|

|

| This week's gainers and losers |

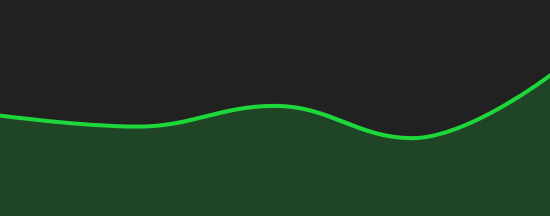

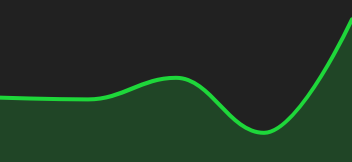

Gainers: Novocure. The oncology laboratory announced that the LUNAR study met its primary efficacy endpoint in non-small cell lung cancer. +62% New York listed Chinese online retailer Alibaba is benefiting from a return of risk appetite in Chinese tech stocks, as the country eases Covid restrictions. Investors are hoping for a recovery in the world's second largest economy. +18.8% European online retail was among the most attacked sectors in 2022. Investors are hoping for cheap takeovers. Autostore, About You, Ocado have benefited this week, and Zalando gains +17.8 % On the strength of a better-than-expected winter season, Ryanair raised its profit forecast for the current year. Other sectoral news also benefited the company, such as the strong passenger traffic momentum at Wizz Air. +13.6%.

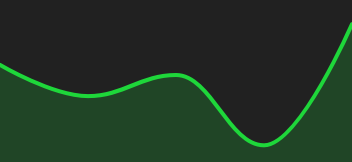

Losers: Among losers, Snowflake and several US tech stocks were severely punished this week, as Wall Street shies away from growth stocks since the Fed's rate policy is difficult to anticipate. -15.3% for the cloud specialist. Tesla is experiencing one setback after another. Already weakened by the purchase of Twitter by Elon Musk, the group announced deliveries below expectations in the fourth quarter and new discounts in China where competition is fierce. -10.4% Constellation Brands, the American spirits giant, has lowered its profit forecasts for the year ending at the end of February, after its fiscal third quarter results fell short of expectations. -9.1% Zoominfo, which provides go-to-market intelligence and engagement platform for sales and marketing teams, fell 14% after many analysts lowered their price target on the stock. |

|

| Commodities |

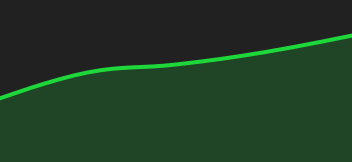

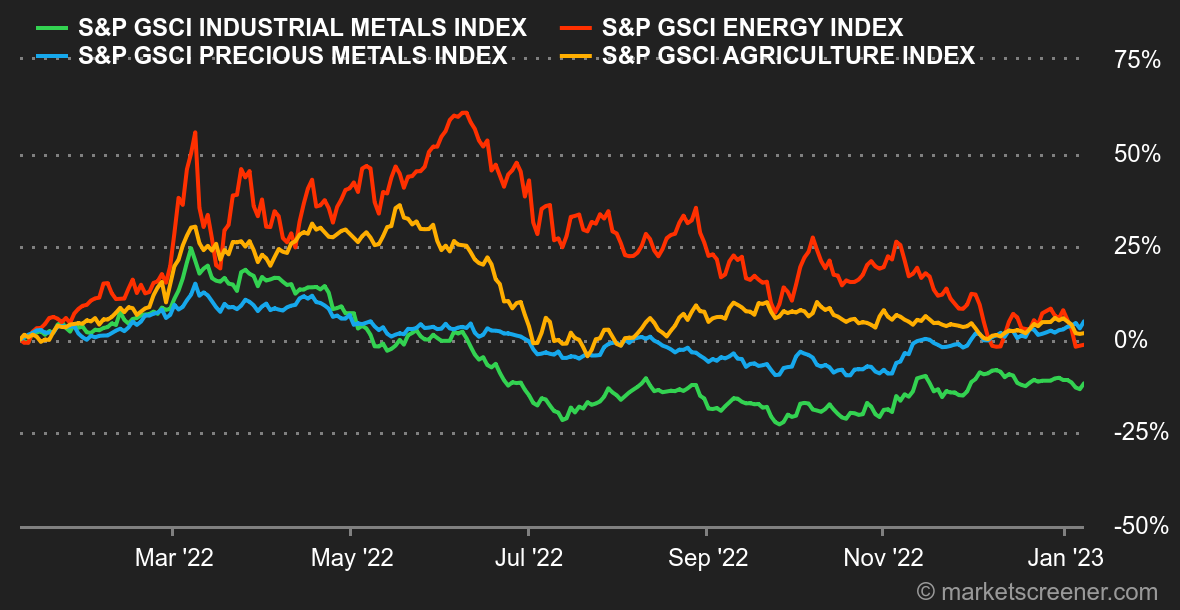

| Energy: There's a hangover this week on oil markets, which are starting the year on the wrong foot since prices are falling by about 7% for Brent and WTI. The hostilities were launched by Reuters, which estimates that OPEC's production increased in December despite the targets for production cuts. The cartel reportedly extracted 29 million barrels per day last month, 120,000 barrels per day more than in November. This increase is largely linked to the resumption of production in Nigeria. At the same time, operators fear the consequences of the acceleration of the Covid-19 in China, which could eventually weigh on demand despite the reopening of the country. In terms of prices, North Sea Brent is trading around USD 83.50 while US WTI is trading at USD 78.40 per barrel. Exceptionally mild temperatures across much of Europe continue to weigh on natural gas prices. The Rotterdam TTF is trading at EUR 75/MWh, its lowest level since November 2021. Metals: Increasing cases of Covid-19 in China are weighing on industrial metals consumption, according to the Shanghai Metal Market. Smelters and steelmakers are cutting back due to lack of manpower. On the London Metal Exchange, a ton of copper is trading at around USD 8400. In precious metals, gold is up to 1850 dollars. The barbarian relic is benefiting from an easing of bond yields. Agricultural commodities: As for soft commodities, wheat and corn are beginning a consolidation sequence in Chicago at 750 and 657 cents per bushel respectively. |

|

| Macroeconomics |

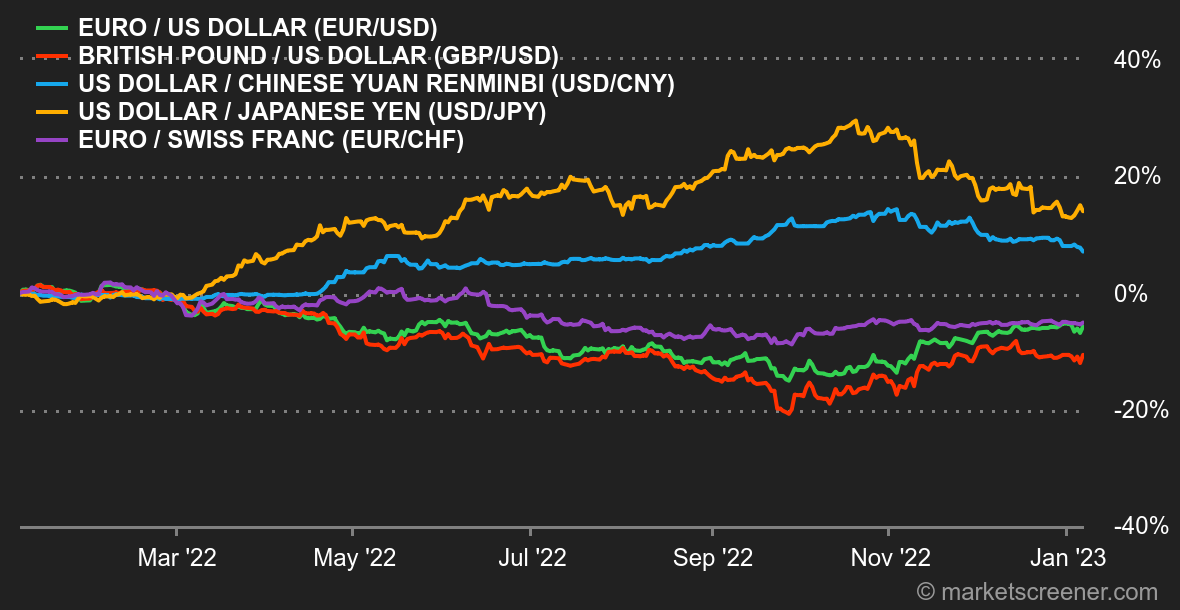

| Atmosphere: The beginnings of a shudder. The reduction in the pace of inflation in Europe has resurrected the prospect of a less aggressive ECB on rates, while in parallel, the sharp drop in the price of gas has reduced the risk weighing on companies in the Europe. In the United States, the mood was a little different with uncertainty still high about the Fed's monetary policy, in a context of statistics still too strong for the central bank to abandon its restrictive policy. At least until Friday and the release of employment data in December showing that job creation continues to slow down. For while unemployment remains at the bottom (3.5%), a sign that the economy is still running strong, but hourly wage growth has subtly slowed. It's not much, but investors seemed to hold on to it as a sign that the Fed's efforts are starting to pay off. Currencies. The back-to-school week instead benefited the U.S. dollar, which rallied more than 2% against the yen and between 1% and 2% against the euro and the British pound. The greenback, after a major slump in the fourth quarter, is continuing its recovery, depending on the statistics published in the United States. As long as they are robust, they fuel the prospect of higher rates for longer. For its part, the euro / franc pair is treading water at around CHF 0.9879 per EUR 1. Rates: "So far so good". Despite a still resilient U.S. labor market that is not doing the Fed any favors, interest rates nonetheless stalled on Friday, fueling the rise in stock market indices. The correlation between interest rates and equity indices, which has been in place for several months, remains unchanged. The 10-year yield is still topped by its 50-day moving average, which is resisting around 3.80/90% and is a good barrier to the upside. In Europe, the German 10-year yield is also back down after having stalled at the October highs around 2.55%. As mentioned in a recent article on the BTP/Bund spread, we favor further easing in rates. Crypto-currencies: In line with the end of 2022, bitcoin is showing relatively low volatility in this first week of 2023, still stuck around $16,800, up 0.86% since Monday, at the time of writing. So investor appetite for bitcoin still remains low for now. Ether, the second largest crypto in terms of valuation, is clearly outperforming the leader by registering a rise of more than 4% over the week but is still far from reversing the trend after a catastrophic 2022. Calendar. Jerome Powell, the Fed boss, is scheduled to deliver a speech on Tuesday. There is little doubt that this will be an important moment for the markets, as will Thursday's release of U.S. inflation for December. To complete the picture, the University of Michigan will unveil its preliminary U.S. consumer confidence index on Friday, another popular date for investors. Elsewhere in the world, China will publish its latest consumer and producer prices on Monday night. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By