|

|

| This week's gainers and losers |

Gainers: Okta. The identification software company did much better than expected, with quarterly revenues up 37%. It also issued an encouraging outlook. +34.6% Biotech Horizon Therapeutics is reportedly being courted by several pharmaceutical companies, including Janssen, Amgen and Sanofi. As a result, its capitalization rose from less than $18 billion to nearly $23 billion in two sessions. +28.9% This was a good week for Pinduoduo, the Chinese e-commerce site listed in the United States, which benefited from a return of investors' appetite for risk. Other stocks in the sector such as Alibaba and Bilibili also benefited. +27.4% The British company Boohoo got a new CEO, a veteran of the City who the market likes. It also became the largest shareholder of Revolution Beauty, increasing its stake from 12.8% to 26.4%. Boohoo rose 11.3% over the week.

Losers: British consulting firm John Wood has warned that its cash flow will not return to positive before 2024, in particular because of exchange losses. While the group remains confident in the medium term, the market has mostly taken into account the bad news. -19.5% Crowdstrike (-12.2%): The cybersecurity company had a rough week on financial markets after it posted disappointing third-quarter results and said new revenue growth was weaker than expected. NetApp (-11%): The data-management firm slashed its guidance for full-year adjusted earnings per share and revenue growth. Retailer Dollar General cut its fiscal 2022 earnings guidance, pressured by cost inflation. Earnings are expected to rise by 7-8%, instead of 12-14% previously forecast. -8.1%. |

|

| Commodities |

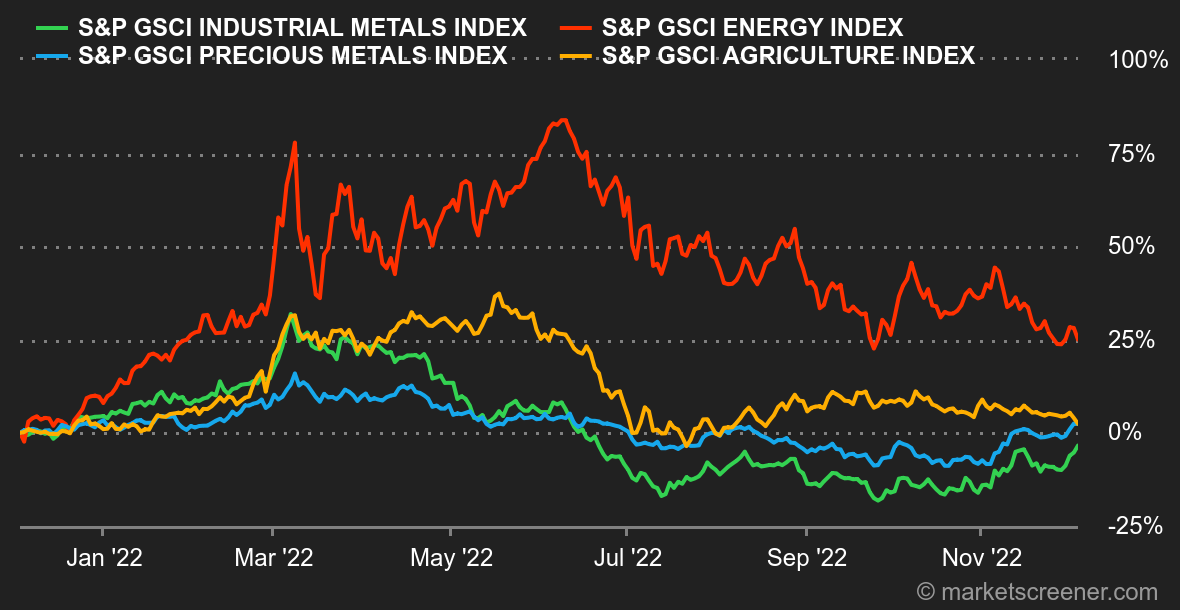

| Energy: Oil prices are poised to end the week higher, buoyed by speculation ahead of an OPEC+ meeting, which will take place virtually this weekend. The stakes are high as the expanded cartel may decide to go further in cutting production due to low oil prices and a slow economic recovery in China. At the same time, Jerome Powell's change in tone, which opens the way for a slowdown in Fed rate hikes, supported risky assets, including oil, which is trading at USD 87.7 for European Brent and USD 82 for US WTI. On the natural gas side, prices soared to EUR 135/MWh for the Rotterdam TTF. Winter temperatures are settling in Europe, boosting gas demand. Metals: Traders continue to follow closely the easing of sanitary restrictions in China, which means more demand for industrial metals. Wednesday's poor manufacturing PMI data did not affect market sentiment too much as metal prices rallied on the LME to USD 8,300 for copper and USD 2,430 for aluminum. Gold continued to rise and briefly reached the USD 1800 per ounce line. Agricultural commodities: Grain prices in Chicago eased, penalized by mixed statistics on US exports. Wheat is trading below 750 cents a bushel, compared to 655 cents for corn. |

|

| Macroeconomics |

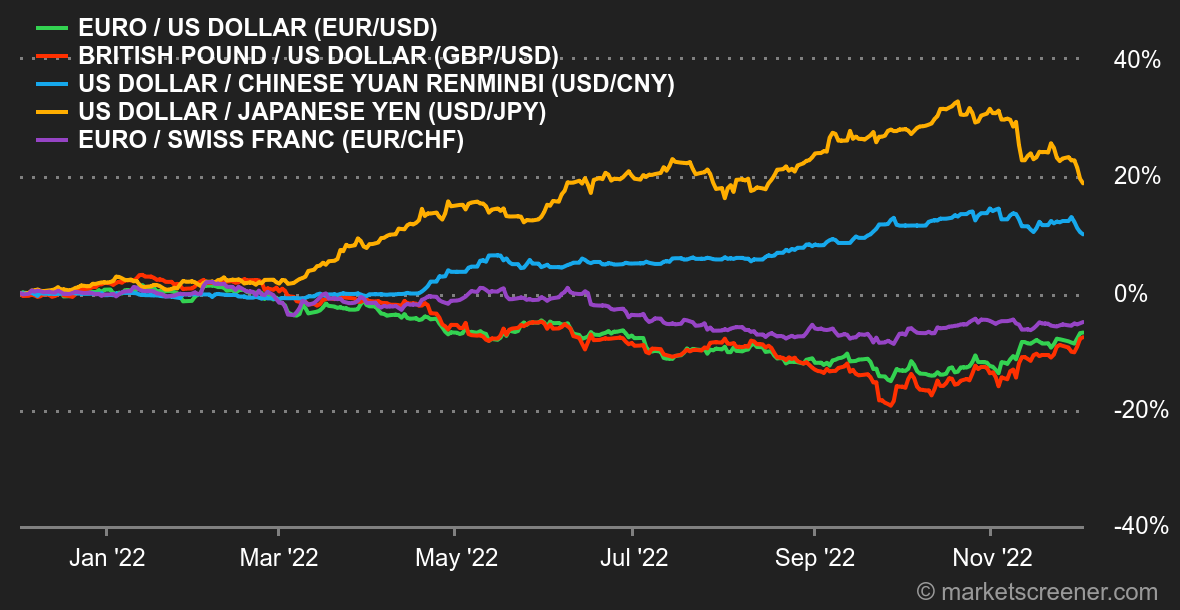

| Atmosphere: Lost in Statistics. Markets continue to overreact to news that could tip U.S. monetary policy one way or the other. Mid-week, Jerome Powell delivered a speech that pleased those who believe rates will peak by the middle of next year, thanks to a moderation in inflation and a soft landing for the economy. Bond yields fell, risk assets rebounded and the dollar took a slap in the face. But Friday was a cold shower, with the release of the US employment figures for November: the labor market is still overheating and wages are still rising. As a result, investors are worried that the Fed will have to stay hawkish for longer than expected. We're going around in circles a bit from week to week. On the other side of the world, Chinese officials look like they are going to abandon a zero-covid policy that is weighing on household sentiment and economic activity. This is a significant lever for the global economy, but one that remains to be confirmed. Currencies: The dollar has suffered a few blows in recent days, culminating in the aforementioned speech by Jerome Powell. The Dollar Index, which compares the greenback to six currencies (euro, pound sterling, yen, Canadian dollar, Swedish krona), came down from its pedestal in the middle of the week, around 105 points. This is a return to its June 2022 levels, after a peak above 114 at the end of September. The euro took advantage of this to climb back to 1.05 USD. The greenback, however, quite logically rebounded on Friday after the announcement of employment data, which broke the circle of statistics favorable to a moderation of monetary tightening. Over the week, the euro also gained ground against the franc, at CHF 0.9849 per EUR 1. Rates: Here too, there was a before and after to Friday's employment statistics. Powell's speech on Wednesday pushed the U.S. 10-year yield down to 3.50%, from 4.20% a month earlier. It rebounded on Friday to 3.57%. The slope of rates is still inverted, a sign that the recession is still on investors' radar. CME's FedWatch tool gives a 75% chance of a 50 basis point rate hike on Dec. 14, compared with a 25% chance in favor of a 75 basis point turn. Elsewhere, the Bund and OAT, at 1.82% and 2.28% 10-year respectively, are little changed from last week. Crypto-currencies: Bitcoin is up 3.15% on the week and is back flirting with $17,000 as of this writing. A timid and soft rebound that is still far from erasing the terrible week of early November that saw bitcoin sink 22% in the wake of the FTX collapse. Ether, on the other hand, is clearly outperforming the leader by registering +7% on the week and is back to hovering around $1300. Despite all this, confidence in the crypto ecosystem is still very fragile and it will probably be a long way to win back the hearts of the crypto-skeptics. Schedule: Christine Lagarde will be out next week, with speeches scheduled for Monday and Thursday. Investors will be able to speculate around the ISM services index in the United States (Monday) and the University of Michigan's producer price/confidence index duo (Friday). |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By