Spot gold rose 0.3% to USD 1,800.40 in morning trading, but the weekly balance sheet is currently negative for the first time in five weeks. Facilitating gold's advance, the dollar weakened, making the precious metal more attractive to those holding other currencies. Gold continues to be surrounded as central banks are in no rush to raise interest rates. "Growth remains a very big concern for central banks," said Stephen Innes, managing partner at SPI AM.

Investors have been watching the Fed's signals closely, as gold, a yield-free asset, tends to benefit from the low-rate environment, while some see the barbaric relic as a hedge against higher inflation fueled by massive stimulus measures. And the signals have been mixed, with a recent Fed report showing the US economy "slowed slightly" in August. But a number of Fed officials said this week that the slowdown in job growth in August would not call into question plans to reduce asset purchases this year.

Despite the elevated macroeconomic risks, the Fed is unlikely to abandon its plans to cut support as early as 2021 and gold is expected to fall in the fourth quarter to around USD1,700, Citi Research said in a note.

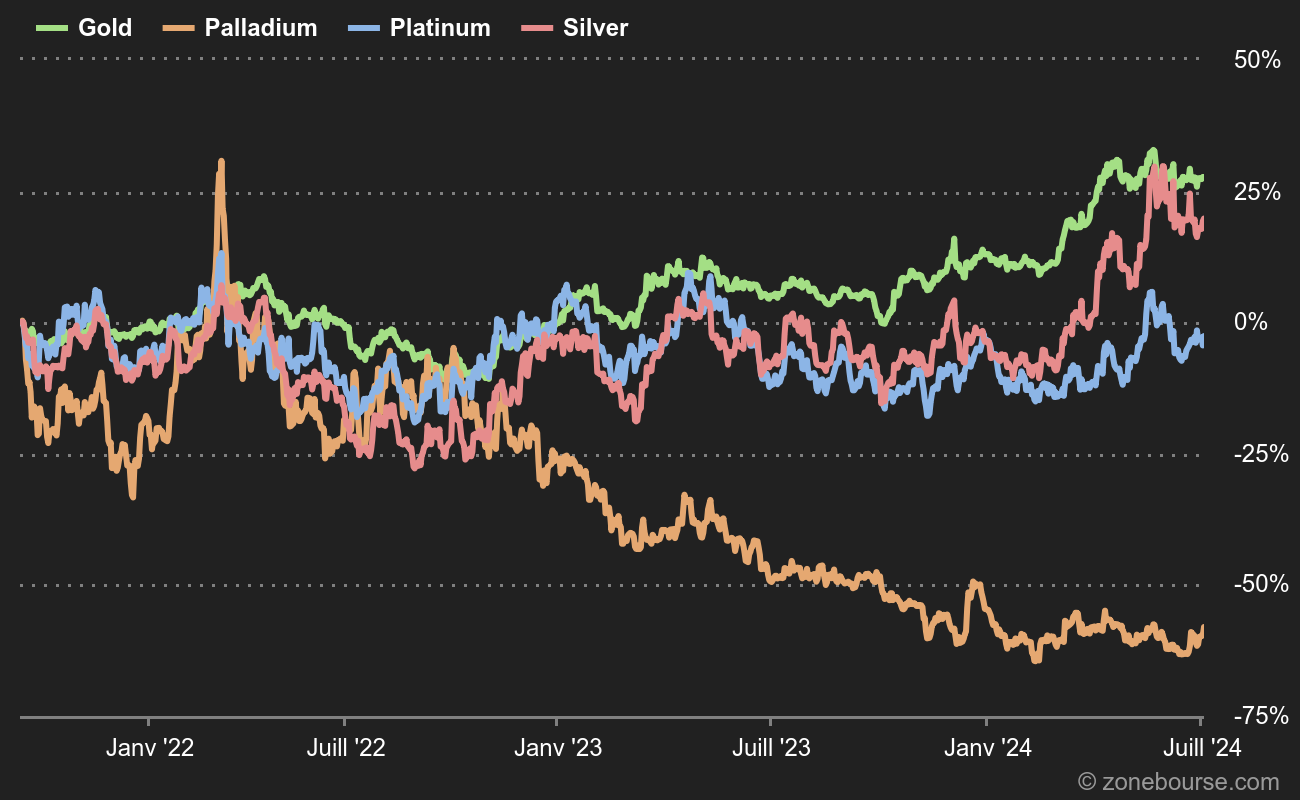

Silver was up 0.5% in morning trading at USD 24.20 an ounce, but is down 2% this week, while platinum has gained 0.4% to USD 981.19, but is down more than 4% on a weekly basis. Finally, palladium recovered 0.5% to USD 2,189.33 but is down 9% on the week.

By

By