They allow you to play the rise of the yellow metal while taking advantage of the growth potential of companies and a possible payment of dividends. A way to gain exposure to gold with more "breadth", shall we say.

Let's take a closer look at three stocks with good fundamentals.

Presentations of our champions

Wesdome Gold Mines Ltd. (WDO)

Wesdome Gold Mines is a gold producer engaged in mining (exploration, extraction, processing and reclamation). The amount of gold mined has increased by 290% from 2016 to 2020 to 90,278 ounces in 2020. The company aims to produce 200,000 ounces of gold in the next year from two mines Eagle River in Ontario and Mishi in Quebec and wants to become a major player in Canada.

Share Price Performance VS Gold Price in USD

Sources: Wesdome.com

K92 Mining Inc (KNT)

K92 Mining is engaged in the exploration and development of mineral deposits in Papua New Guinea, in particular the Kainantu gold mine which includes gold deposits. K92 Mining operates in one of the world's most gold-dense regions yet to be exploited (along with South America): the Pacific Islands. The company has been growing strongly since 2018 with sales increasing in two years from $70.9 million to $201 million in 2020.

Agnico Eagle Mines Limited (AEM)

Agnico is a well known player on Canadian soil and has a history of over 60 years. The company has several mines in Mexico, Canada and Finland, and exploration activities in the United States and Sweden. Agnico also mines silver, copper and zinc. The company has a long-term vision of value creation with steady growth in net asset value and is accumulating increasingly impressive gold reserves.

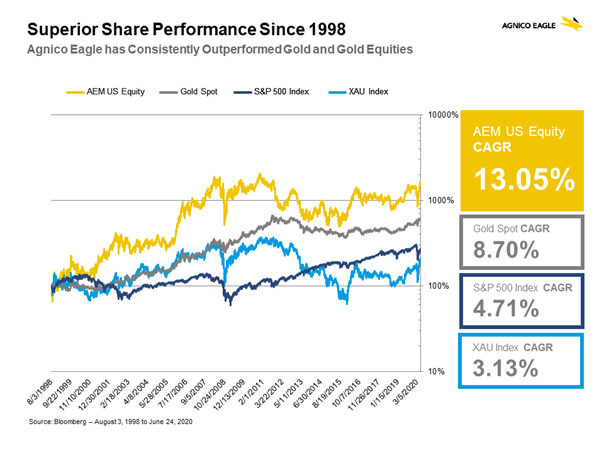

Share price performance since 1998

Source: Agnico Eagle Mines Ltd.

What they have in common

To evaluate the profitability of these various players, we took into account their all-in sustaining cost or AISC (more transparent than cash cost, which represents only the cost of operating the mine), which we subtracted from the average selling price per ounce of gold to calculate a net margin.

This AISC takes into account the development cost, which corresponds to the long-term investments or more commonly "CAPEX", the administrative costs of operation and finally, the costs related to the closure of a mine. It is therefore an indicator that is supposed to better reflect reality. This net margin, also known as the "breakeven point", corresponds to the minimum profitability threshold per ounce, which is essential in calculating the profitability of gold companies. The higher the price per ounce, the more this profitability follows an exponential curve.

Thus, mining companies can act as a lever on the price of gold. Indeed, when the price of an ounce of gold goes from $1,200 to $2,000, their margin is multiplied because their extraction cost remains the same. Anything above their breakeven point is their net margin.

The three champions of the day have excellent profitability levels in view of their netback (net margin calculated above) while having an acceptable valuation. They are therefore less dependent on the price of the ounce to be profitable.

They are also in very good financial health, with a special mention for Agnico's gold reserves (22 million ounces) which give it a safe haven status.

Two are smaller but fast growing players (K92 and Wesdome).

Conclusion

These three stocks have a good chance of improving in price based on their intrinsic fundamentals, at least as long as the price per ounce does not fall below the fateful $1200 mark.

For those who find the task of stock picking in the gold industry too complicated, you may well look at ETFs; in particular the one at iShares.

Our experts offer you a thematic list of gold and silver players right here .

By

By