|

Friday September 24 | Weekly market update |

| The U.S. central bank was gambling big this week at a re-entry meeting that coincided with a rise in risk aversion, as investors speculated about the consequences of a bankruptcy of Evergrande, one of China's largest developers. In the end, the Fed seems to have gotten out of the mess quite nicely by giving the market what it came for. As for the Evergrande case, Chinese authorities look torn between their desire to sanction the group and their fear of provoking a mini-economic seism. Markets remain globally in a rather wait-and-see situation - after all, they have already made significant gains in 2021 - while betting on a continuation of the growth dynamic. |

| Indexes Barring Asia, the week was positive for financial markets, despite some declines on Friday. The Hang Seng fell by another 3%, the Nikkei lost 0.8% while the Shanghai Composite ended at a balance. In Europe, the CAC40 recovered 1.2%, the Dax 0.3% and the Footsie 1.4%. For the peripheral countries of the euro zone, Italy regained 1.3%, Spain 1.5% and Portugal 2.4%, thus signing the best weekly performance. In the US, at the time of writing, the Dow Jones is up 0.6% over the last five sessions, the S&P500 inches up 0.4%, while the Nasdaq100 is down 0.5%. |

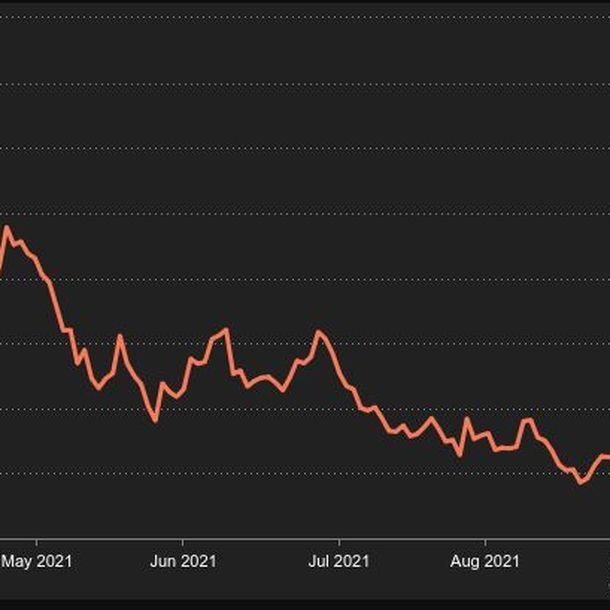

| Commodities Oil prices have signed a new week of progress, boosted by a decline in U.S. inventories - for the seventh consecutive week. The tension on the energy market in Europe, where the price of gas is soaring, also promotes demand for oil. Brent crude oil broke the USD 77 per barrel barrier, its highest level of the year. WTI is trading at around USD 74. The speeches of central bankers are definitely not helping the cause of precious metals, whose prices have been weighed down this week by the forecasts of the Federal Reserve. It is preparing for a more restrictive policy at the monetary level. The Evergrande drama also weighed on the price of the gold metal, with the prospect of the property developer meeting its deadlines in the very short term. Gold lost ground to USD 1,750, while silver stabilized at around USD 22.6. On the base metals front, aluminum resumed its upward path at USD 2940 and is still on a roll due to global supply disruptions. Another notable fact is that copper limited the breakout this week, further evidence that investors are not anticipating a dark scenario on Evergrande. In agricultural commodities, less favorable weather in Russia and Europe supported wheat prices. Corn, on the other hand, lost ground due to a larger-than-expected US crop. Evolution of US oil stocks  |

| Equity markets QuantumScape is a promising start-up developing solid-state lithium metal batteries for electric vehicles. This week, it saw its stock gain more than 26% after announcing a partnership with a big carmaker - its second big partner after Volkswagen. The company said the unnamed OEM has committed to collaborate on the evaluation of prototype solid-state battery cells. QuantumScape's bottom line is up significantly this year, and EPS is expected to grow 89% in 2021. The tax credits and rebates included in the Biden infrastructure plan should provide significant support for electric vehicle sales in the United States, which is good news for the battery specialist. QuantumScape jumps 26%  |

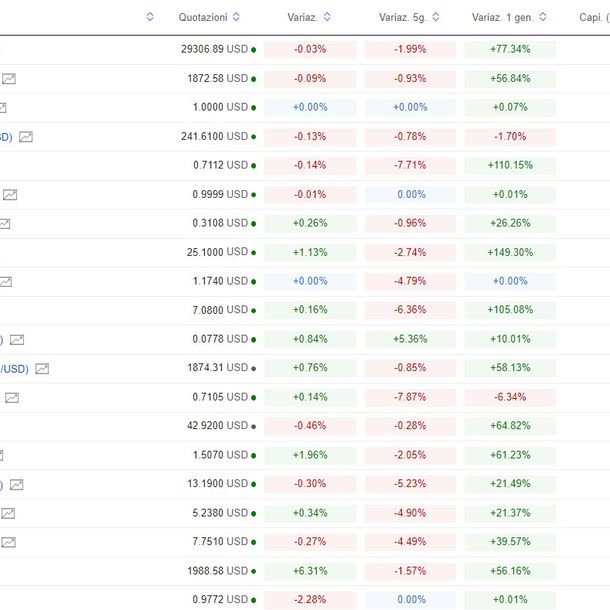

| Macroeconomics Time stood still (a bit) on Wednesday as the U.S. central bank told investors its short and medium term plans. As for the near future, the Fed served investors the menu they were hoping for, namely a gradual reduction in asset purchases and a delay in raising policy rates. The reception was rather good, even if the central bank provided some additional elements that confused some. In particular, the induced medium-term rate projections were a bit higher than what specialists thought. With a few hours delay, bond yields rose from 1.3% to 1.44% for the US 10-year, while the Bund reached -0.22% compared to -0.3% late last week. The French OAT is now well anchored in the green (0.1%), while the Swiss 10-year bond is at -0.2%. In the foreign exchange market, the dollar took advantage of the turmoil on equity markets at the beginning of the week, still partly linked to the Evergrande case, to play its role as a safe haven. The greenback climbed back up to EUR 1.17, before dropping a little to return to around USD 1.1743. The greenback is still in the forefront against the major currencies, especially emerging currencies. The EUR/CHF pair did not move much, after an unsurprising quarterly update from the Swiss National Bank. "The franc is not as strong as it used to be, as prices have risen much faster abroad and the exchange rate has remained fairly stable," UBS points out, adding that this renewed competitiveness is in some ways the result of the SNB's firm policy hand. Let's take a look at crypto-currencies, which are struggling in September. Bitcoin and its peers had a particularly complicated session on Friday after the Chinese central bank took another crackdown on the use of virtual currencies. The statistics published this week showed that the global economic momentum remains robust but is no longer near the top. The September PMI indicators, which measure the optimism - or pessimism - of corporate purchasing managers, are still well anchored in the positive zone in the West, but are on the downside of the curve. How far will this go? This is probably one of the big macroeconomic issues of the coming months. Next week will still be rich in indicators (durable goods orders and inflation in the US in particular). It will also be packed with speeches from central bankers, who seem to be over-subscribed for conferences in the early fall. Not to mention, of course, the German parliamentary elections taking place over the weekend, the outcome of which is uncertain to say the least. A tough September for cryptocurrencies  |

| Evergrande is still a bit scary It was a rather curious week, to say the least, which started badly for equity markets, concerned about the situation of Evergrande. Mildly reassuring signals from the developer allowed a mid-week rebound, which only lasted until Friday. More questions about the Chinese behemoth bankruptcy and the trajectory of the Fed's key rates marred the last hours of weekly trading. The fall opens a more uncertain page for equity markets that continue to digest a very favorable start to the year. |

By

By