|

Monday February 17 | Weekly market update |

|

Despite recurring fears related to the coronavirus outbreak, with a clear increase in the number of global cases (more than 70,000), most financial centres continued their recovery, driven in particular by good quarterly results, the rebound in oil and financial stocks. Risk appetite therefore remains intact, even though the impact of the epidemic on the global economy may be underestimated. |

| Indexes Over the past week, in Asia, the Nikkei lost 0.6% while the Hang Seng gained 1.6% and the Shanghai Composite 1.4%. In Europe, the CAC40 has returned to its annual records, recording a weekly performance of 0.7%. The Dax, for its part, is at its zenith and gains 1.7% while the Footsie is down 0.6%. For the peripheral countries of the euro zone, Portugal gained 0.7% and Spain 1.5%. In the United States, the Dow Jones gained 1.1%, the S&P500 gained 1.4% and the Nasdaq100 gained 2.2%. |

| Commodities The OPEC and the International Energy Agency (IEA) have jointly revised downwards their forecasts for oil demand growth in 2020, due to the containment measures taken by the Chinese authorities. The IEA estimates that the impact on oil consumption in China will be "significant" and anticipates demand to fall in the first quarter, the first time this has happened in more than a decade. However, prices have recovered over the week, as traders are hoping for a strong move by OPEC+ to regulate global supply. Brent rose to USD 56.4 and WTI to USD 51.5 per barrel. The price of gold stabilizes close to its highs at USD 1575, still sought after by investors. Silver continues to hold steady at USD 17.7. The atmosphere remains heavy on the industrial metals compartment, which is on the front line in the face of the coronavirus crisis. However, the main components are offering a timid rebound this week, with the advance of copper (+1.1% to USD 5716), nickel (+2.31% to USD 13065) or lead (+2.29% to USD 1877). New attempt by the CRB to bounce back  |

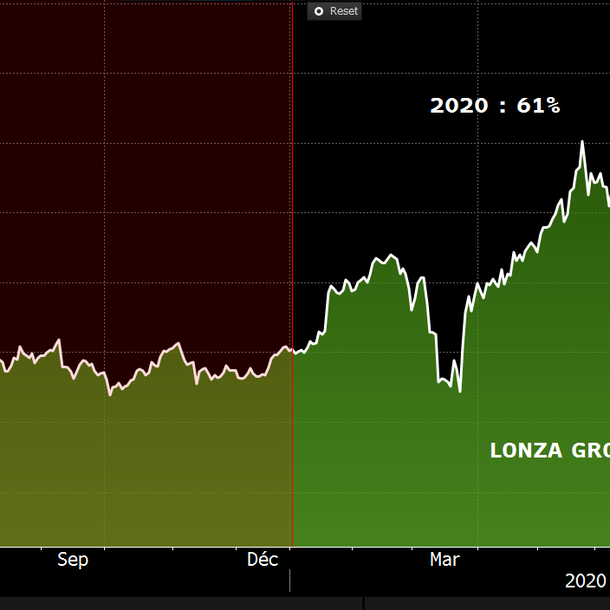

| Equities markets Lonza Group In line with its benchmark index, which is almost perpetually rising, Lonza Group has already accumulated 18% since the beginning of the year and is positioned at the top of the SMI increases. The group, based in Basel, is one of the world's leading developers, manufacturers and marketers of chemical products. Already in great demand in 2019, the share price has risen by more than 50% on a rolling year basis. Margin growth is one of the strengths of the historic Swiss company, which was founded 120 years ago. Weighing 31 billion dollars to date, however, it represents only 2.7% in terms of index weighting. The annual results are convincing, with sales growth of 6.8% and an operating margin of 27.4%. This performance was driven by the Pharma Biotech and Nutrition segment (80% of sales), with an 11% increase in sales and an EBITDA margin of 32.9%. Its valuation levels (37x NBI expected in 2020) are explained by its growth rate and profitability, in parallel with a strong reduction of its debt. Investors largely welcome these good fundamentals. Increase in the Lonza Group share price  |

| Bond market The government bond market continues to be subject to the vagaries of the coronavirus. In response to its spread, investors have rushed to safe havens, such as euro area government debt securities. As a result, yields eased once again on the Old Continent, as did the Bund, with a yield of -0.4%, and the French OAT, with a yield of -0.15%. This fragile environment was further disrupted by the European Commission's assessment in its stable economic forecasts at 1.2%, which also benefited the southern countries. The main rates, Italian (0.90%), Spanish (0.28%) and above all Greek (0.91%) have experienced downward trends. Indeed, the yield on the 10-year Greek government bond hit a new all-time low. Only one year ago, the same benchmark was still around 4% (see chart). At the end of January, Athens was able to finance itself over 15 years, a first since 2009. Swiss debt remains very popular with investors, although it generates a debit interest rate of -0.70%, and the US T-bond also saw its yield fall to 1.59%. Evolution of the yield on the 10-year Greek government bond  |

| Forex market At its lowest level for three years, the single currency is suffering from growing concerns about the health of the European economy and the situation in Germany. The other bearish factor for the EUR/USD was the greenback's rise, which continues last week's momentum. The major currency pair is trading below USD 1.0850, opening up more bearish targets. Also in Europe, the pound sterling reacted positively, as the GBP/CHF pair rose 200 basis points to CHF 1.28 following the announcement of a stimulus package. This upward momentum is also true against the dollar at USD 1.305 or against the single currency at GBP 0.83, a 4-year low. The Dollar thus ended last week higher against the other major currencies, thanks to data showing that the U.S. economy is doing much better than elsewhere in the world. The U.S. economy once again showed dynamism in January, with strong job creation and a recovery in manufacturing activity. The rise in the greenback was confirmed on all fronts, such as against the Brazilian currency at BRL 4.36, which marks an all-time record, or against other safe haven currencies such as the yen (-140 basis points at JPY 109.8) and the Swiss franc at CHF 0.97 (+150 pts). |

| Economic data Weakened by disappointing industrial production figures in Germany as well as in France and Spain, Europe continues to experience sluggish growth. These statistics rekindle fears of recession, despite the negative interest rate policy conducted by the ECB to stimulate the economy. Investors in the euro zone also lost optimism in January. The Sentix investor sentiment index fell to 5.2 for the month after 7.6 in December. The deceleration in world trade, the Chinese health crisis and the Brexit are weighing on the Old Continent. The latest institutional forecasts predict a growth rate of 1.2% for this year and the next. In the United States, weekly jobless registrations have risen less than expected (210k) and core inflation (core CPI), at an annual rate, is up by 2.3%, a figure unchanged from those of the past three months. This week will be a busy one, with central bank (Fed and ECB) minutes. Later, the publication of the "Flash PMI" indicators, established by the IHS Markit institution among purchasing managers, will provide a relevant view of the economy from their companies. |

| Equities are still in strong demand The possible economic repercussions of the coronavirus remain a topic of discussion across financial markets, even if this health crisis does not put particular pressure on share prices. And yet, when publishing, companies do not forget to mention the possible consequences of the virus on their business. The Fed reiterated this week, stigmatizing the likely impact on the Chinese economy. The resilience of the markets remains surprising to say the least and can be explained by its comparative valuation. Indeed, the risk premium that measures the attractiveness of an asset class (equities) relative to sovereign bond yields is close to historical highs and is therefore reassuring for the markets. This comes at a time when indices are breaking records. The persistence of negative interest rates in Europe is not unrelated to this and therefore prolongs the attractiveness of equities. |

By

By