|

Monday June 7 | Weekly market update |

|

Good statistics on both sides of the Atlantic allowed many financial markets to set new records last week, despite the rise in inflation, which raises fears of an upcoming adjustment of central bank monetary policies. On Friday, lower-than-expected job creation in the United States allowed indexes to remain high. |

| Indexes Over the past week, Asia has slightly underperformed, with the Nikkei down 0.7%. The Hang Seng lost 0.9% and the Shanghai Composite 0.25%. In Europe, the CAC40 gained 0.4% over the last five days, the Dax gained 1% and the Footsie 0.5%. As for the peripheral countries of the euro zone, Italy gained 1.3%, Spain lost 1.5% and Portugal posted the worst weekly performance, with -1.8%. The Nasdaq100 recorded a weekly gain of 0.4%, the S&P500 climbed 0.3% and the Dow Jones climbed 0.5%. |

| Commodities Good economic statistics, OPEC+ control of world production and a drop in US inventories: many good signals on oil markets, where some references have crossed symbolic price levels. This is notably the case for Brent, which is currently trading above USD 70. WTI is trading above USD 69. Precious metals, on the other hand, are taking a break and lacking the fuel to continue their ascent. Gold is back below USD 1,900 per ounce, platinum is losing ground at USD 1,150 while silver and palladium are trading around USD 27.5 and 2,830 respectively. In industrial metals, the strong dollar weighed on the entire segment. As a result, copper went below USD 10,000 per metric ton. Zinc, aluminum and lead have also been on the decline over the past five days. Nickel was the odd man out as it rose to USD 18,000, supported by strong demand for stainless steel in China. New annual record for Brent  |

| Equity markets The German automotive sector is recovering, holding the top positions on the DAX in year-to-day variation. The market is slowly but surely recovering, helped by a reduction in VAT in January and health restrictions that are gradually being relaxed in May. BMW has performed 30% since the beginning of the year, and 9% over the week. Over a sliding 12-month period, the manufacturer's May sales have climbed 92%. However, the level remains below the pre-pandemic period. In addition, vehicle production is still under pressure from the shortage of semiconductors. BMW has also announced for November this year, its first 100% electric vehicle. This launch is the first step towards achieving its goal of having 50% of its global sales come from fully electric vehicles by 2030. The popularity of green energy cars was confirmed in May. Nearly 27,000 units were sold, representing a market share of 11.6%. There are now four times as many on the road. The stock is still undervalued, trading at only 8x its 2021 earnings. Consensus analysts are revising earnings per share upward for the next two years. Bullish acceleration of BMW stock  |

| Bond market On the interest rate market, the US 10-year bond continued to post a yield of around 1.6%, as if inflationary fears had subsided in recent weeks. The various statistics on the US economy, which are often positive, have not led to any violent movements. A certain wait-and-see attitude reigns as the June meeting of the US Federal Reserve, which will deliver its monetary policy verdict on the 16, along with its new economic projections, approaches. In Europe, the German and Swiss signatures remain in negative territory over 10 years, at -0.214% and -0.189% respectively. The French OAT stands at 0.15%. On the debt side of Southern European countries, the Italian 10-year yields 0.874%, higher than Greece's 0.808%. |

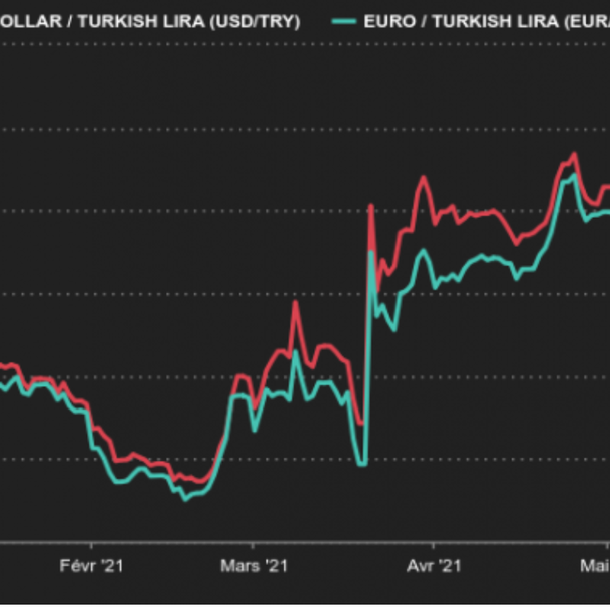

| Foreign exchange market Dollar Recovers, Then Falls Back The dollar (USD) seemed to get its revenge mid-week, rallying against the major currencies on the back of strong US data. On Thursday, the greenback accelerated sharply with the release of good ADP employment figures in the United States. This was particularly true against commodity currencies such as the Australian dollar (AUD), but also against the euro (EUR), which fell back below the USD 1.22 mark. But the greenback suffered a setback on Friday with the release of official labor market data for May, which came out rather weak compared to the hopeful ADP survey. The EUR/USD then rose to 1.2170. On another note, the Turkish lira (TRY) suffered again, hitting an all-time low of TRY 8.80 per USD (see chart), after President Erdogan's comments that "it is imperative to lower policy rates". Finally, the ruble (RUB), which is trading at 73.01 against the dollar, may see some fluctuations after the Russian finance minister said that the Russian sovereign wealth fund would in the short term convert its dollar holdings into gold, euros and yuan. Turkish Lira Suffers Against the Euro and the Dollar  |

| Economic calendar In China, activity data was broadly in line with consensus. The manufacturing PMI came in at 51 (51.1 last month) and the services PMI at 55.2 (54.9 previously). In the euro zone, with the exception of German retail sales (-5.5% vs. -2.4% expected and +7.7% last month), all statistics exceeded expectations. Also in Germany, the CPI index rose by 0.5%, the manufacturing PMI came in at 64.4 and the services PMI at 52.8. In France, these same indices are respectively at 59.4 and 56.6. For the euro zone, the PMI indices were 63.1 and 55.2. The CPI index climbed by 2%, the PPI index by 1% and the unemployment rate fell to 8%. Retail sales fell less than expected (-1.4% expected). In the United States, the situation is identical, with the ISM manufacturing and services index at 61.2 and 64, its highest level since its creation in 1997. As for employment, it appears to be robust, with 978K jobs created in the private sector (ADP survey). The monthly employment report showed an unemployment rate of 5.8%, with 559K jobs created (consensus 645K) and hourly earnings up 0.5%. |

| Increasing divergence The reopening of the economy is combined with a V-shaped recovery in global growth, marked, however, by an increase in divergence. This exit from the crisis, which is singular in its speed, is also singular in the widening gap between the entities of the economy. Last week, we have seen flourishing growth expectations in the US (8.4% between 2019 and 2022) and Asia, while Europe's outlook is rather sluggish (1.7% between 2019 and 2022). However, this reopening has benefited almost all Western indices. An attraction for more volatile assets has also been felt. This improvement marks a lower risk aversion among investors who are more optimistic about the economic outlook for the second half of 2021. |

By

By