|

|

| This week's gainers and losers |

Top gainers : Avast (+47.7%) : The British competition authority has finally approved the takeover of the company by NortonLifeLock for 6 billion pounds, which will create a heavyweight in cybersecurity. Coinbase (+41.2%) : The cryptocurrency trading platform, will join the Aladdin network of BlackRock. One more step towards legitimizing the cryptoasset sector in finance. Uber (+35.8%) : The company has reported its first-ever positive cash flow quarter in 13 years. The ride-hailing company is still in a loss position, but business remains strong, which is enough to make investors happy. Moderna (+18.3%) : The medical company is looking at about $21 billion in revenue from its Covid vaccine this year, and announced a $3 billion share buyback program. Epam Systems (+17.9%) : The company that specializes in the development and marketing of advanced digital solutions published good quarterly results.

Top losers : Ball Corporation (-19.3%) : The packaging specialist is reporting quarterly sales up 20% but a disappointing quarterly profit. It is hampered by the sale of its Russian assets and has announced a delay in the opening of its new factory. Medifast (-12%) : The diet specialist, reported a better-than-expected quarterly profit but significantly lowered its guidance for fiscal 2022, which is expected to be impacted by inflation. Eli Lilly (-7.2%) : Its quarterly profit fell 32% and missed consensus, the pharmaceutical company lowered its annual outlook and took a $400 million hit from foreign exchange. Rolls-Royce (-7.4%) : The aircraft engine specialist, posted a net loss of 1.6 billion pounds, thanks to currency effects, inflation and supply challenges. Rebound in aviation revenues are still waiting. |

|

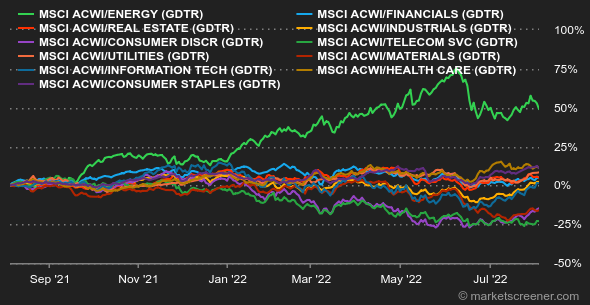

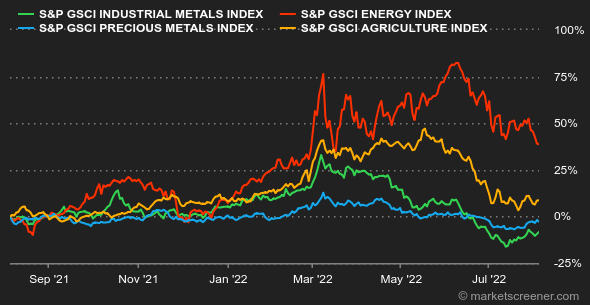

| Commodities |

| Energy Russia has made good on its threat to cut gas supplies to Europe, keeping Dutch FTT prices around €200/MWh. The risk of a winter gas shortage is growing on the old continent. On the oil side, both Brent and WTI dropped nearly 10% over the past week, settling at $94 and $88 respectively. OPEC has maintained optimistic forecasts for oil demand in the second half of the year, but the gloomier outlook could trigger a reassessment of forecasts according to Commerzbank. Metals Gold rallied to $1,775, as U.S. Treasury yields and a falling dollar boosted demand for the historic safe-haven asset. Silver, palladium and platinum are following gold's lead and grabbing a few dollars. AngloGold Ashanti, the world's ninth largest gold producer, saw its profits decline by 18% despite a 10% increase in production, due to inflation hitting costs. Many other gold companies have yet to release their results in August. Agricultural Commodities Wheat is experiencing its third week of falling trading volume as global hedge funds pull back from an asset they loved so passionately in the early months of the year (+50% in February). Wheat fell less than 5% to USD 780 per bushel. The Ukrainian Ministry of Agriculture reported a 45% year-on-year drop in seed harvests, with an average of 3.64 tons per hectare. Three ships containing nearly 60,000 tons of corn left the port of Odessa in an effort to ease the strain on grain demand. Corn lost 2.80% to USD 602 and soybeans fell 2.4% to USD 1456. |

|

| Macroeconomics |

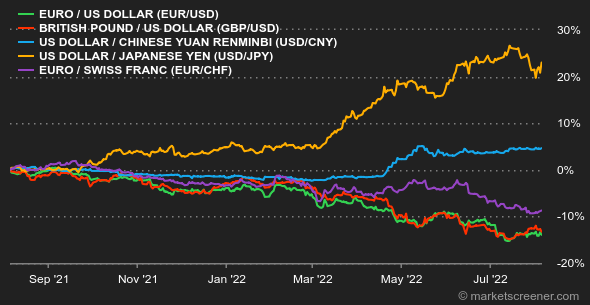

Central banks continued their rate hikes this week, with a new mantra: the 50 basis point increase. The RBA (Australia), BCB (Brazil), RBI (India) and BOE (UK) all gave a double whammy during the week, in an attempt to bend inflation. This should work better than strategies based on the simple hope that inflation will go away on its own. However, we will have to wait to see the impact of these restrictive policies, because the wage/inflation spiral is still taking its toll. On Friday, the July employment data for the US showed that the labor shortage is not going to get better and that wages are still on the rise. At the same time, Nancy Pelosi's visit to Taiwan has worsened Chinese-US relations, taking away the prospect of a reduction in the tariffs imposed by Washington on Beijing, which could have helped fight price increases. Rates: U.S. bond yields fell for much of the week, despite cautious statements from Fed members who continued to hammer home the point that rate hikes will continue until price fever subsides. But investors preferred to focus on their renewed appetite for risk, until Friday and the release of employment data, which showed that the US economy is still overheating. This could imply additional rate hikes... . The US 10-year went from 2.68% to 2.82% in a matter of minutes. The yield curve remains inverted, with 6-month, 2-year and 5-year maturities paying better than the 10-year. In Europe, yields also rebounded at the end of the week. After all, if the US is struggling to fight inflation, how could it be otherwise on the old continent? The German Bund is at 0.9%, the French OAT at 1.44% and Italian BTPs at 2.99%. Currencies: Over the past week, the euro and the dollar have been roughly neutralized around the USD 1.02 for EUR 1 area. The greenback, on the other hand, regained some ground against the British pound and the Australian dollar, despite the monetary tightening by the Bank of Australia and the Bank of England, which the markets had already well integrated. As for the single currency, it gained 0.5% against the franc, at CHF 0.977 for EUR 1. Crypto-currencies: Bitcoin remains almost at equilibrium for this first week of August, hovering around $23,000 at the time of writing. While Coinbase announced yesterday that it was partnering with BlackRock to allow customers of the world's largest money manager to trade and hold bitcoin directly on its Aladdin software, the price of the digital currency has not moved a bit. It would seem that tensions in the Chinese-U.S. relationship, as well as rampant inflation are curbing investors' appetite for risky assets and thus the influx of capital into crypto assets. Calendar: Prices, it's all about prices. US inflation for July will be released on Wednesday, August 10. The next day, producer prices for the same period will be unveiled. On Friday, August 12, the University of Michigan will publish the state of the American consumer in August. Elsewhere in the world, Chinese inflation for July will be published on the night of August 9 to 10. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By