|

|

| This week's gainers and losers |

| Avis Budget (+16%): Stocks linked to the tourism sector have woken up this week. The US car rental company also benefited from Barclays raising its recommendation from Underweight to Neutral, although the bank's analyst maintained a valuation below current levels. International Business Machines (+10%): The group's quarterly results have attracted investors. In particular because they were fueled by the group's cloud offering, which was previously perceived as lagging behind its rivals in this area. Shopify (-17%): Difficult week for the Canadian star, as investors moved away from the technology sector. The announcement of discussions to buy the technology startup Deliverr didn't help. Didi Global (-30%): The decision to leave the U.S. listing continues to weigh on the Chinese counterpart of Uber. Shareholders have yet to vote on the deal. Netflix (-36%): The group lost subscribers at the beginning of the year and the market has lost faith in the model. Even Bill Ackman, who joined the capital in January, sold everything. The growth crisis of streaming coincides with questions about the business model, including the lack of advertising and the ease with which customers exchange access. AngloAmerican (-15%): The miner had a tough week, as it revealed that its copper-equivalent production dropped 10% in the first quarter. Many analysts downgraded the stock. Carvana (-12%): The U.S. used car specialist, unveiled its first ever quarterly sales decline. The dealership will sell $2 billion of shares, among other things, to cope with this headwind. |

|

| Commodities |

|

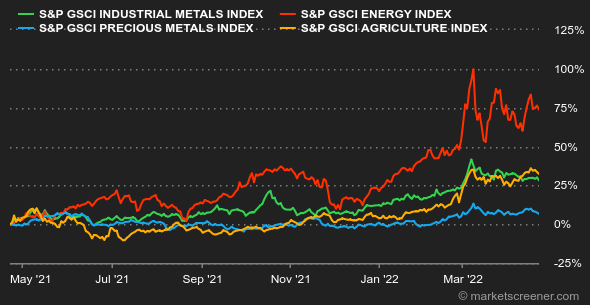

A bearish weekly sequence for oil markets, which continue to evolve according to developments in Ukraine. More specifically, it is the evolution of Russian production that is being closely monitored, in a context where supply is struggling to meet demand. In this respect, the IMF's downgrading of global growth has led to fears of a tightening of oil demand, which explains the easing of prices this week. Brent crude is trading at around USD 106 per barrel, compared with USD 103 for US oil, WTI. Precious metals have been battered this week, penalized by the Fed's change in tone, which has strengthened the greenback and bond yields, much to the dismay of the barbarian relic. In a sign of capitulation, gold is gradually moving away from the USD 2,000 mark. This sharp decline is also affecting silver (which is trading at USD 24.3) as well as platinum (USD 930). Note that palladium has stalled this week, an outperformance that is linked to the significant weight of Russia in the production of this metal, which accounts for nearly a third of global supply. As for industrial metals, it is generally time to breathe due to the rise of the greenback. Only nickel prices (USD 33775) remained relatively firm. Copper has been fluctuating and is trading around USD 10,300 on the LME. A word on agricultural commodities with lumber, whose price has risen back above USD 1000, a 15% increase in five days. Lumber prices had fallen heavily due to rising inventories and easing supply chain disruptions. In Chicago, wheat and corn have given up ground and are buying at 1070 and 780 cents a bushel respectively. |

|

| Macroeconomics |

|

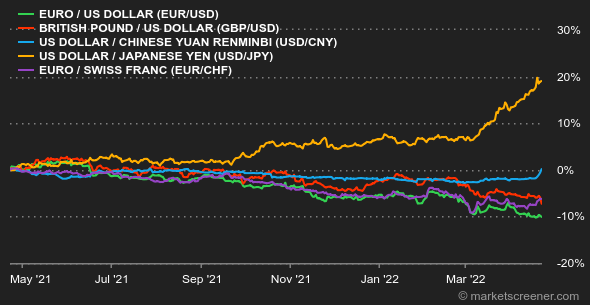

The week was not particularly prolific in terms of macroeconomic indicators, or rather, they did not provide much information. Fed officials continued to prepare investors for a higher rate environment. Fed Chairman Jerome Powell himself blew away the last hopes of a slow-motion monetary tightening on Thursday: his statements raised the probability of a half-point rate hike on May 4 to 100% or close to it. The Fed's determination to raise rates quickly led the yield on US debt to rise, with a 10-year maturity at 3.95% at the end of the week, accompanied by a new inversion of the yield curve, while the 5-year yielded just above 3% at the same time. In Europe, the German Bund reached 0.94% and the French OAT 1.39%. Swiss debt closed at 0.84%. In the foreign exchange market, the dollar continued its rise against Asian currencies, against the yen at JPY 128.398 and against the yuan at CNY 6.4927. The euro/dollar pair has seen some jolts, but the greenback is holding its own at USD 1.0820. Cryptocurrencies: Bitcoin is still unable to break out of the $40,000 zone in which it has been gravitating for more than 10 days now. A lateralization of the price of the digital currency that has enough to put the nerves of crypto-investors to the test. The cryptosphere players are letting themselves be carried along by the gloomy macroeconomic situation, which has little or no inherently bullish catalysts to revive the crypto-asset market. Next week, three big dates are in store in the US: the March durable goods orders (Tuesday), the first estimate of Q1 GDP (Thursday) and the March PCE inflation (Friday). Also on tap are Germany's Ifo business index for April (Monday) and the euro zone's April inflation estimate (Friday). |

|

|

| Things to read this week | ||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By