|

Friday August 6 | Weekly market update |

| Strong earnings reports and encouraging US macroeconomic data helped support traders' risk appetite this week, allowing indexes to set new records. The robustness of US employment data released on Friday confirms this scenario, even if the Federal Reserve may have to prematurely reduce its monetary support. |

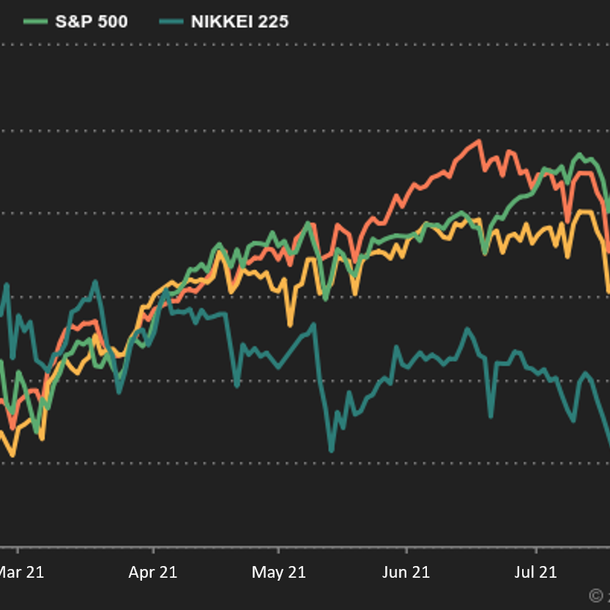

| Indexes Over the past week, all continents have risen. In Asia, the Nikkei recovered 2%, the Shanghai composite 1.8% and the Hang Seng 1%. In the US, all indexes set new records. The S&P500 achieved a weekly performance of 0.9%, the Nasdaq100 gained 1% and the Dow Jones 0.8%. In the euro zone, green is clearly dominant. The CAC40 gained 3.1% over the last five days, the Dax rose by 1.4%, as did the Footsie. For the peripheral countries of the euro zone, Spain and Italy are up 2.4%, and Portugal 2.2%. The SMI, more feverish, grabs 0.45%. Index comparison  |

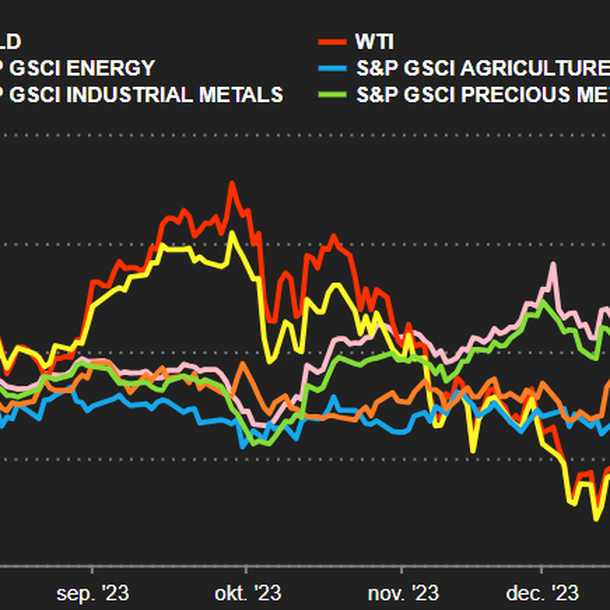

| Commodities Weighed down by the unexpected rise in US inventories and concerns about the spread of the Delta variant on demand, oil prices have lost ground this week. Traders are also closely watching the situation in the Middle East, as new incidents occurred in the Strait of Hormuz, a key oil trade route. Brent crude oil, which temporarily fell back below USD 70, is trading at USD 72 per barrel. The US benchmark, WTI, is trading at USD 69.8. Gold is back to square one and is once again back on the USD 1,800 per ounce line. The selling trend also affected the industrial metals segment, where copper, nickel and aluminum took a break. Copper is trading at USD 9429 per metric ton. In agricultural commodities, there were no major changes, except for lumber, which continued its correction to USD 524. Agricultural vs Gold vs Industrial metals  |

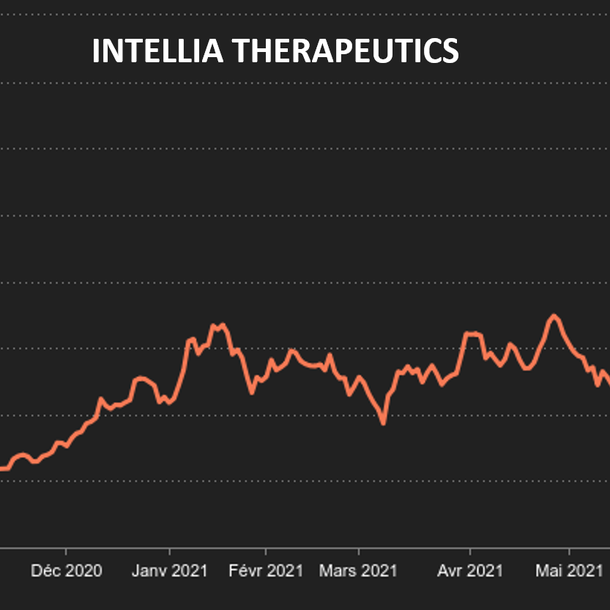

| Equity markets Intellia Therapeutics is a genome editing company focused on developing curative therapeutics using CRISPR/Cas9 technology. In June, the company said it has become the first to successfully use gene editing technology inside the human body, opening up a new area of therapies. Its shares gained 203% since January 1 and rose by 20.5% over the last 5 days to $168.96. The group, based in Cambridge, Massachusetts, posted revenues of $6.55 million for the quarter ended June 2021. It ended with strong cash position of $551.3 million, and raised an additional $648.1 million of net proceeds from follow-on offering in July. With a strong financial position and a well-validated platform, the company is likely to expand and accelerate its development across its full-spectrum pipeline. Intellia Therapeutics's upward trend  |

| Macroeconomics This pivotal week between July and August, which generally focuses on corporate results, was not without interest at the macroeconomic level. First of all, on the side of the central banks, with the last meeting of the Bank of England before September 23. The BoE has not changed anything for the moment, but has sent "a moderate signal of future policy tightening", to use the words of Wells Fargo Bank. The first round of tightening will not come soon, as economists are talking about the third quarter of 2022, a year from now. The BoE sees inflation reaching a temporary peak of 4% at the end of the year and has raised its growth projections for 2022 and 2023. The other economic event of the week was the July US jobs report, which is the focus of much attention as the Fed has made it a key indicator of its monetary stance. The situation is more favorable than expected, with the unemployment rate falling from 5.9% to 5.4% and very high monthly job creation (943,000 vs. 870,000 expected). Fans of the half-empty glass will see this as a good reason to resume speculation on the timing of the reduction in monetary support from the US central bank. Those who prefer to see the glass half-full will be pleased that the economic recovery is supported by an acceleration in job creation. On another note, the Financial Times reported on Thursday that the world's negative-yielding outstanding debt totaled $16.5 billion, its highest level in six months. After fearing an explosion in yields, investors are now wondering about the implications of this reversal. Currently, German, Swiss, Dutch and French 10-year debt are below the 0 level. Japan's has also briefly moved into negative territory. The German 30-year has also slipped into the red, at -0.06% this week. The record of negative interest rates at the end of December ($18 billion) has not been reached, but it is getting closer. At the end of the week, the Bund is at -0.49% and the Swiss 10-year at -0.45%, while the French OAT is at -0.16%. Even Portuguese debt is tending towards the bottom, currently at 0.10%, while Italy, the dunce of the major European nations, is borrowing at 0.54%. In the United States, the 10-year bond has fallen to 1.24% and real rates are now firmly in the red. In the foreign exchange market, the euro is still depressed at USD 1.177. The Bank of Australia's slightly stronger-than-expected shift to tight monetary policy sent the Aussie into a tailspin, but within narrow limits at USD 0.73913. The euro lost some ground against the pound sterling, at GBP 0.8483, while the cable was little changed, remaining around USD 1.39 to 1 GBP. The Swiss franc was flat at CHF 1.075 per EUR. |

| A step closer to tapering Indexes broke records again this week, buoyed by continued accommodative central bank rhetoric, strong earnings reports and robust economic data. These good figures are causing investors to fear a possible reduction in the support measures granted to the economy. Especially if the threat of ongoing inflation continues to lurk. |

By

By