|

Monday March 22 | Weekly market update |

|

Despite the willingness of central banks to reassure investors, partly by keeping rates and asset purchases unchanged, but also by suggesting that inflation is temporarily on the rise, financial markets were prey to some profit taking last week. Bond yields continue to rise, once again pushing traders to reduce their exposure to highly valued technology stocks, especially since indices are currently holding close to their records. |

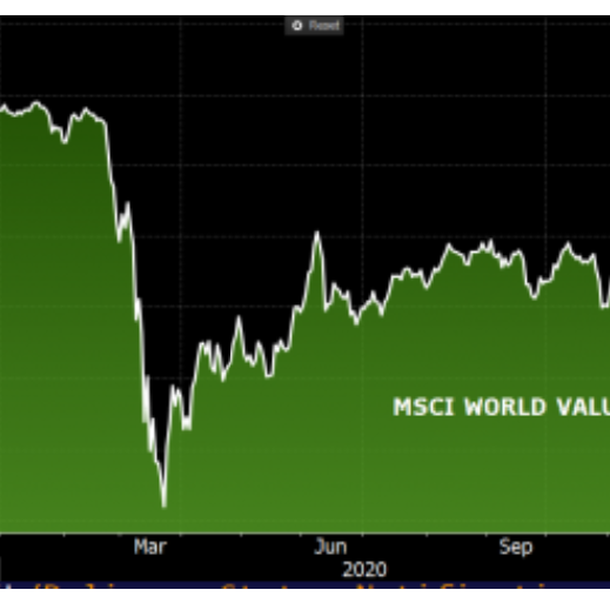

| Indexes Over the past week, Asian indices have held up well. The Nikkei gained 0.25%, the Hang Seng 0.7% while the Shanghai composite lost 1.4%. In Europe, the CAC40 recorded a weekly loss of 0.6%, the Footsie of 1.1% while the Dax gained 1%. For the peripheral countries of the euro zone, Portugal lost 0.1%, Spain 1.7% but Italy gained 0.2%. The Dow Jones is losing 0.1% over the last five sessions, the S&P500 is down 0.5%, as is the Nasdaq100, to the benefit of "value" stocks (see chart). MSCI World Value  |

| Commodities Movement on the oil market this Thursday, the barrel of WTI and Brent lost 7% at the close. Negative sentiment due to doubts about the deployment of the AstraZeneca vaccine in Europe, commercial oil reserves as well as rising tensions between the United States and Russia. At the beginning of the week, the London barrel was close to $70, today it is at $64. Of particular note is the surge in the price of palladium, which has risen 12% over the past 5 days, reaching $2604. Indeed, following the bottleneck at two Siberian mines, Nornickel announced a drop in production of platinum, copper, nickel and palladium, of which it is the largest producer. On the yellow metal side, the recent increase in US bond yields and the Fed's optimistic stance is increasing the cost of holding gold. This may imply a continuation of the downward trend in the price of the safe haven metal. It had reached its highest level since March 1. Gold is now trading at $1,732 per ounce. The global commodity index breaks through a supporting oblique  |

| Equities markets Gan Limited is a company specializing in the design, development and distribution of gambling games for online casino and sports betting applications in the United States. The company went public in May 2020 and has seen its value double to date, rising more than 30% since the beginning of the year. It is now worth just over $1 billion. The gaming software distributor was able to benefit, at the end of 2019, from a boost in US legislation. Indeed, the government of Michigan signed a bill concerning the legalization of online gambling. In New Jersey, legalized since 2013, online sports betting and casinos have recently generated a revenue of nearly 1 billion dollars per month. A sum that could give ideas to other states, offering new opportunities to Gan Limited and other players in the sector. According to analyst forecasts, the company's revenue is expected to increase significantly in 2021, from $30 million in 2019 to just over $100 million. Also according to analyst forecasts, the company's EBITDA could increase by more than 40% per year on average. Results for 2020 will be released on March 25. |

| Bond market Growth is expected to be strong in 2021 in the US. Despite this optimism, the Fed is sticking to its cautious line of not wanting to quickly reduce bond purchases. The U.S. central bank must first verify the real levels of growth and inflation before beginning its tapering. The monetary authorities' forecasts for these two aggregates are higher, but the majority of its members do not see a rise in key interest rates before 2024. As a result of even temporary inflationary risks, investors are selling the bond market, creating pressure on 10-year long-term rates. The Tbond is now trading at a yield of 1.75%. In Europe, the tension is more moderate with a German bund losing a few basis points at -0.30% and a French OAT still close to a symbolic zero (-0.08%). In the south of the old continent, borrowing conditions remain particularly advantageous for countries such as Italy (0.66%) and Spain (0.30%). |

| Forex market The euro remains under pressure as the Covid situation deteriorates, particularly in Italy. Most of the euro zone's third largest economy is once again under lockdown for several weeks. The suspension of the AstraZeneca vaccine instills doubt among market operators, creating additional pressure on the euro. However, vaccination resumed on Friday in these countries. The EUR/USD parity fell again to break the USD 1.19. On the other hand, the good economic news from the United States boosted the dollar, which went up against almost all its parities. The greenback soared against the yen to JPY 109, an advance of 600 basis points over 2021 (see chart). Across the Channel, the British pound is again nibbling away at safe haven currencies, with the GBP/JPY pair setting a three-year high at JPY 152. Traders have also turned their attention to the Canadian dollar. The loonie leads the G10 currencies on the weekly sequence with substantial gains, notably against the dollar at USD 0.805 and against the euro at EUR 0.674 (+200 basis points). Appreciation of the dollar against the yen  |

| Economic data In China, industrial production jumped by 35.1%, retail sales by 33.8% while unemployment rose slightly to 5.5%. For the Eurozone, statistics were few this week. The CPI index came in as expected at +0.9% (+1.1% excluding food and energy). The trade balance showed a surplus of 24.2B against 28.8B expected. In the United States, most figures disappointed. Retail sales fell by 2.7%, industrial production by 2.2%, leading indicators rose by only 0.2%, and weekly jobless claims rose to 770K. On the other hand, manufacturing activity did well, with the Empire State index at 17.4 and the PhillyFed index at 51.8 VS 22.5. |

| Arbitrage favors European indices The abrupt sector rotation of the last few months continues inexorably, leaving an increasingly palpable doubt in the minds of traders about the strength of their "growth" position. Fortunately for Europeans, indices such as the CAC40 and even the STOXX 600 are more heavily weighted in cyclical (or discounted) stocks than their American counterparts. This is not the end of the world for growth stocks, but some valuation levels are becoming increasingly inappropriate as the health situation improves and the economy reopens. |

By

By