|

Friday November 26 | Weekly market update |

| Financial markets thought they could have a break, with inflationary fears persisting and expectations of an earlier-than-expected rate hike. But they have just experienced a sudden return of risk aversion. Friday's session saw a generalized drop in indexes after the discovery of a new variant of COVID, potentially more resistant to vaccines, leading to fears of a cascade of restrictions on a global scale, at a time when the situation was returning a little more "to normal". Volatility should remain high in the coming sessions. |

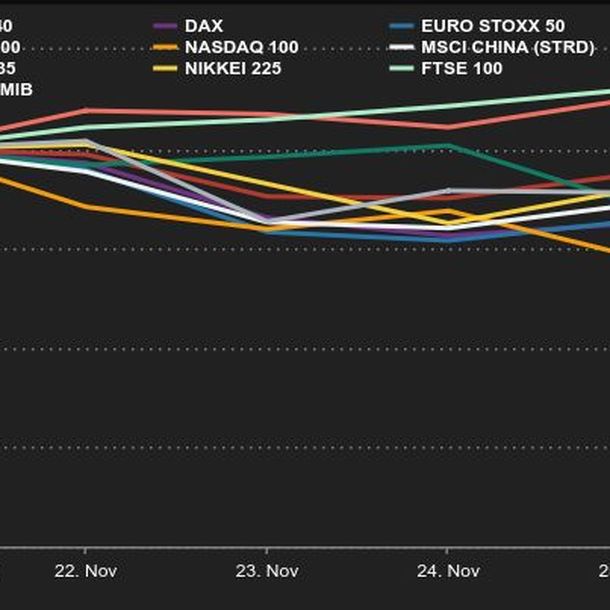

| Indexes Over the past week, the vast majority of indexes lost ground. In Asia, the Hang Seng lost 3.8% over the last five days, the Nikkei 3.3% while the Shanghai composite gained 0.7%. In Europe, the CAC40 fell by 5.2%, the Dax by 5.6% and the Footsie by 2.5%. For the peripheral countries of the euro zone, Italy lost 5.4%, Spain 4% and Portugal 1.4%. At the time of writing this weekly update, New York has had a truncated week with Thanksgiving. The Dow Jones lost 2.0% for the week, the S&P500 2.0% and the Nasdaq100 2.9%.  |

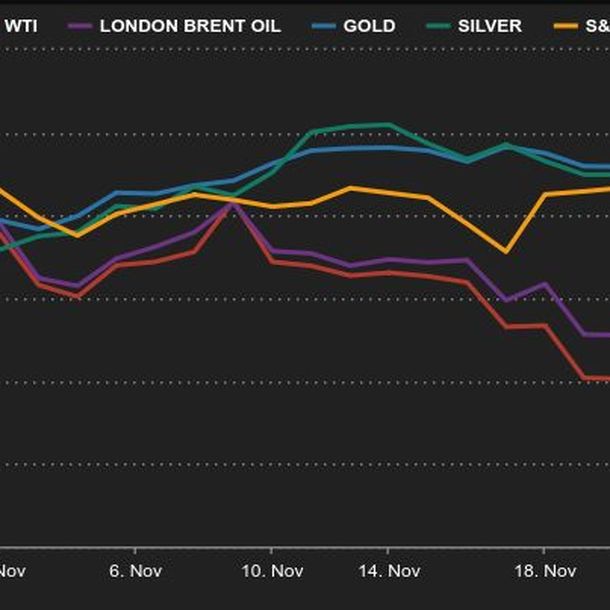

| Commodities Oil prices have resisted the US move to tap into their strategic reserve with other oil consuming countries to pressure prices. However, they couldn't stand the emergence of a new and more virulent variant of the coronavirus, with new travel restrictions. As a result, the price of Brent crude oil fell back below USD 80 and is trading at USD 77. The US benchmark is also falling, to USD 73 per barrel. Despite a rise in risk aversion giving gold some color today, the barbarian relic still remains shunned by investors, hurt by a rising dollar and a slight increase in US real bond yields. The golden metal is trading at USD 1,800 per ounce. Industrial metals, on the other hand, have resumed their upward trend, as concerns about tight supply are pushing prices higher. Indonesia has announced that it will stop exporting bauxite, copper and tin by 2024 in order to move up the supply chain for these commodities. Copper is trading at around USD 9930 per metric ton.  |

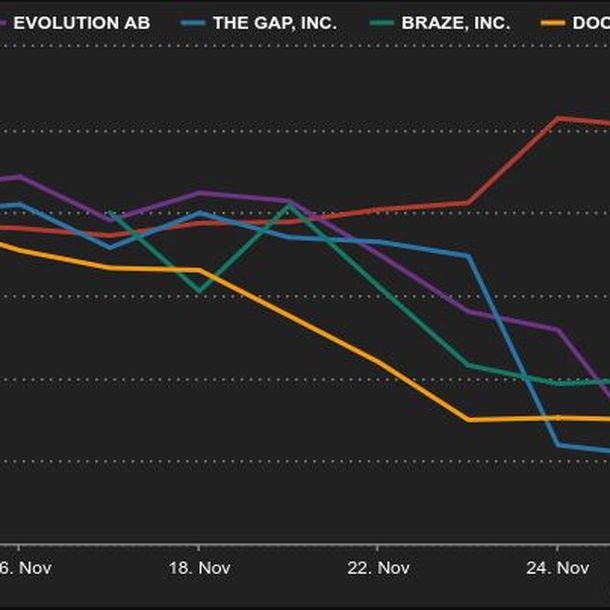

| Equity markets HP Inc: nice week of gains - some 15% - for the American company well known for its computers. The current context of high demand for computer equipment allows it to post stronger than expected quarterly results and good prospects. Evolution AB: the Swedish group that develops online casino games has lost 30% of its value after allegations of illegal gambling in banned countries and subject to US sanctions. An internal investigation has been opened. Gap unveiled flat quarterly revenues compared to 2020 and 1% lower than 2019. The retailer is suffering from supply issues and estimates a $300 million sales shortfall. -24.9% this week The upturn was brief for Braze, which went public on November 17. The US CRM software company, which counts Burger King and Etsy among its customers, dropped 20.7% in the past week Doordash (-19.4%) soared after announcing the acquisition of Finnish Wolt and its entry into the European market. But the acquisition is expected to generate more losses, competition will be fierce.  |

| Macroeconomics Europe showed Thursday that its economy is strong, with November PMI indicators all exceeding economists' expectations. For the record, these surveys conducted by Markit take the pulse of purchasing managers from a wide range of companies, assuming that their inclination to spend or not is a very good leading economic indicator. France, Germany, the UK and the Eurozone in general all show strong PMI growth, which bodes well for the future. In the end this week, it was the U.S. data that weakened, especially October's durable goods orders which declined. On the employment front, however, the weekly numbers are still strong. Everything could have been as good as it could have been, but for the return of the pandemic at the end of the week. The discovery of a variant that appeared in southern Africa, apparently very virulent, plunged the financial markets into consternation, as they thought they were pretty much done with Covid-19 restrictions. In addition to the collapse of oil, the fall of equity markets and the modest rise of gold, the biggest impact of this return of risk aversion is to be found in bond rates. In Friday's session alone, 10-year US government debt went from a yield of 1.63% to 1.53%, or 10 points. Over the same period, the Bund went from -0.25 to -0.32%, while the French OAT is trending back towards 0, around 0.05%. If the pandemic were to lead to new restrictions, central banks would surely have to slow down the reduction of their support, investors believe, which explains the easing on bond rates. In the foreign exchange market, the dollar pushed the euro below 1.12 in the middle of the week, but the greenback eventually gave up some ground afterwards, while remaining at high levels. The greenback also hit a four-year high against the yen in mid-week, at JPY 115.41. The EUR/CHF pair moved a bit in favor of the safe haven currency at CHF 1.0448 per EUR. The most publicized slide of the week was that of the Turkish lira, including a -13% session on Tuesday, against the backdrop of a deep crisis over President Erdogan's stubborn refusal to allow the central bank to raise key rates. The new variant also raises the temperature on the cryptocurrency market. This Friday, the market concedes 7% of its total market capitalization, bringing it below the $2500 billion mark. Bitcoin, meanwhile, is not left behind. Feverishly, it is letting its counter slip below $55,000 at the time of writing. Next week, US central bankers will be in the spotlight with multiple speeches scheduled for Monday. The most watched statistic of the week is scheduled for Friday: the US employment figures for November, one of the important markers of US monetary policy. |

| Covid-proof stocks are popular again Markets are suddenly aware that the virus never really left. The new, more contagious and rapidly mutating variant, named B.1.1.529 and detected in South Africa, is a harbinger of a new wave of infection. Naturally, "Covid-proof" stocks, especially in the field of health related to vaccination, have surged. But let's not draw hasty conclusions on a variant about which the scientific community does not know much yet. It is during these turbulent times that we realize that being confident on our positions is priceless. As far as economic statistics are concerned, next week, manufacturing PMI will be released on Wednesday, the unemployment rate and producer price index in Europe on Thursday, and the composite PMI and services PMI on Friday. Have a great weekend! |

By

By