|

|

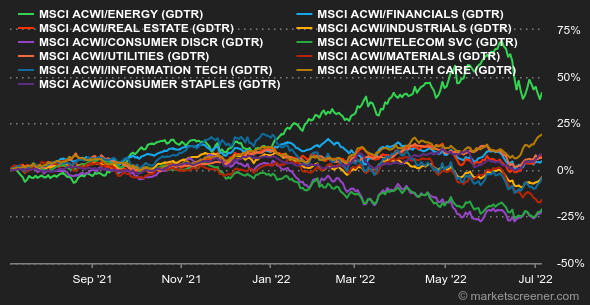

| This week's gainers and losers |

Gainers:

Losers :

|

|

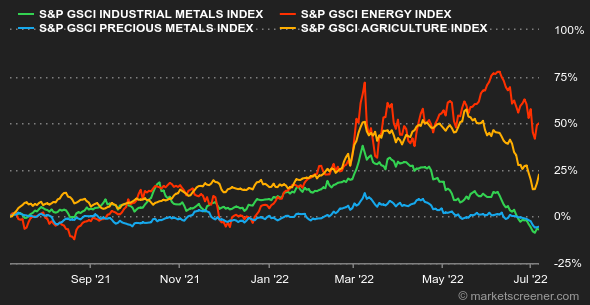

| Commodities |

| Oil: Prices plunged this week, weighed down by growing recession fears that weigh on the outlook for black gold demand. The two global benchmarks, North Sea Brent and US WTI, even briefly fell below USD 100 per barrel. Norway's Equinor announced a resumption of operations at its three oilfields affected by a strike, while OPEC reiterated its concerns about the ability of oil-producing countries to increase their production, as Western sanctions weigh on Russian supply. In terms of prices, Brent crude has slightly recovered on Friday is trading near USD 106 per barrel while the US benchmark WTI is trading around USD 104. Metals: It cannot be said that sentiment is improving in the base metals space. Pressure remains intense on copper, which is in the midst of a new weekly downtrend at $7,835. Like oil, the market remains obsessed with fears of recession, which is synonymous with a decline in demand for industrial metals. However, China recently announced a new stimulus package to boost infrastructure spending, a $220 billion boost that should support demand. The mood is not much happier in the gold metals, where a strong U.S. dollar and high bond yields have pushed gold prices to a new annual low of $1,735. Silver is following the same trajectory at USD 19.10. Agricultural commodities: The price decline continues in Chicago where wheat is trading around 850 cents a bushel. Russia has reduced its export taxes to support its wheat shipments. In Europe, crop prospects are becoming more modest as drought and high temperatures impact yields, particularly in France. |

|

| Macroeconomics |

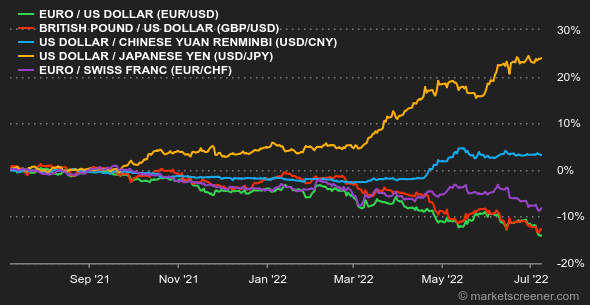

| Atmosphere: China is getting restless. The market seems to have absorbed some of the bad news of the last few weeks. It no longer rule out the possibility that restrictive monetary policies will succeed in reducing inflation without undermining the economy too much. In this context, the Chinese government's stimulus programs - in particular by pushing local governments to invest - have supported the trend. There have also been rumors that the U.S. may reduce its tariffs on certain Chinese products. But these have not yet been followed up. Rates: The week was marked by a rise in bond yields in the US. Ten-year debt is paying 2.99%, slightly lower than the 2 and 5-year maturities which are hovering around 3.02%. This inversion, not even the smallest of margins, highlights recession fears. In Europe, the trend is still downward with the German bond back at 1.27%, while the French 10-year OAT is at 1.81%, back to early June levels after peaking at 2.4% in the middle of last month. The Italian 10-year is back at 3.22%, after rising to 4.19% less than a month ago. Currencies: The dollar keeps strengthening euro fell 3% to $1.01112 against the greenback over one week. This may seem small, but in the foreign exchange market it is a considerable gap. The euro also lost 1.5% against the Swiss franc (to 0.9888 CHF) and more than 1% against the British pound (to 0.8472 GBP), reassured by the announcement of Boris Johnson's departure. Cryptocurrencies: Bitcoin is starting July a little more serene than in previous weeks. In the wake of stock market indexes, the digital currency has rebounded slightly since Monday and is back flirting with $21,500 as of this writing. Crypto-investors have therefore been able to enjoy a week's respite on bitcoin, although it will be a long road for some before they see their positions back in the green after a historic June that saw a -37% underperformance on the asset. Calendar: The first U.S. inflation figures for June are expected on Wednesday, July 13. Producer prices will follow on July 14 and retail sales on July 15, the same day as the University of Michigan's consumer confidence index. So much for the great growth debate. Elsewhere in the world, the focus will be on Chinese growth in the second quarter: the first estimate will be published next Friday. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By