|

Friday October 15 | Weekly market update |

| Focusing their attention on the first corporate results, operators have gradually regained their appetite for risk this week, as have the main financial markets, which have regained their height. Many uncertainties remain, such as the sustainability of inflationary pressures, the surge in commodity prices, and the extent of the reduction in central bank support, but the macro and microeconomics seem to confirm for the moment that the outlook remains encouraging. |

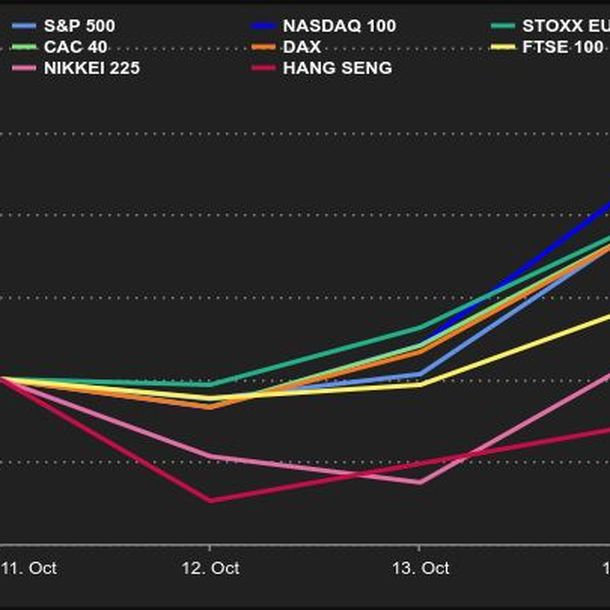

| Indexes Over the past week in Asia, indexes have clearly recovered. The Nikkei gained 3.6%, the Hang Seng 2% while the Shanghai Composite was down 0.5%. In Europe, the CAC40 recorded a weekly performance of 2.5%, the Dax gained 2.5% as well and the Footsie 1.9%. In the peripheral countries of the euro zone, Italy gained 1.7%, Portugal 2.7%, but Spain lagged behind, with only +0.4%. As for New York, at the time of writing this weekly update, the S&P500 is up 1.7% over the last five days, the Dow Jones 1.4% and the Nasdaq100 1.8%. Indexes bounce back  |

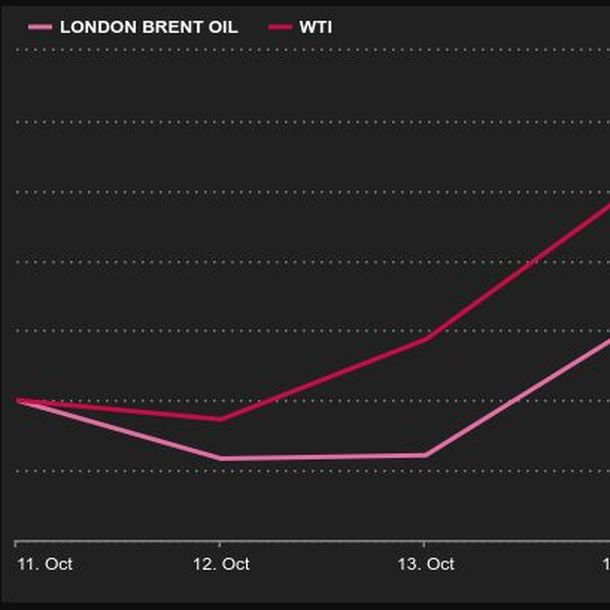

| Commodities Oil markets are on the rise for the sixth week in a row. The growing tension on other energy markets, namely natural gas and coal, benefits oil due to a higher demand. As such, the International Energy Agency has revised upwards its forecast for global demand in 2021 but also for next year. The main benchmarks, European Brent and US WTI, are therefore trading above USD 80, at USD 84.8 and USD 81.8 per barrel respectively. Risk appetite, on the other hand, has weighed on gold prices, which have been close to the USD 1,800 mark this week. Precious metals remain generally neglected, unlike industrial metals, which have resumed their advance due to growing pressure on supply. This is particularly the case for zinc, which has reached a new annual high of USD 3,550 per metric ton. Nyrstar, one of the world's largest zinc producers, has cut production by almost 50% at its three European smelters due to the surge in gas prices. Oil prices keep surging  |

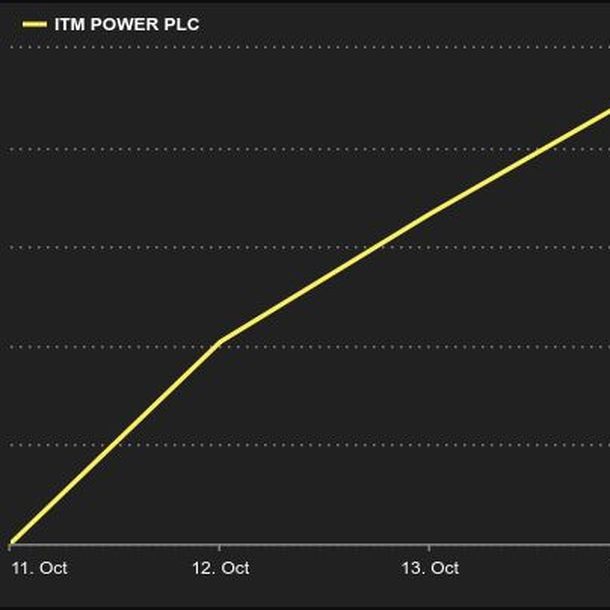

| Equity markets ITM Power, a step ahead in hydrogen ITM Power is a British company that belongs to the restricted circle of "pure players" in the hydrogen industry. As such, its share price has suffered the effects of the stock market's fashion, which fell in love with the specialty in 2020, before considering that oil is perhaps more secure in the short term. As a result, the share price has fallen from GBp 10.56 in 2016 to GBp 724 on January 27, and then to around GBp 440 currently. Enough to make investors seasick. Over the week, however, the stock has recovered more than 10% with the market's renewed interest in hydrogen technology, in a world looking for alternatives to fossil fuels. Research that is back in the spotlight when gas and oil prices are soaring. Unlike many recent players, ITM Power's creation dates back to 2001 and its listing on the stock market in 2004. The company is not mature, however, as it has been piling up losses ever since and its revenue to capitalization ratio could make the granddaddy of experimental investment Cathie Wood faint (£2.6 billion in capitalization for £4.28 million in revenue in 2020). But ITM Power has a proprietary electrolyser technology dedicated to "green" hydrogen and a modern factory in Sheffield to manufacture them. The company has benefited from numerous research programs, which gives it a good lead over the competition. Its cooperative ventures with Linde and Shell, in particular, offer it the opportunity to approach a new stage of development that should enable it to start generating cash between 2025 and 2030, according to current projections. It's expensive, it's valuable, but it's not to be placed in every hand. ITM Power  |

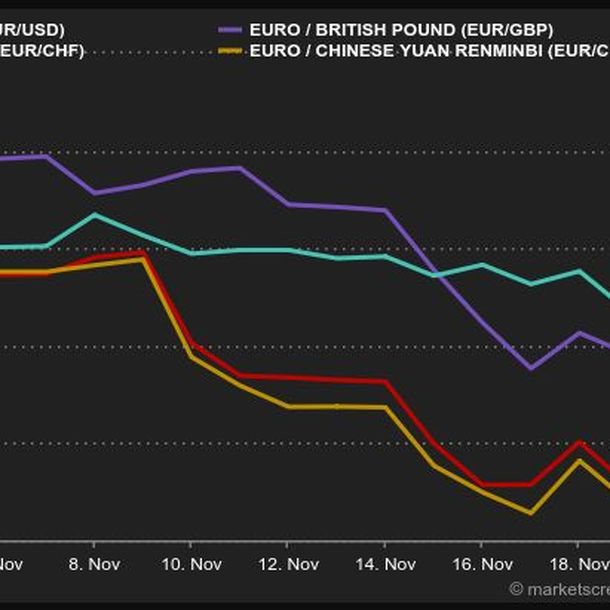

| Macroeconomics Macroeconomic indicators alternated again this week between good and bad, but it is clear that the former category has grown. For example, the United States published robust weekly employment data and lower than expected producer prices. At the end of the week, retail sales rose much more than expected. Meanwhile in China, strong exports in September also surprised economists. The only downside was the deterioration in the ZEW index of German financial confidence. At the beginning of the week, the rise in bond yields gave the markets a new cold sweat. But the threat has subsided. U.S. government debt hit a multi-week high of 1.60% on the 10-year. This move pushed the Bund back to -0.09% and the Dutch signature into positive territory. On Friday, the waves smoothed out with the Bund back at -0.16% and the Dutch bond at -0.04%. On the currency front, the euro/dollar pair moved slightly in favor of the single currency, which eased the pressure that had been prevailing for several weeks. Back to USD 1.16 for 1 EUR. "Interest rate and yield differentials continue to play a key role in determining exchange rate movements at the moment, as evidenced by the fall of the yen and the recovery of the pound sterling," Unicredit traders point out. Indeed, the Japanese currency has fallen to USD 114.35 from JPY 110 earlier this month. The pound is trading at GBp 0.8438 against the euro, levels not seen since late winter 2020. The first estimate of Chinese Q3 GDP is due next Monday. The other major event will take place on Friday, October 22, when the new October PMI indicators for the world's major economies will be published. EUR/USD  |

| Gone with the Wind Investors seem to have regained some appetite for risk this week, reassured by the first results of US banking stocks. Traders are expecting 30% earnings growth for S&P 500 companies in the third quarter compared to last year. The clouds seem to be lifting slightly as we head into the end of the year, although as we have seen, the market has held up well against the bad news of recent weeks. Earnings season continues next week with the results of several tech giants. |

By

By