|

Friday June 5 | Weekly market update |

| Financial markets had a near-perfect week, with a largely positive weekly balance sheet, thanks to encouraging macroeconomic data and hopes for a rapid recovery across the globe. New support measures announced by the ECB also fuelled traders' risk appetite, overshadowing the persistent tensions between China and the United States. |

| Indexes Over the past week, all major indices have risen and Wall Street is back to pre-coronavirus levels. In Asia, the Nikkei gained 4.5%, the Hang Seng recovered 7.88% and the Shanghai composite 2.7%. In Europe, the CAC40 is up 8%, while the Dax is up 8.5%, Portugal gained 7.2%, Spain 8.1% In the U.S, the Dow Jones is up 3.5%, the S&P500 is up 2.8% and the Nasdaq100 is up 1%, on its historical highs. Nasdaq100  |

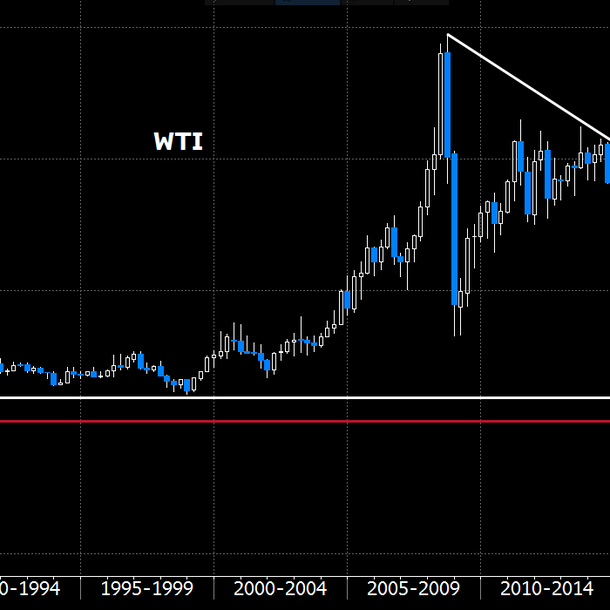

| Commodities The cartel's production reached its lowest level in 20 years. It fell to 24.77 mbpd (million barrels per day) in May, a drop of 5.91 mbpd compared to April. Initially scheduled for 9 and 10 June, the OPEC+ summit was brought forward to this weekend. Members of the enlarged Organization will focus on improving the rate of quota compliance, targeting Iraq in particular, which has promised to make up its shortfall by July. The market welcomes these results, with Brent thus settling above USD 40 a barrel, while WTI is trading at USD 38. The upward rally in equity markets is beginning to weigh on gold prices. The XXL gains recorded over the past three weeks in most financial markets are prompting traders to turn away from gold. However, this consolidation trend needs to be qualified, since gold has shown relative resilience, having lost "only" 3% since its peaks and rising by 12.80% since January 1. Silver is following the same path, losing ground over the week at USD 17.68. The sky is clearing on the hard commodities compartment. Benefiting from improved economic data from China, a return of risk appetite and the weakness of the greenback, base metal prices are recovering. Copper gained 2.2% to $5452 per metric ton. For the past 20 years, WTI has been highly volatile (graph in quarterly data).  |

| Equities markets Among the winners of the health crisis, TeamViewer ranks high. The German company took advantage of the additional demand for remote access solutions and the explosion of remote working, turning itself into a makeshift companion to get through this period of containment and it seems legitimate to imagine that its technological solutions will benefit from this craze in the future. At the end of March, this was reflected in results with a 75% increase in sales to €120m compared to €68.6m a year earlier. At the same time, the operating margin followed the same trend, increasing to 62%. The company anticipates total invoicing for the current financial year of € 450 million and a 56% margin. For its part, management clearly states its intentions: to seek opportunities to acquire interesting technologies, while investing significantly in R&D. These fundamental qualities have led to a breathtaking stock market performance since its IPO in September 2019. After a quick return on its IPO price, following the first wave of index declines, the stock quickly returned to investors' radar and jumped 90%, from €25 to €45. Such a performance places the stock on the podium of the TecDAx index, only beaten by Sartorius AG. Powerful rebound of the Teamviewer stock  |

| Bond market The meeting of the Governing Council of the ECB was a real event. Indeed, the euro area's monetary depositaries decided to increase the volume of the Emergency Pandemic Procurement Programme (EPPP, for short) by a total of €600 billion. In this still complex cyclical environment, a further dose of monetary policy accommodation seems justified. Instantly, the announcement led to a reduction in spreads on debt securities issued by peripheral countries. The Bund's yield rose to -0.29 (+20bp in one week) and the French OAT symbolically returned to positive territory (0.03%). Conversely, Italy benefited from this massive support plan and saw its ten-year borrowing rate fall to 1.41%, as did Spain at 0.56% and Greece in particular at 1.31%. For its part, the Swiss ten-year bond market is under slight pressure, with a rate of return rising to -0.37%, i.e. the level of mid-March. The upward trajectory of interest rates is also evident on the other side of the Atlantic with a Tbond at 0.83% (+18 basis points) as well as in Japan, where the bond benchmark is showing a positive yield, which has been far from the norm for the last two years. |

| Forex market By taking the decision to intervene massively and for longer, the ECB has given a boost to the euro (1.1350 against the greenback). This advance is being replicated against all currencies. It materializes, in fact, in a violent manner against the yen at JPY 123.7 (+ 300 points) and against the Swiss franc at CHF 1.08, marking a 2020 high. Japan recorded a record drop in household consumption in April (-11%), thus registering a seventh consecutive month below zero. In this euphoric market environment, traders were selling the Japanese currency, temporarily losing its safe haven status. It is currently trading at JPY 109.2 (-150 basis points). In the UK, the pound sterling is recovering against the note and is trading at USD 1.26 (+300 bps). This week's movement is in the southern hemisphere where the AUD is gaining ground on all its counterparts as the AUD/USD 0.69 and AUD/JPY at 76 yen. Recovery of the single currency against the yen  |

| Economic data On the macroeconomic front, the Caixin Manufacturing and Services PMI indices in China exceeded expectations at 50.7 and 55 respectively (consensus 49.7 and 47.4). The "official" PMI indices were in the consensus, above the 50 mark, which reflects a slight increase in activity. In the euro zone, the manufacturing and services PMI indices were also better than expected (39.4 and 30.5), as were the unemployment rate at 7.3% and retail sales down by 11.7% (consensus -15%). The PPI index, on the other hand, fell by 2% and German industrial orders fell by 25.8%. In the United States, the ISM Manufacturing index just missed the consensus (43.1 vs. 43.5 expected), while the ISM Services index exceeded expectations at 45.4 (44.2 expected and 41.8 last month). Industrial orders fell by 13% and the trade deficit widened to -49.4B. On employment, the ADP survey in the private sector was much better than expected, with "only" 2.76 million job losses (consensus -9 million). The unemployment rate fell surprisingly to 13.3% with the creation of 2.5 million non-agricultural jobs (consensus -7750K). |

| A V-shaped recovery Markets are euphoric. The recent intervention of the ECB to increase its support plan beyond expectations has boosted buying initiatives. Financial support for companies in difficulty, a revival in demand, a tightening of interest rate spreads, avoided dislocation of the euro zone, risk areas are being mitigated by monetary measures never used before by central banks. The recovery is moving very quickly, with sector allocations helping indices to rise, with purchases being made in sectors that were very neglected during the health crisis. |

By

By