Grain-based milk (soy, oats, spelt or rice), nut milk (cashew, almond, coconut), seed milk (hemp, sunflower, flax) or even legumes such as peas. Alternatives to cow's milk are spreading on supermarket shelves faster than a bowl of hot chocolate spilled on a breakfast table. While soy largely dominated the market for new dairy products in its early days, all "alternative" milk segments are now growing rapidly, on all continents. In Europe, the Americas, Asia, Australia and Russia, the boom in plant-based dairy products is showing attractive rates, justifying the multiplication of players and the interest of outsiders in the financial manna at stake.

Although this market is very mature in the United States, it is still expected to grow by 20% by 2020. More modestly, it is hovering around 8% growth in Australia, while Thailand claims 40% of consumers of plant-based dairy products. The non-dairy drinks sector grew by 24% in Europe in 2020, mainly driven by the United Kingdom (25% of consumers) and Germany, closely followed by the Netherlands, Belgium, France and Spain.

Among key players, there are pure players, small brands absorbed by large groups, and private labels.

A non-exhaustive list in Europe:

- ECOTONE: it is the European leader in organic food. It holds a string of brands, including Bjorg (pioneer of the French market, it holds a place of choice with 50% of market share in 2019), Bonneterre, Alter Eco, Clipper, Naturela, Destination and Evernat. In Germany, it owns Allos, Little Lunch. In the UK: Clipper, Whole Earth and Kallo. In Italy: Isola Bio. In Spain: El Granero. In the Netherlands: Zonnatura.

- TRIBALLAT NOYAL: this family business has been distributing the SOJASUN brand for three generations.

- OATLY: the world's number one in the sector, the Swedish pure player, born in 2016 and listed in the United States, first approached the major coffee shops to establish itself among the general public.

- DANONE: the French giant bought WhiteWave Foods in 2016 for $12.5 billion. The deal gave it a hand in ALPRO (which has about 13% of the sector's market share in France), and SILK, an oat milk brand.

- KOKO DAIRY: founded in 2010, the British company specializes in coconut milk.

- UPFIELD: the Dutch company owns the Flora and Blue Band brands.

- MORRISONS: the British distributor has entered the race with its own products.

- NUTRIOPS: the Spanish company markets the almond milk brand Ecomil.

- NESTLE: the Swiss company markets Wunda, a brand of vegetable milk based on pea proteins.

- ANDRITZ GROUP: the Austrian group, which specializes in the manufacture of industrial production equipment, also entered the plant-based beverage industry.

A non-exhaustive list in North America:

- CHOBANI, STARBUCKS, NESQUIK , DUNKIN: dairy brands are trying to catch up with the trend with the launch of oat milk products.

- ELMHURST: pure-player that has transformed itself from a traditional dairy player.

- HP HOOD: the traditional dairy company has launched its Planet Oat brand.

- PACIFIC FOODS: the vegan product specialist.

- CALIFIA FARMS : pure-player surfing on a fast growth on the other side of the Atlantic.

- THE HAIN CELESTIAL GROUP : on the niche market of organic and natural products, the group owns the brands Rice dream, Soy dream, and Westsoy.

- BLUE DIAMOND GROWERS: a specialist in the cultivation, processing and distribution of almonds, the American company owns the Almond Breeze brand.

- ARCHER DANIELS MIDLAND: a food giant specializing in oilseeds. RIPPLE FOODS: pure-players in alternative dairy products with pea proteins. DAIYA FOODS: pure-players in alternative dairy products.

And in Asia pacific:

FREEDOM FOODS GROUP: Australian group specializing in dairy products, which markets the SoNatural and MilLab brands.

Vegetal meat:

It is necessary to distinguish plant meat (or alternative meat) from artificial meat (or false meat). The former is intended to replace traditional meat, by imitating it but without animal proteins. It is composed of a vegetable protein base (soy, peas, mushrooms or beans, most often) to which fats, colorings and thickeners are added to give it a fleshy appearance. The second is grown in a laboratory, using animal stem cells

.

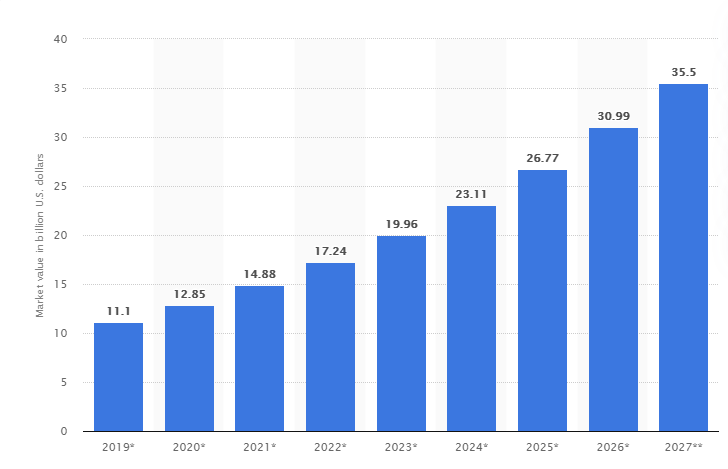

Forecast value of the global plant-based meat market between 2019 and 2027, in millions of dollars (Source: Statista)

The global alternative meat market totaled $19.5 billion in sales volume in 2019. Increasing rapidly, it should weigh 140 billion dollars in 2029 according to Barclays (i.e. 10% of the total meat products market), or 100 billion dollars in 2034 according to the more timid estimates of JPMorgan. During the lockdown period, the consumption of plant-based meat substitutes even jumped by 270% in the United States. Finally, investments in alternative protein startups increased by 178% in 2020.

The plant-based meat market is divided between pure-players and food giants, who have seen it as a growth lever to exploit. (This list is not exhaustive):

- BEYOND MEAT: the well-known American firm, launched in 2009, owes its success to its ability to reproduce the texture and taste of meat, as well as to its massive distribution network (McDonald's, KFC, Pizza Hut, etc.).s, KFC, Pizza Hut, Buffalo Grill, as well as all the Casino chains in France (Géant, Monoprix and Franprix ), Tesco in the United Kingdom, Delhaize in Belgium, Edeka in Germany, Coop in Sweden.

- IMPOSSIBLE FOODS: born in 2011, the brand has become established thanks to its partnership with Burger King and its presence in 7,000 American and Asian restaurants.

- GREENLEAF FOODS: with 40 years of experience, it operates the LightLife and Field Roast brands.

- SIMULATE: The US company, parent company of the Nuggs and Discs vegetable chicken brands.

- DARING FOODS: the latest American plant-based chicken producer.

- MOTIF INGREDIENTS: based in Boston, the start-up offers protein ingredients for other alternative meat producers.

- QUORN: a specialist in mycoprotein (mushroom-based), and a subsidiary of the Phillipine company

- MONDE NISSIN, the brand has launched into alternative chicken.

- TYSON FOODS: Although the largest exporter of American beef, the giant has entered the vegan market with its Raised and Rooted brand.

- SMITHFIELD FOODS: The world's largest pork producer, the American company has a dedicated line.

- MAPLE LEAF: Canada's largest meat company built the largest meat substitute plant in the U.S. in 2019 for $310 million.

- ZERO EGG: Unsurprisingly, the Israeli company produces eggs... without eggs!

- KELLOGG'S: With its Incogmeato brand, offers plant-based chicken.

- CHAROEN POKPHAND FOODS PLC: The Thai conglomerate introduced a range of plant-based products in 2020.

- NR INSTANT PRODUCE PCL: The listed Thai company started selling a fruit-based pork imitation, jackfruit, in 2016. By 2020, 7% of its revenue came from the sale of plant-based food.

Artificial meat:

3D meat, artificial meat, clean meat, lab meat, synthetic meat or in-vitro culture... there is no shortage of verbatim to define this new meat production. Authorized for consumption since last December in Singapore, this synthetic alternative still has a long way to go to reach the level of vegetable meat. The players in the sector are few and far between (non-exhaustive list).

- EAT JUST: The Californian start-up produces nuggets made from laboratory-produced chicken meat, which will soon be sold in restaurants in Singapore.

- MOSA MEAT: A Dutch-based "food tech" company, Mosa Meat has been working since 2013 on the in vitro culture of beef, based on cells taken from cows.

These FoodTech companies, halfway between new technologies and the food sector, enjoy strong investor interest: this market raised ?2.7 billion in Europe in 2020, according to DigitalFoodLab, which is only 12% of global FoodTech investments. Synthetic meat is still expensive to produce, but production costs are getting lower every year. Its adoption by populations is expected to further accelerate this trend: for exemple, 23% of Canadians say they are willing to consume lab-grown meat, while 80% of French millennials are inclined to add it to their diet.

By

By