|

|

| This week's gainers and losers |

| Gainers Veeva (+20%): The U.S.-based provider of cloud solutions for the pharmaceutical industry reported better-than-expected quarterly results. The company also announced a positive outlook for the second quarter, and raised its revenue and earnings forecasts for the rest of the year. It should also be noted that Veeva benefits from favorable recommendations from all analysts, and has just announced a partnership with Belgian biopharmaceutical company UCB on clinical trials. Chewy (+19%): The online specialist in pet products also did better than expected in the last quarter, both in terms of earnings and revenues. The group, which announced its entry into the Canadian market this year, also raised its annual revenue forecasts above analysts' consensus. Chewy also won a lawsuit this week against the US Occupational Safety and Health Administration. Dechra (+15%): Dechra Pharmaceuticals remains in the animal care sector. The British veterinary pharmaceuticals group has received and accepted a £4.46 billion takeover offer from Freya Bidco, a company backed by Swedish private equity group EQT and sovereign wealth fund Abu Dhabi Investment Authority. On completion of the transaction, scheduled for late 2023 or early 2024, the pharma company will delist from the London stock exchange. Losers Dr. Martens (-11%): A difficult context for British boot manufacturer Dr. Martens, which reported disappointing annual results, including a 26% drop in pre-tax profits. The group says it is facing several headwinds: a bottleneck at its Los Angeles distribution center that affected deliveries, increased depreciation on systems investments, and a £10.7 million charge for currency translation on its euro-denominated bank debt. However, it has announced a 10% increase in revenues, a dividend payment and a share buyback of at least £50 million. Lucid (-17%): The American electric vehicle manufacturer announced this week that it had raised around $3 billion from its main shareholder, the Saudi Arabian Public Investment Fund. An announcement that was not well received by the market, as Lucid had recently stated that the company's liquid assets would be sufficient to finance operations until at least the second quarter of 2024. The group is also hampered by rising interest rates and a gloomy economic context. Dollar General (-20%): The US small-price specialist reported quarterly results below expectations, with EPS and operating profit down. Weighed down by an uncertain macroeconomic context and a drop in customer traffic, it also revised its annual outlook downwards. At the same time, the group revised its target for the number of store openings this year. |

|

| Commodities |

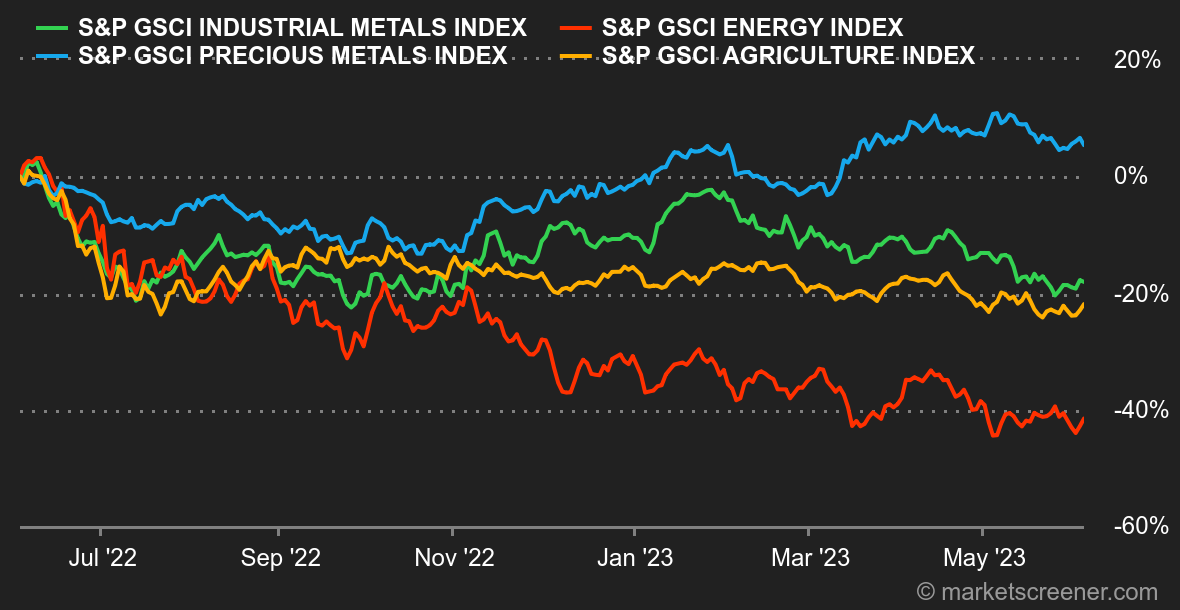

| Energy: Tick-tock... Only a few days to go until the OPEC+ meeting this weekend. Its members are unlikely to decide on further supply cuts despite a fall in oil prices, according to Reuters, which quotes two sources from the alliance. Let's wait for Sunday to get the verdict. Still on the subject of OPEC, the cartel's production fell by 0.5 million barrels per day (mbpd), according to Bloomberg, to 28.26 mbpd in May. In terms of prices, North Sea Brent is trading at around US$75 a barrel, compared with US$70.50 for its US counterpart, WTI. Metals: Base metal prices bounced back this week thanks to a favorable alignment of the planets: the return of risk aversion with the resolution of the US debt problem, the fall in the greenback and the reduction in LME inventories all contributed to a rebound in copper, aluminium and tin. The proof is in the pudding, with copper back above the USD 8,000 mark on the LME, now trading at around USD 8,200. Gold has also regained some ground, thanks to the fall in bond yields. The barbarian relic is trading at around 1980 USD an ounce. Agricultural products: Tension continues unabated in the Black Sea, where Ukraine claims that Moscow is not respecting grain agreements. Also in Ukraine, the latest data from the Ukrainian Ministry of Agriculture shows that, unsurprisingly, wheat and corn sowings have fallen by 38% and 16% respectively year-on-year due to the war. It's clearly not the same story in the USA, where crops are developing well, allowing the USDA (US Department of Agriculture) to bank on prospects for record harvests. On the price front, cereal prices ended May sharply lower. In Chicago, wheat is selling for 610 cents a bushel, compared with 585 cents for corn. |

|

| Macroeconomics |

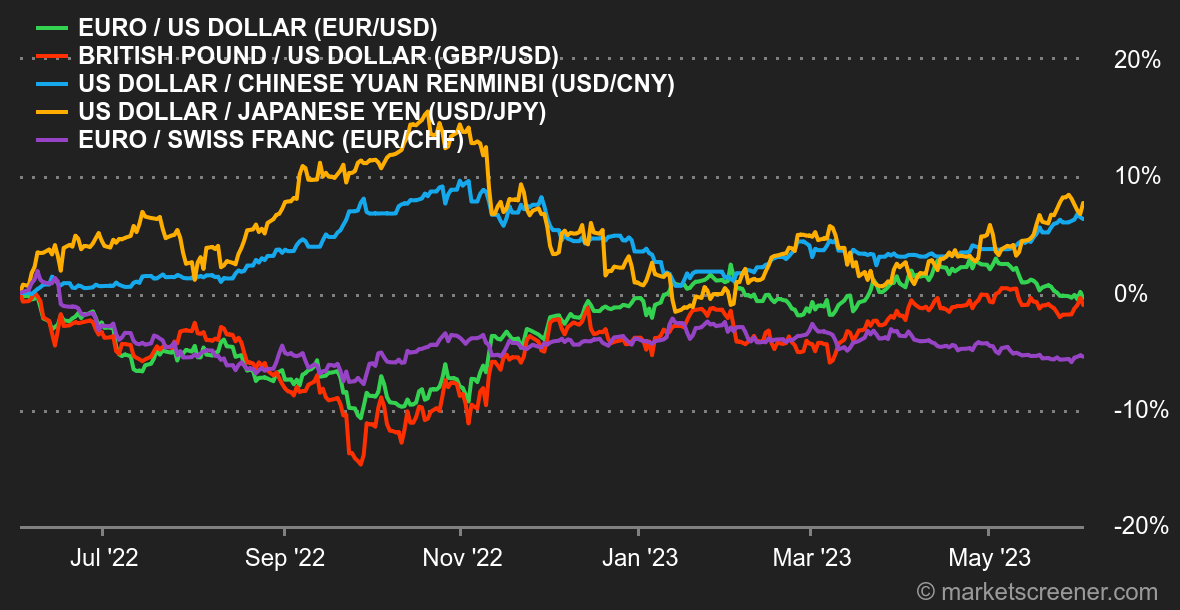

| Atmosphere: Unsinkable. The week was rich in macroeconomic indicators. Investors learned in no particular order that the Chinese recovery still has the vigor of an anorexic chick, that European inflation is a little less dramatic than expected and that the US labor market is still solid, even if the unemployment rate has tended to rise over the past month. The markets continue to pick and choose what interests them in order to convince themselves that the Fed is done with rate hikes. And it's working quite well. There is unlikely to be any monetary tightening in the US on June 14. Some central bankers continue to claim that there will probably still be some afterwards, but investors only listen to stories of artificial intelligence and the return of technology. The Nasdaq 100 gained 32% in 2023. The Dow Jones, zero. Currencies: A rather curious week for the US dollar, which spiked on Wednesday after a sort of bloodbath by investors, who abruptly (and briefly) raised the spectre of a Fed rate hike on June 14. The greenback fell back when the prognosis of a monetary status quo skyrocketed. The euro's rise from 1.067 to 1.077 USD was helped by Christine Lagarde's continued firm stance on inflation, despite lower-than-expected price rises in May in several European countries, including France and Germany. The US dollar also suffered against the Australian dollar, at 0.6620 USD to 1 AUD, after the Reserve Bank of Australia explained that the battle against inflation is not won and that Australians must be prepared to suffer further. The RBA will update its monetary policy next week. Rates. Resilience, resilience. That's how we might describe the US job market. Job creation figures for May came out 339k higher than 195k expected. This, of course, is not good news for the Fed, which is waiting for job losses to curb inflation and halt its rate hike cycle. In spite of this, and in view of the recent clarifications given by members of the Federal Reserve, investors are still counting on a status quo at the next monetary committee meeting. According to Fedwatch to CME, the probability of a rate hike has fallen to 29%. Meanwhile, the US 10-year yield is currently testing its former resistance turned support at 3.64%. Only a break of this level would send the market back to the key medium-term support of 3.34/31%. Cryptocurrencies. Bitcoin closed its first month in the red in May, after four months of consecutive gains since the start of the year. This week follows the same trend as the previous month, with bitcoin down almost 4% and hovering around $27,000 at the time of writing. After a strong start to the year, the leader in digital currencies is slipping back, and has not benefited from investors' enthusiasm for technology stocks in recent weeks. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By