|

Monday September 14 | Weekly market update |

|

Financial markets are reeling from a hectic previous week, with the US tech sector struggling to stabilize. The rejection of the US stimulus plan also prompted operators to limit their initiatives. Nevertheless, Europe is doing well and is managing to regain some ground, while the European Central Bank has left its monetary policy unchanged and is also less pessimistic about the recession. |

| Indexes Over the past week, in Asia, the Nikkei gained 1% while the Hang Seng declined by 1.1% and the Shanghai composite by 2.8%. In Europe, the CAC40 managed to recover 1.2%, the Dax performed 2.5% and the Footsie 3.8%. For the peripheral countries of the euro zone, Italy gained 2% and Portugal 1.2%, while Spain lost 0.7%. Red was clearly dominating in the US, especially across technology, banking and commodity stocks. The Dow Jones recorded a weekly loss of 1.7%, the S&P500 lost 2.3% while the Nasdaq100 fell 3.9%. |

| Commodities The decline is taking hold in oil markets, as Saudi Arabia reduced its official selling prices for shipments to Asia, its main market. A sign that the world's largest oil exporter sees a recovery in demand that is still uncertain by the end of the year. In addition, the EIA raised its estimates for US oil production. As a result, Brent crude oil has fallen below USD 40 per barrel, while WTI is trading close to USD 37. On the contrary, the price of gold moved only slightly this week and is still trading close to USD 1940 per ounce. Silver is also lagging behind USD 26.7. Performance is more mixed in the hard commodities compartment, whose components are generally on a downward trend. Copper traded around USD 6700 per metric ton, nickel gave up 1.5% at USD 14200 while zinc fell to USD 2380. |

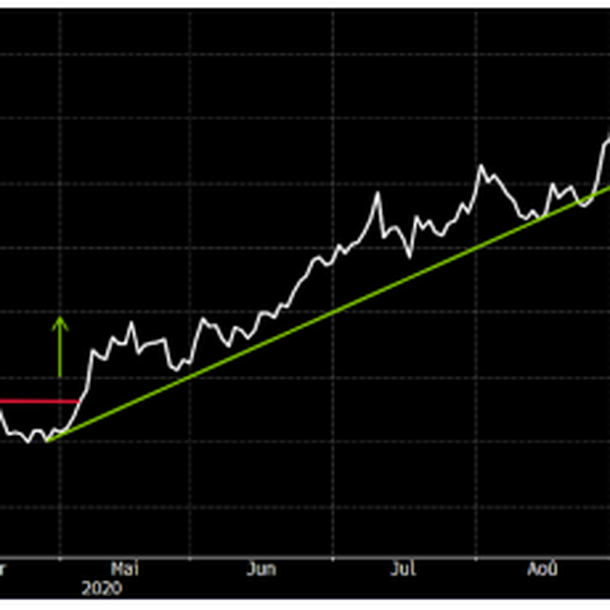

| Equities markets Americans citizens turned to sport during lockdowns, which helped New York-based Peloton Interactive to grow. It sells high-end fitness equipment for individuals as well as distance learning with teachers via subscriptions. The group currently has 1.1 million subscribers, almost twice as many as a year ago, and is struggling to meet the demand. It expects to reach 2.1 million subscribers by the June 2021 fiscal year. The popularity of apartment bikes and treadmills during containment has enabled Peloton Interactive to generate its first quarterly profit of $89 million. As a result of this strong activity, the company also doubled its revenues in the space of a year. In fact, Peloton Interactive is expected to grow strongly in 2022, with an average annual growth rate of 52.7% to reach $4.2 billion. In the same year, the company is expected to generate positive free cash flow of $78.4 million. Peloton Interactive recorded an unrealized gain of more than 220% for the year, whereas it made its IPO just one year ago at USD 29. Progress for Peloton Interactive  |

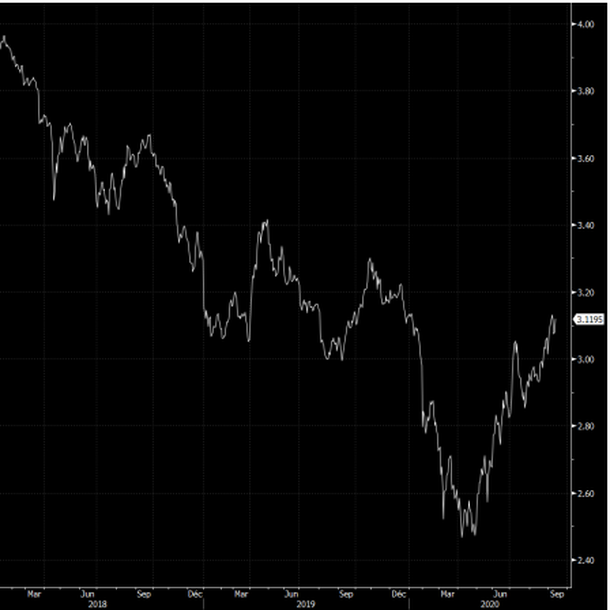

| Bond market The barometer of the bond market remains at last week's levels: buyer interest has not been sufficient to propel the Bund Future upwards, thus towards lower yields. The German bond is trading with a negative rate of -0.46%. The French OAT duplicates this stabilization with a yield of -0.17%. Italy kept a rate below 1% while the country unveiled plans to use the funds allocated to it by the European Reconstruction Fund. Rome's objective is to gradually close the productivity gap with the hard core of Europe through reforms and investment projects. Spain is benefiting from the good atmosphere on the bond market to monetize its loan on a 0.3% basis. Still in Europe, the Swiss benchmark remains the most sought-after, generating a return of -0.49% on the 10-year bond. In the US, the Tbond rose slightly to 0.68%. If there is certainly an anchor point on the lower part of the interest rate curve because of the Fed, this curve could become a little more accentuated with the need to finance the deficit. In China, the ten-year rate continues its progression to reach 3.13%, an 18-month high (see graph). 10-year yield in China  |

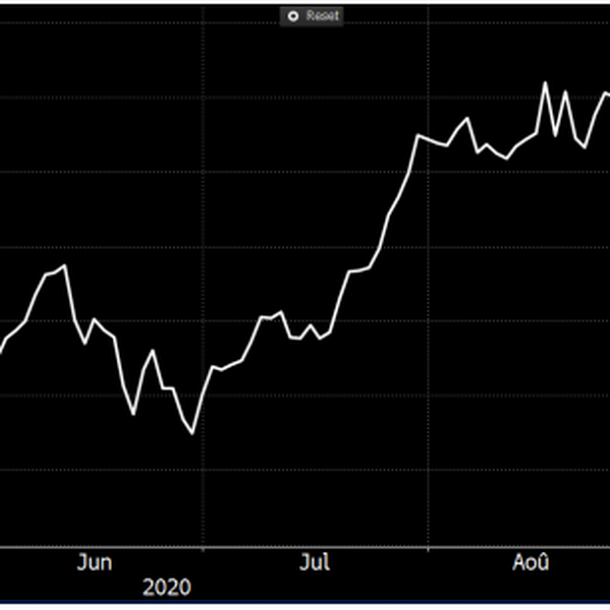

| Forex market ECB President Christine Lagarde said the euro's exchange rate needs to be monitored for its impact on prices, but she did not signal any urgent need to adjust policy. On this announcement the single currency, in a phase of consolidation against the dollar, regained some color at USD 1.183. Hit by headwinds in Brexit negotiations, the pound fell back to its lowest level. The cable is trading below USD 1.27 and the EUR/GBP parity at 0.924. The British currency will have lost nearly 5% since the beginning of the month against its major counterparts, validating a bearish pattern, especially since the atmosphere is becoming increasingly icy in negotiations between Europe and the UK. In Asia, the yuan remains strong against the dollar with a parity at CNY 6.84, an annual low for the greenback. China shows ambitions for a stronger currency to impose it as a reserve currency. In Turkey, the country is heading towards an exchange rate crisis due to a loss of confidence and a sharp depreciation of the lira, which is trading at TRY 8.8 against the euro, or 1400 basis points since last May. Correction of the cable  |

| Economic data In China, the trade balance came out above expectations, with a surplus of 417B (consensus 385B), while the CPI and PPI indices were in line with expectations, at +2.4% and -2% respectively. In Germany, industrial production disappointed (1.2% against 4.5% expected) but the trade balance improved to 18B. In France, it was -7B and industrial production rose by only 3.8% (consensus 5.1%). The only major statistic for the euro zone, GDP declined by 11.8% (-12.1% expected). In the US, the PPI and CPI indices rose by 0.3% and 0.4%. Weekly unemployment registrations remained unchanged at 884K, as last week, and oil inventories rose to 2% (consensus -3.1M). This week will be punctuated by data on activity on both sides of the Atlantic, U.S. housing figures and especially the Fed's monetary policy decision on Wednesday. |

| A period of consolidation The term consolidation can describe the course of investors' most popular stocks. The Nasdaq continues to evolve in excess and it is common to see lightning-fast declines in some stocks, like Tesla, which saw its valuation melt by 30% (following a peak of 520%) in just a handful of stock market sessions. In Europe, the under-exposure of continental indices to the technology sector partly explains this wide gap in index performance over the past few months. At the same time, the rise in the euro/dollar exchange rate is neutralizing to some extent the gains on US equities. |

By

By