|

Friday October 1 | Weekly market update |

| Financial markets suffered heavy losses this week, battered by rising inflation and the surge in commodity and energy prices, amid fears of a readjustment of central bankers' monetary policies. Financials and energy-related stocks performed well overall, while technology stocks understandably took a heavy toll. |

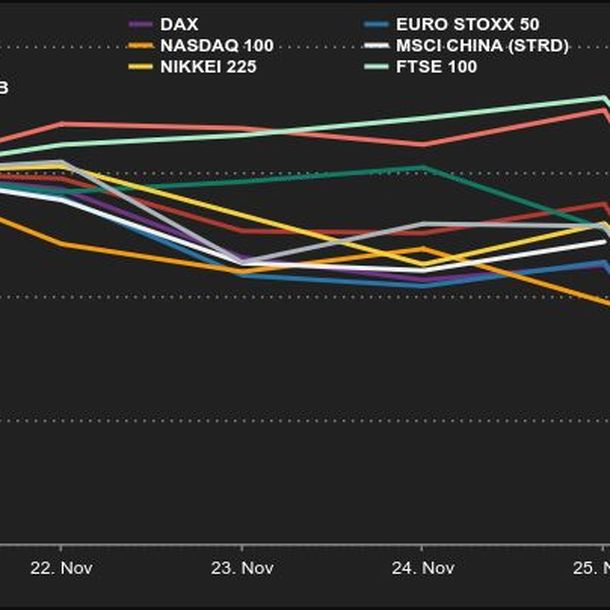

| Indexes Over the past week, red dominates. Only the Hang Seng regained 1.6% while for the rest of Asia, the Nikkei fell 4.9%, after gaining 4.8% in September (more than 9% at its highest) and the Shanghai composite lost 1.2%. In Europe, despite this Friday's rally, the CAC40 recorded a weekly loss of 2.2%, the Dax gave up 2.7% and the Footsie 0.3%. For the peripheral countries of the euro zone, Italy lost 1.5%, Spain 1.2% while Portugal gained 0.8%. In the United State, at the time of writing, the Dow Jones has lost 2.1% over the last five sessions, the S&P500 is down 2.9% and the Nasdaq100 is down 4.22%, suffering from the rise of the bond market. In September, only the Nikkei is doing well  |

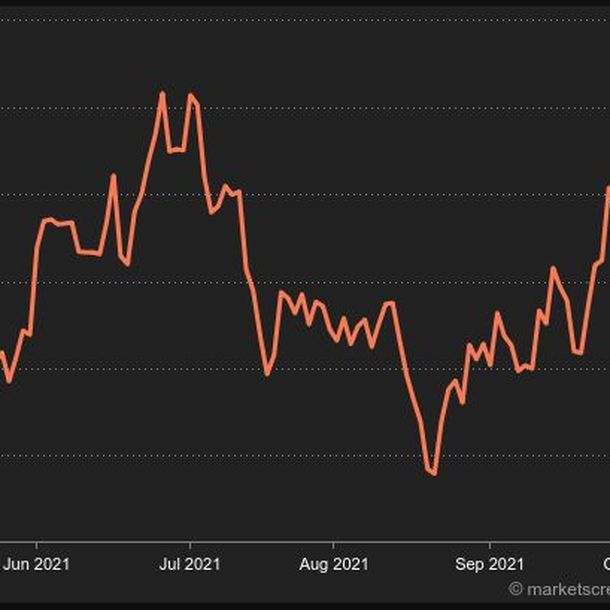

| Commodities Oil prices have stabilized this week, torn between the new increase in U.S. inventories and the surge in natural gas in Europe, which makes oil more attractive for power generation. As a result, investors opted for a sort of status quo as they awaited the next OPEC+ meeting, which will be held in Vienna next Monday. The expanded cartel is expected to increase production by 400,000 barrels per day. Brent crude is trading at around USD 77.8 per barrel at the end of the week, compared with USD 74.3 per barrel for the US benchmark. The rise in volatility in risky assets has benefited gold this week, which has regained some height. But make no mistake, the gold metal is still trapped in a never-ending downward spiral, where one move forward is followed by two moves back. In terms of price, you'll need to pay just under $1,760 to buy an ounce of gold. Consolidation sequence for the industrial metals segment, dragged down by weakening manufacturing PMIs in China. Copper is trading at USD 8645, nickel has lost ground at USD 18180, as have lead (USD 2113) and aluminum (USD 2850). In agricultural commodities, wheat prices recovered to 725 cents per bushel, supported by the downward revision of stocks by the US Department of Agriculture (USDA). Fertilizer price inflation also fueled wheat's rise, as farmers considered switching to less nitrogen-intensive crops such as soybeans for the upcoming crop year. |

| Equity markets Oil and gas prices are soaring on supply concerns, pushing energy stocks higher. Occidental Petroleum Corp. gained 12.2% in 5 days. The US group recorded cash flow from continuing operations of $3.3 billion in its second quarter and maintained capital discipline with spending of $698 million, resulting in free cash flow excluding working capital of $2.0 billion. Its adjusted income attributable to common stockholders reached $311 million, or $0.32 per diluted share, compared to a net loss attributable to common stockholders for the year-ago quarter of $346 million, or $0.36 per diluted share. Occidental Petroleum  |

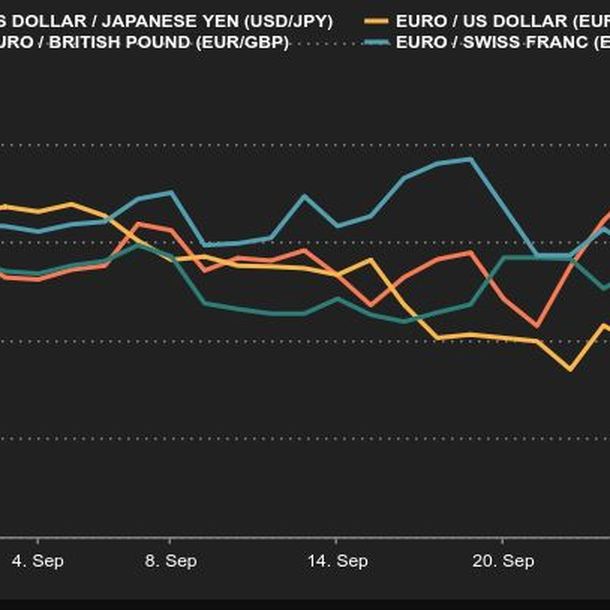

| Macroeconomics Equity markets faced a reality check at the hinge between summer and autumn, not without a good dose of paradox. Western macroeconomic indicators remain good, even if the exuberant post-covid peak has passed, but peripheral mini-shocks are multiplying. In addition to the shaky financial situation of the Chinese real estate giant Evergrande and the shortages that are upsetting all strata of the economy, there has been a surge in energy prices. This surge is hitting the European citizen's wallet as much as the Chinese industrialist's. The causes are multiple, but the consequences are identical. In other words, this new variable is not good for central bankers and their scenario of transitory inflation. However, Jerome Powell (Fed) and Christine Lagarde (ECB) have repeated over and over again throughout the week their belief that inflation will eventually ease. Investors are increasingly skeptical. It is no wonder that bond yields have risen in anticipation of a more aggressive - and/or faster - rate hike than expected. Over 10 years, the T-Bond has returned to 1.50% and the Bund to -0.22%. It should be noted, however, that the acceleration slowed down in the middle of the week. At this stage, central banks seem to be sticking to the scenarios announced in September: asset purchase programs will be reduced in the fall, but monetary tightening will wait. However, the spectre of "stagflation", a term that has come back into fashion recently, is lurking. For the time being, it has been kept at bay by global growth, which remains high if not really solid. The other macroeconomic event of the week, closely related to all the above, is the strengthening of the dollar. It is trading at USD 1.1579 to 1 EUR at the time of writing. The Dollar Index, which compares the greenback to a basket of six major currencies, has reached its best level in ten months, at around 91.11. This strength makes sense in a world where risk aversion has returned. It comes despite a more than confusing domestic political situation in the United States, where President Biden is struggling to get his spending agenda endorsed, caught between a short and divided majority and Republicans who have powerful fiscal leverage. Next week, the OPEC meeting scheduled for Monday raises some expectations at a time when oil and gas prices are soaring. The other big event circled in red is on Friday with the release of the September US employment figures, which are eagerly awaited as they will be an important marker for US monetary policy. Dollar puts pressure on the Euro  |

| Markets understands quickly, but they need a long explanation It's hard for investors to weave their way through the obstacles forever. Shortages, rising prices, broken supply chains and the energy crisis have all fallen on deaf ears until now. The sudden rebound in rates was therefore like an electroshock, or a purge, giving the impression that markets have belatedly realized that central bankers will have to rethink their plans in the near future because of the not-so-transient inflation trajectory. |

By

By