Atmosphere: Strong rebound for the US and European markets at the beginning of earnings season, despite an unfavorable macroeconomic context. At the end of this week, we feel that caution is still the order of the day, given the outperformance of defensive stocks. If you are looking for new all-time highs, look at inflation: the persistent and widespread rise in prices is seriously starting to have an effect on spending and this is being highlighted by the contraction in economic activity. In the Eurozone, the first estimate of the July composite PMI fell to 49.4 from 52 the previous month. Fears of a potential recession are still weighing on markets and next week will be decisive for the US. Indeed, on July 28, the estimated quarterly GDP growth rate will be published, a figure that could well convince officials that we are in a technical recession. Stay tuned.

Rates: Bond markets are still being closely watched by investors. For many, a serious rebound in the equity market cannot take place until bond yields calm down. In this regard, yields are falling in Europe this week following the release of the PMI index. The French 10-year is hovering around 1.6% while the German Bund is getting closer and closer to 1% on the same maturity. Note the spread with the Italian 10-year despite the ECB's willingness to protect the country with a targeted QE. The market seems to be asking for more details on this support plan and for the moment is mainly interested in the 0.5 point rate hike carried out by the ECB on Thursday. In the US, the bond market is a little quieter, with a 10-year yielding 2.76%.

Cryptocurrencies: For its part, the crypto-currency market has had an explosive week with bitcoin recovering more than 10% since Monday, and an ether has more than 15% over the same period at the time of writing. A powerful rebound that comes after a quarter of historic purge on this market. Digital assets have, in addition, against all odds, held up well after Elon Musk announced that he had sold, in the second quarter of 2022, 75% of the bitcoins held by Tesla "to strengthen its holdings in fiat currency."

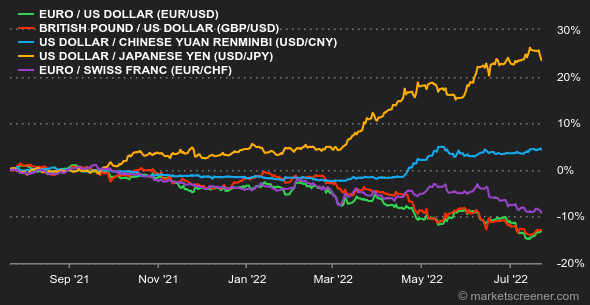

Currency :

Not much movement to report in Forex. The dollar remains strong. Despite the ECB raising its key interest rates by 50 basis points, the EUR/USD is stabilizing at 1.020. With the start of a tighter monetary policy, the uncertainty surrounding the single currency should fade somewhat. This will help, if only in the short term, to keep the euro above the parity threshold. In the UK, the pound sterling is following the same path as the US dollar. After a rebound in the single currency that began late last week, the EUR/GBP crystallized at 0.850. The only currency to continue its rally is the Swiss franc. At the time of writing, the EUR/CHF continues to fall, posting an exchange rate of 0.9830. An all-time low.

Calendar:

Next week promises to be a busy one for economic statistics. To open the ball, the US consumer confidence figures will be released on Tuesday. This is a key statistic for tracking future household spending. This will be followed on Wednesday evening by the much awaited announcement from the Federal Reserve. A 0.75 point rate hike should be officialized. Expected to be +0.4%, quarterly US GDP growth will be released on Thursday at 2:30 pm. The monthly Core Consumer Price Index will be released on Friday. Finally, the Eurozone will also publish the July Consumer Price Index on Friday. Year-on-year, it is expected to be 8.7% - up from 8.6% in June.

|

By

By