|

Monday May 24 | Weekly market update |

|

Last week, financial markets were nervous, initially losing ground with inflationary fears, before recovering, reassured by the maintenance of the Fed's ultra-accommodating monetary policy in the months to come. The balance sheet appears to be slightly negative on both sides of the Atlantic, but volatility is tending to rise again, proof of the prudence of market participants, given the strong rise in indices in recent months. |

| Indexes Over the last five days, in Asia, the Nikkei has performed 0.8% and the Hang Seng has climbed 1.5% while the Shanghai composite has lost 0.1%. For the Eurozone, the CAC40 is up 0.1%, as is the Dax, while the Footsie is down 0.3%. Spain, Italy and Portugal are doing better, with respective performances of 0.7%, 0.6% and 1.5%. In the US, the Dow Jones lost 0.2%, the S&P500 was stable and the Nasdaq100 recovered 0.6%. |

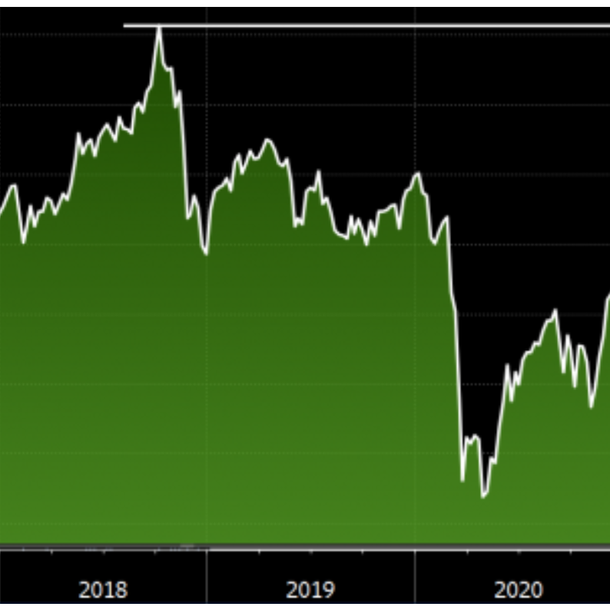

| Commodities It was a complicated week for oil markets, where operators fear the return of Iranian supply, raising a serious question about the market's ability to absorb a potential surplus of one million barrels per day. The increase in U.S. inventories also weighed on the trend. Brent crude is back in the USD 65 area, while the US benchmark is trading at USD 63 per barrel. Gold continues its upward trajectory. The easing of long-term real rates is benefiting the safe-haven asset, which, let's not forget, by its very nature offers no return. Gold is on the verge of ending the week at its highest level, around USD 1880 per ounce. Silver, on the other hand, is stabilizing at USD 27.8. As for base metals, they ended the week in mixed order. Copper and aluminum lost ground at USD 10080 and USD 2392, while lead and tin posted positive weekly performances at USD 2200 and USD 33350 per ton. Consolidation of WTI  |

| Equity markets Carrefour is a French multinational retail corporation that operates a chain of hypermarkets and grocery stores. While CEO Alexandre Bompard has just been reappointed for three years - even if his remuneration is debated - the stock has performed 17% over the last two months. Investors are divided between expectations of sustainable inflation and the economic rebound. The market is therefore looking at slightly more defensive stocks. The company had already received renewed attention at the beginning of the year. Indeed, the acquisition of 224 convenience stores in Taiwan as well as the possible takeover offer from its Canadian counterpart, Couche-Tard, had aroused market interest. The share price rose by 20% in two weeks. Immediately corrected by the market at the end of January, after the veto of Bercy to the merger. The French food retail sector is one of the toughest in Europe in terms of competition. And Carrefour lags behind its peers Leclerc and Lidl in the area of customer satisfaction. However, the group is making financial investments and has managed to regain market share, something that has not happened for years. In addition, the Brazilian market is growing structurally and is generating margin for the group. Carrefour's share price is 0.20 times its sales and 13.7 times its profits in 2021. Carrefour stock up sharply  |

| Bond market The upward trend in yields continues. The amount of debt with yields below the symbolic zero mark has fallen by a third from the November 2020 peak, from $18 trillion to $12 trillion. This pressure on the government bond market has intensified with hopes for economic recovery, but also with the massive support packages announced by the US, elements that are causing inflation to drift. The rise in yields has been reflected in Europe, where a large proportion of these negative-rate securities are concentrated. The Bund is trading at -0.10% and the French OAT at 0.30%. Italian (1.3%) and Spanish (0.90%) debt is following the upward movement. Across the Atlantic, the 10-year benchmark is stabilizing at 1.60%, while in Switzerland, the traditionally sought-after national debt is still paying negative interest to its creditors at -0.15%. |

| Foreign exchange market The week saw a warning shot on cryptocurrencies, which shows that these assets are not yet safe havens. Moreover, by prohibiting banks from using these currencies, the Chinese are formalizing their reluctance to see them compete with their own national currency. In the United States, after a few complicated sessions, the greenback recovered thanks to the analysis of a few small phrases from the FOMC minutes, where it is said that it would be appropriate at some point to start discussing a plan to adjust the pace of asset purchases. The EUR/USD parity stalled again from its resistance at USD 1.2240 to fall back below USD 1.22. In the U.K., aided by a recovery momentum, the British pound is at a three-year high against the dollar at USD 1.41. The GBP remains above USD 1.22. Evolution of USD/JPY  |

| Economic calendar The second estimate of Q1 GDP in the Eurozone confirmed the preliminary reading: after a contraction of -0.7% in Q4 2020, the bloc still suffered a 0.6% drop over January-March. Among the major economies, only France managed to stay in the green (+0.4%) thanks in particular to consumption and the construction sector. In the United States, it was the Philly Fed index that attracted attention. This indicator compiled by the Philadelphia Fed measures the manufacturing dynamics of the large Pennsylvania city. It fell quite heavily from 50.2 to 31.5 points between April and May. Most leading indicators have moderated this month, but continue to indicate that businesses expect to grow over the next six months," the survey's authors said. This slowdown was paradoxically welcomed by the markets, which saw it as a sign of a moderation in economic overheating. This could delay the need for the Fed to act to moderate a too brutal economic expansion. The May PMI activity indicators for the major Western economies confirmed continued strong momentum in both services and industry. In the euro zone, special mention should be made of services, which are particularly strong. |

| Renewed nervousness Anxiety is rife. On their highs, indices capsized from inflationary pessimism to monetary euphoria. Volatility has returned to the forefront with announcements of a possible tapering plan (slowing of asset purchases by central banks). A good way to remind us that indices are more like a raging torrent than a long, calm river. It remains to be seen what story investors want to tell themselves, amid all the available scenarios. |

By

By