|

Friday October 29 | Weekly market update |

| The overall good results of major groups on both sides of the Atlantic, as well as the ECB's continued accommodating monetary policy, have allowed financial markets to continue their rise this week and Wall Street to set a string of historical records. However, a few declines happened on Friday, as the latest results seem to be more mixed on the outlook. Caution is also reinforced by the Fed's rate decision next week, which could be a source of volatility. |

| Indexes Over the past week, Asia has been against the tide. The Hang Seng lost 2.7% over the last five sessions, the Shanghai Composite 0.5% while the Nikkei resisted better with a gain of 0.3%. For Europe, volatility persists. The CAC40 recorded a gain of 1.7%, the Dax gained 1.8% and the Footsie 1.2%. For the peripheral countries of the euro zone, Italy climbed 0.6%, Spain by 1.2% while Portugal consolidated by 2.7%, after its strong growth in recent weeks. As for US indexes, they have reached records. At the time of writing, The Nasdaq100 recorded a weekly performance of 0.5%, the Dow Jones of 1.1% and the S&P500 climbed 1.3%. |

| Commodities Oil prices have taken the path of decline this week, a legitimate delay given the course taken since the beginning of the year. High prices have embellished the accounts of the main producers who have unveiled results up significantly. This is particularly the case for TotalEnergies, Eni and Equinor, to name only the main European companies. Brent crude oil is trading at around USD 83.5 per barrel, while WTI is trading above USD 82. The ounce of gold is still rubbing up against the psychological barrier of USD 1,800, which the barbarian relic is struggling to break through. The selling trend also concerns the industrial metals segment where copper, nickel and aluminum have paused. On the agricultural commodities front, wheat is back to its highest level of the year in Chicago, above 770 cents a bushel. Wheat has not escaped the rise in commodity prices, with its price jumping more than 25% year-over-year. Strong global demand and supply depressed by poor weather and low inventories are contributing to this rally. |

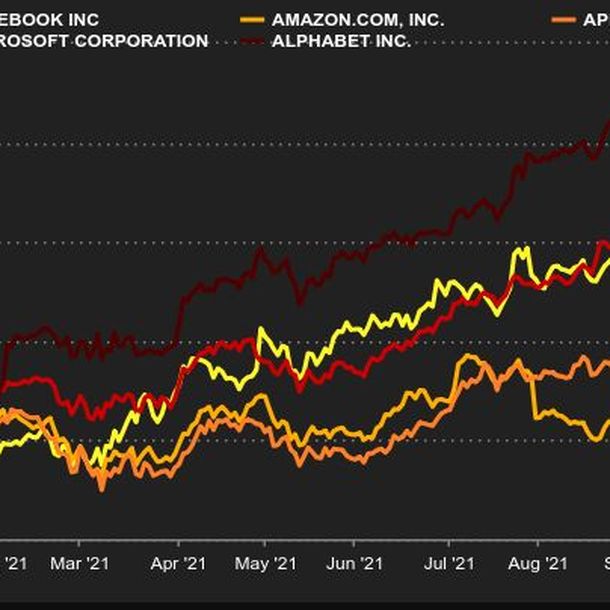

| Equity markets The return of takeover bids In France, the CNP Assurances saga is coming to an end with the final stage of the reorganization of the insurer's capital. La Banque Postale, which already has a majority stake, will buy out the shares held by BPCE and will put EUR 21.90 on the table for the shares remaining in the hands of minority shareholders. The share price was hovering at EUR 15 before the announcement. In Switzerland, banking software specialist Temenos is the star performer this week, rising 15% on rumors of private equity interest. The aptly named Swedish EQT and American Thoma Bravo are reportedly evaluating a buyout, but nothing has been confirmed or denied at this stage. Facebook takes refuge in the metaverse Attacked from all sides, Facebook is organizing its defense. Mark Zuckerberg has announced that his group will be renamed "Meta", to seal its offensive in the "metaverse", and to put the company's different platforms on an equal footing: Instagram, WhatsApp and Facebook. And perhaps also to open a new chapter after these difficult times? Apple and Amazon a tone below Rare enough to be highlighted, the two American giants are among the poor performers of the Q3 reporting season. Apple suffered a shortfall in sales due to shortages, while Amazon suffered from cost inflation due to recruitment difficulties in the US. Microsoft and Alphabet, on the other hand, are less dependent on products and have shone: not surprising, finally, that these two stocks show the strongest progress among tech giants this year. Top / Bottom: Worldline vs Anheuser-Busch Inbev Belgian brewer AB Inbev gained more than 10% on the week after producing strong results. The pre-pandemic levels are back and the group's top-of-the-range beers have the wind in their sails. On the other hand, the French payment specialist Worldline saw a quarter of its market capitalization evaporate, after announcing slightly disappointing results and producing less ambitious medium-term forecasts than expected. A matter of big money The latest earnings reports and news have consecrated or reconstituted two companies. Microsoft, the quiet force, has overtaken Apple as the largest market capitalization on Wall Street. This is not the first time, but it illustrates the difference in the quality of the two companies' results this year. At the same time, Tesla entered the very select club of companies that weigh more than $1,000 billion, thanks to two very positive signals: a huge order from Hertz for its rental fleet and the record sales of the Model 3 in Europe last month. Microsoft and Alphabet largely dominate  |

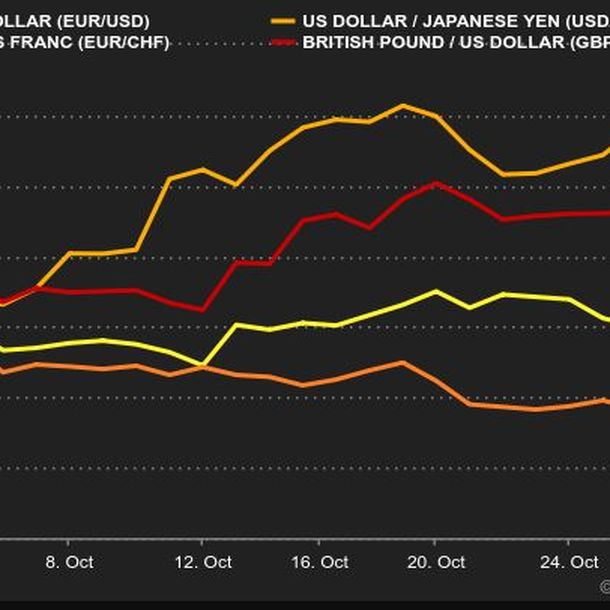

| Macroeconomics The litany of statistics is still unclear as to whether the global economy will slow or accelerate. During the week, US durable goods orders figures for September were very strong, but Q3 growth was weak. In Europe, it was the German Ifo business confidence index in October that disappointed, as did German Q3 growth, but French and Italian GDPs surprised positively. Central banks, too, are caught in the crossfire. The ECB, for example, admitted this week that it had been a little optimistic about inflation. The leitmotif for the time being is to unravel the anti-pandemic support mechanisms without causing too much damage to economic activity. But what will happen if prices continue to go off the rails? In the foreign exchange market, there has been little violent movement, although the euro has recovered a little against the greenback. It is trading at around USD 1.1650, after falling below the USD 1.16 base the week before. The EUR/CHF is at CHF 1.06152 and the Cable is at USD 1.37866 per GBp. On the sovereign debt market, which remains at the center of the game given the questions about the adequacy of monetary policies to the economic context, the lines moved during the week. Not in the United States, where US debt is paying 1.60% over 10 years, a slight decline from the previous week. But in Europe, where the position of the European Central Bank, less comfortable with inflation levels, has pushed up the cost of debt for all states, but with sometimes violent movements on Friday for the most fragile economies. The Bund rose to -0.09% (+5 points) and the OAT to 0.28% (+7 points). Italian debt reached 1.20% (+15 points) and Greek debt 1.28% (+23 points). Even the Swiss signature is carried away by the movement at -0.07% (+8 points). The market is waiting to see if the ECB will set up a new repurchase plan to replace the PEPP - it probably will - and what its conditions will be. It may be necessary to avoid too much turmoil around the debt of some eurozone countries, especially Greece, which explains the surge in the country's borrowing rate. Next week, the big macroeconomic news will be almost exclusively American, with the ISM manufacturing and services indexes on the menu, but above all the Fed's regular meeting, which will take stock on Wednesday, November 3, of its monetary policy and how it fits into the economic cycle. This is likely to be a pivotal moment for the asset purchase program and visibility on the evolution of key rates. Legend: Evolution of the main currency pairs  |

| Resilient in all circumstances In line with previous weeks, US and European companies have published good results, often exceeding expectations. The shortages can still be seen in results, but the prospects for fixing them by next year seem good. The US manufacturing PMI will be released on Monday, while the services PMI will have to wait until Wednesday, just before the FOMC conference. These figures may create volatility on markets. In the meantime, positive corporate results should continue to push indexes to new records. |

By

By