able to climb back above parity with the dollar at the end of the week. The euro is trading at CHF 0.9665. Over the weekend, the dollar also lost ground against other currencies. Notably the yen, which reacted after losing a quarter of its value since the beginning of the year. The Japanese authorities have indeed left doubt about a possible intervention to support their currency. Cryptocurrencies: Bitcoin started the week badly but seems to be ending it in better shape. The leading cryptocurrency was closing in on the USD 21,000 mark on Friday. Next week will be an important one for the crypto universe, as Ethereum's merger from proof-of-work to proof-of-stake is scheduled to take place between September 13 and 15. Calendar: The next volatility pool for speculation on the evolution of U.S. key rates is scheduled for Tuesday with the U.S. inflation for August. Investors will also follow the US retail sales (Thursday) and the University of Michigan confidence index (Friday) to see if the US consumer still has an appetite for spending. The Fed's next meeting is scheduled for the following week, on September 21, with the now classic dilemma: a 50 or 75 points of increase? |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By