Atmosphere: Bad news? Good news! Things are improving on financial markets with the return of a good old habit: any signal likely to weigh on the Fed's rate hike is welcomed. So a weak macroeconomic statistic invariably triggers the "if things get worse, the Fed will be forced to limit its rate hikes" reasoning. We hold on to what we can. At the same time, the hope of a Chinese awakening with the easing of confinements in the country creates a slightly more buoyant climate.

Rates: U.S. yields pretended to retreat at the beginning of the week, as investors believed that the Fed would soften its stance in the face of less buoyant economic statistics. But they recovered fairly quickly, with the 10-year maturity paying around 2.98%, up from 2.73% at the end of last week. In the meantime, central bankers Loretta Mester and Lael Brainard explained that rates might also have to be raised in September. In Europe, the week was also marked by a sharp rise in rates. German 10-year debt reached 1.27%, French 10-year debt reached 1.80% and Italian 10-year debt reached 3.4%. The ECB will update on its rates next week, while markets expect it to set the stage for a rate hike at its next meeting in July.

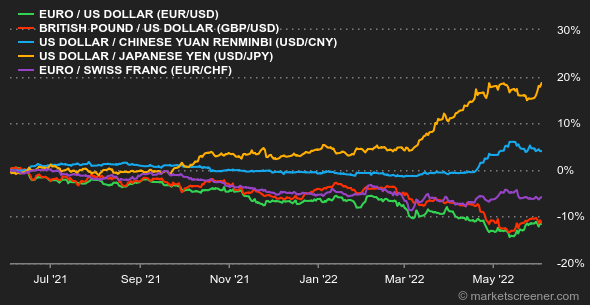

Currencies: With the exception of the U.S. dollar's rebound against the yen, there were no big swings in the major currency pairs over the week. The euro struggled for direction to finish at USD 1.0727 , fairly close to its level from last Friday. The Dollar Index is almost unchanged from last week around 101.89 points. Since January 1, the greenback has gained 13% against the yen, 8% against the British pound and 6% against the euro. It should be noted that currency effects are not trivial for companies, even multinationals: Microsoft has revised this week downward its targets because of the strength of the dollar.

Cryptocurrencies: For its part, bitcoin could end a streak of 9 consecutive weeks of decline if it closes above USD 29,500 on Sunday night. For now, it is hovering around USD 30,000 at the time of writing. After shedding more than 30% of its capitalization over the past two months, the digital currency is still not out of the woods in this very deteriorated macroeconomic environment and may yet test the nerves of crypto-investors during this June.

Calendar: The ECB meets on Thursday, June 9 to decide on its monetary policy stance. The next day, the US Bureau of Statistics will release May inflation figures in the US, which will determine whether the high point has been passed and how fast the decline is starting. Unless...

|

By

By