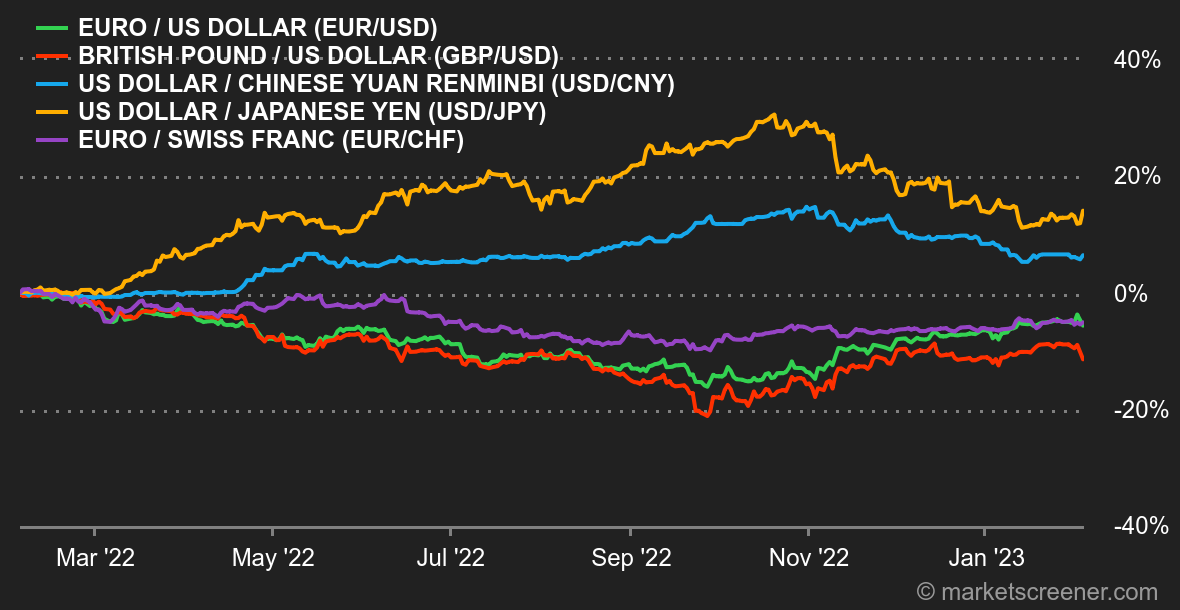

Atmosphere. Fight the Fed. The monetary policy decisions announced this week by the Fed, ECB and BoE did not deviate from expectations in terms of rate hikes. On the other hand, the conferences that followed had some surprises. Especially on the side of the US central bank. Investors feared that Jerome Powell would chastise them for their excessive optimism. Nothing of the sort happened. The central banker appeared confused and his calls for caution were a flop. His posture even reinforced the bulls' favorite scenario of the moment: the Fed is very close to its rate peak and the economy will hold up until it is time to resume a downward cycle. The only "shadow" in the picture is the very dynamic US employment figures for January, published on Friday, which raise fears of a return to firmness by the Fed. We are going in circles. Currencies. The euro regained ground this week against the major currencies, due to the position of the European Central Bank. The institution raised rates by a quarter point, as expected, keeping a firm speech, where the Fed and the Bank of England seemed more measured. The euro is trading at USD 1.0870 and CHF 0.9979. The British pound, on the other hand, lost ground as the BoE governor suggested that much of the work has been done in the current monetary tightening cycle. Elsewhere, the yen advanced against the U.S. dollar to JPY 129.60 per USD. Rates. Last Wednesday's announcement of a 25 basis point hike by the Fed was interpreted by investors as a dovish sign that the US 10-year yield would suffer. However, the employment report impacted sentiment. It largely exceeded expectations and simply cancelled out the drop recorded a few days earlier. In the end, the 10-year oscillated in a narrow channel of +/-3.35% and 3.56%. An upward breach of this range would validate a more significant rebound to 3.90/95%, which would certainly weigh on equity indices. The German 10-year yield is also yo-yoing between 2.32% and 1.97%, without really managing to show a clear trend in the short term. Cryptocurrencies. Bitcoin remains at equilibrium around $23,000 this week, after recording its best January since 2013. A performance that can be explained by a clear revival of investor appetite for risky assets in the beginning of 2023. If the macroeconomic environment continues to brighten and U.S. monetary policy softens in the coming months, the conditions will be right for the cryptocurrency market to continue its ascent. But it is still far too early to draw any certainty on this subject. Timeline. In addition to another fresh batch of corporate results, investors have a few important appointments next week. Starting with a speech by Jerome Powell on Tuesday. Will the Fed Chairman look to refine his Wednesday remarks? It's a mystery. In Europe, the EU will release its new economic forecasts on Thursday. Eyes will turn back to the US on Friday with the release of the preliminary consumer confidence index from the University of Michigan. An important marker to determine if the economy is decelerating slowly or violently. |

By

By