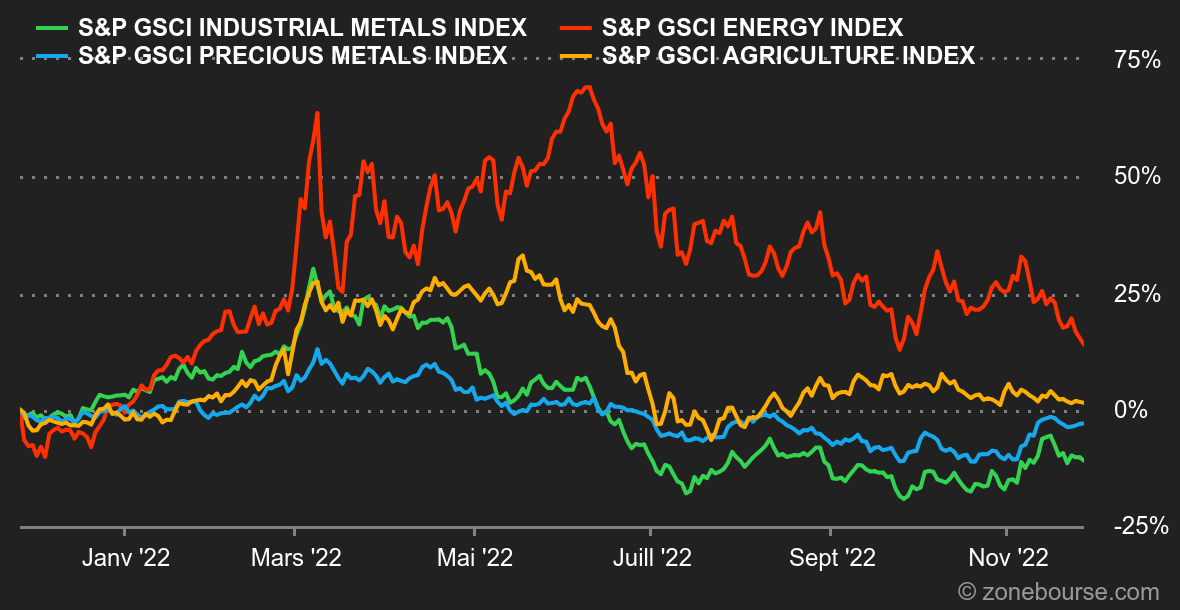

Energy: Oil markets remain under pressure and have once again lost ground in the past week. The European Union is reportedly considering a price cap for Russian oil of between $65 and $70. It should be noted that Russian oil is already trading at a significant discount to Brent (Urals is currently trading at around $67 per barrel). We can therefore deduce that this price ceiling should not affect Russian production that much. North Sea Brent is trading at around USD 81 while US WTI is trading at USD 74 per barrel. In Europe, gas prices are stabilizing around EUR 120/MWh for the Dutch reference (Rotterdam TTF). Russia is accusing Ukraine of storing gas in transit on its territory and destined for Moldova. Gazprom is thus threatening to reduce its flows via Ukraine.

Metals: Industrial metals were down overall, penalized by concerns related to new health restrictions in China. The circulation of the coronavirus is pushing the Chinese authorities to lockdown several cities and districts again. In other words, the market still has to wait to play out the scenario of an outright recovery in demand for metals. Copper is trading slightly above USD 8,000 per tonne on the LME. In precious metals, gold is treading water at USD 1,760. Also on the precious metals front, the World Platinum Investment Council is forecasting a deficit market for platinum next year, the first since 2020. The Institute points to strong demand from the automotive industry (whose needs are expected to grow by 3.3% year-on-year) while global supply is expected to grow by only 2%. Platinum is trading at around USD 988.

Agricultural commodity: Ukraine estimates that it will be able to export 13 million tons of wheat in the 2022/2023 season, a significant drop since the country exported nearly 20 million tons of wheat the previous year. Wheat is trading below 800 cents a bushel in Chicago, compared to 660 cents for corn.

By

By