|

Friday January 7 | Weekly market update |

| Reassured by the reportedly milder Omicron variant, financial markets set new all-time highs at the beginning of the year, before suffering profit taking. In particular, the Federal Reserve's comments rattled markets, as it considered reducing its balance sheet and raising rates earlier than expected, due to a tight labor market and persistent inflationary pressures. With the quarterly earnings season approaching, volatility is likely to remain high. |

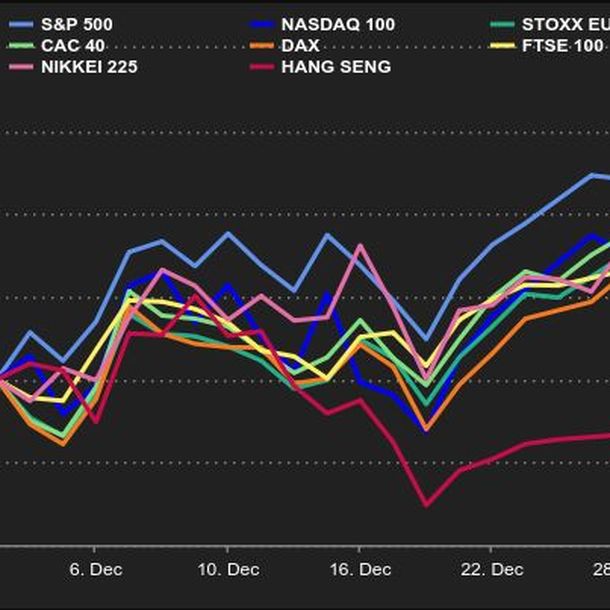

| Indexes Over the past week, in Asia, indexes finally ended in a scattered order. The Shanghai Composite lost 1.65%, the Nikkei 1.1% while the Hang Seng gained 0.4%. In Europe, although erasing part of the gains accumulated over the first few days, the green dominates. The CAC40 rose by 0.9%, the Dax by 0.4% and the Footsie by 1.3%. For the peripheral countries of the euro zone, Spain gained 0.4%, Portugal 0.3% and Italy 0.9%. In the United States, however, the picture is different. At the time of writing, the Dow Jones lost 0.2% over the last five days, the S&P500 1.7% while the Nasdaq100 fell by 4.2%.  |

| Commodities Oil prices are starting the year on the right foot. Supported by production disruptions in North America, due to difficult weather conditions, but also in Kazakhstan, where a state of emergency has been declared throughout the country, prices have risen five consecutive sessions. The US benchmark, WTI, momentarily broke the USD 80 mark while Brent is trading around USD 82. Gold, on the other hand, has declined over the past five days. Despite rising risk aversion, the precious metal is failing to gain favor with investors. As a result, gold has once again fallen below the USD 1,800 mark. The refrain is similar for silver, which is losing ground at USD 22.1. In industrial metals, zinc and aluminum prices continue to be supported by rising energy costs in Europe, which is still suffering from the effects of soaring natural gas prices. European smelters are forced to reduce their production, which tends to push up prices. |

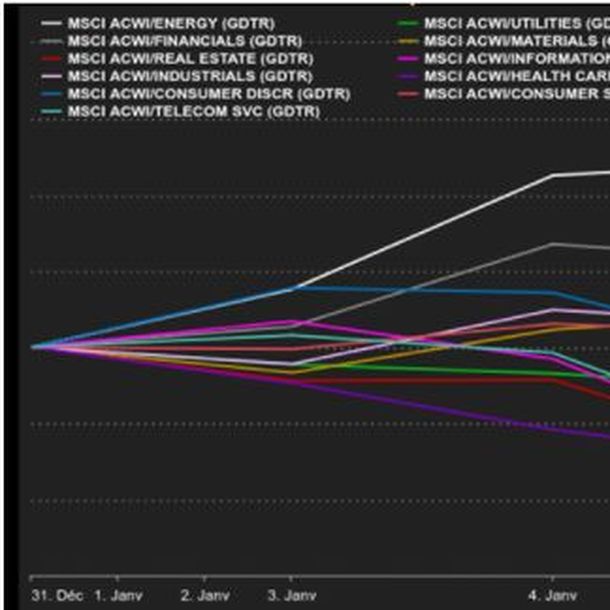

| Equity markets - Daimler / Stellantis / BMW / Renault / Ford (+10 to +20%): the sectoral trends were strong this week. Automobiles shone on cheap buybacks from investors hoping that 2022 will be the year of global sales recovery, thanks to reduced shortages and the development of new ranges, especially electric. - Lufthansa / IAG / Wizz Air (+10 to +20%): fears that recede, rightly or wrongly, on the Omicron variant have boosted the sectors related to tourism. In particular airlines hit by the various waves for two years. - Carrefour (+13%): France's number one food retailer is benefiting from the return of rumors of a merger with Auchan. A price of EUR 23.50 per share has even been mentioned. The market believes in consolidation, but not to the point of throwing itself into speculation. The absence of any denial of the rumors has contributed to the rise in the share price. - Valneva / Novo Nordisk / Sartorius Stedim Biotech (-10% to -30%): this is a bit of a backlash to the increases seen in aviation or automotive. If the pandemic threat is reduced, the healthcare sector will become less popular. It's the communicating vessels. - Exxon Mobil / ConocoPhillips (around +10%): another beneficiary of the week, the oil sector, especially in the US, with the rise in the price of a barrel and the prospect of a business that would be less affected by the pandemic, after the Omicron peak. - Shopify / Servicenow / Salesforce (-10 to -15%): the last major sector to be impacted this week, the technology sector is paying a heavy price for the current sectoral rotation.  |

| Macroeconomics The beginning of the year was not as quiet as expected, with the release of the minutes of the last Fed meeting on Wednesday night. Nothing very new, except for a good reminder to investors - it's in the air now - to remember that the change in monetary policy is now. The U.S. central bank is aware that it needs to raise rates at a steady pace to limit inflationary damage and prevent the labor market from becoming inefficient. Inflation is also being discussed in Europe, where the first estimate for December points to an annual price increase of 5%, which is obviously above the forecast (4.8%). In the United States, the December employment figures surprised: few new jobs were created but the unemployment rate fell again. The euro/dollar pair has changed little since the beginning of the year, still around the pivot point of USD 1.13 for 1 EUR. Traders have incorporated into their strategies a slightly higher risk of economic slowdown in connection with the rate policy, which has caused some jolts in commodity currencies, such as the Australian (AUD), New Zealand (NZD) or Canadian (CAD) dollars. At the same time, the dollar continued to rise against the Turkish lira (TRY). The EUR is trading at CHF 1.04222, up for the week. The release of the Fed's minutes pushed the yield on 10-year US debt back up to 1.72%, a rather rational reaction even though real rates remain firmly anchored in the negative. So is the German Bund, even though it has gone from -0.33% to -0.07% today in two weeks. The French OAT has reached 0.26% and Swiss debt is on the way to entering positive territory again (-0.04%), a step now taken by the Dutch signature (0.03%). This is logical, given the US monetary developments. "The short-term interest rate curve now almost entirely predicts a rate hike in March, more than three 25 basis point hikes in 2022 and a policy rate above 1.75% in three years," points out a good connoisseur of the Fed. On the cryptocurrency side, the market is looking grim in recent days. The $69,000 peak in the price of bitcoin in early November seems a long way off after dropping almost 40% in just two months. Bitcoin is now hovering around $41,000 at the time of writing. The total market capitalization of the cryptocurrency market has followed suit, shedding more than $1 trillion over the same period, dropping from $3 trillion to less than $2 trillion. The next few weeks are shaping up to be eventful for digital assets. Have we entered a bear market cycle? Only time will tell. Next week, the European unemployment rate for November will be published on Monday, the US consumer price index for December on Wednesday, and the production index on Thursday, as well as the European trade balance for November on Friday. |

| Gone with the rates It was a turbulent week. While indexes were soaring at the beginning of the week (especially in Europe), the Fed minutes changed the situation. This very probable rate hike, faster and stronger than expected, led to a sector rotation in favor of value stocks, especially banks, insurers and car manufacturers. You might say that these are cheap buybacks after the portfolio grooming in December. 2022 looks set to be a volatile year, and just as interesting as 2021. |

By

By