Analysts cut their forward 12-month earnings estimates for Asian companies for a fifth consecutive month in June, citing the economic fallout from the coronavirus pandemic.

They lowered their estimates by 3.8% at end-June, after cutting their forecasts by 4.5% in May.

"Consensus estimates do not point to a return to pre-crisis EPS levels until the third quarter of 2021. And even this estimate is highly uncertain," said Daniel Morris, senior investment strategist at BNP Paribas Asset Management, referring to earnings per share (EPS).

"The timing of a vaccine is the most important factor determining how quickly companies can return to pre-crisis activity levels."

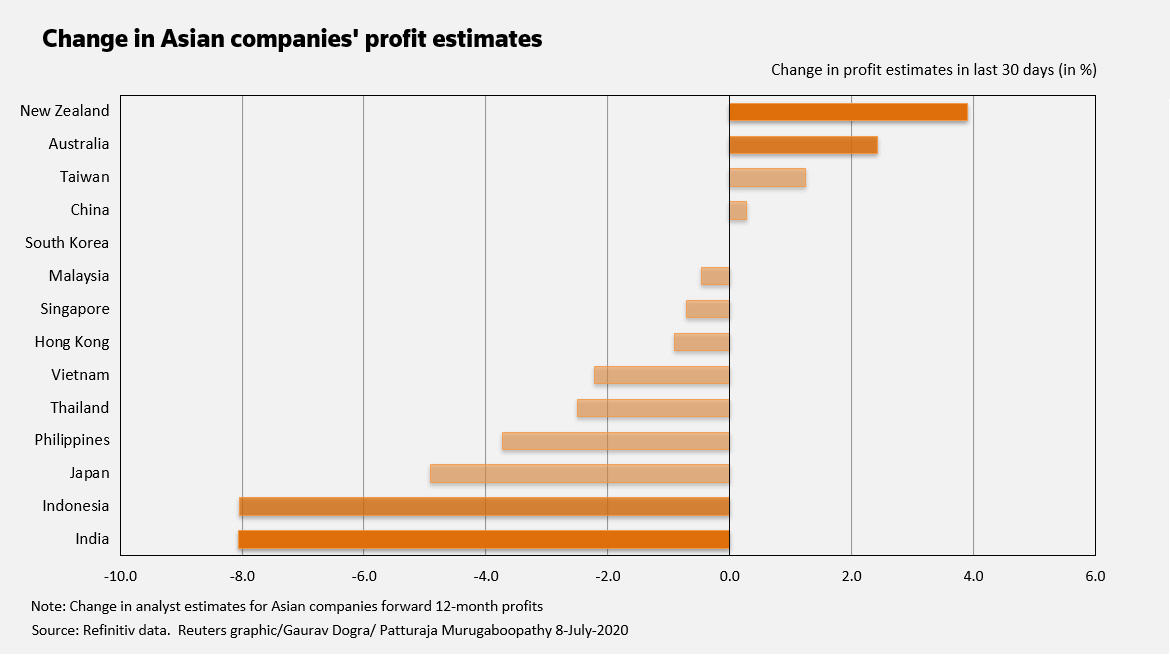

Over the past 30 days, analysts have slashed Indian firms' forward 12-month earnings forecasts by 8.05% - the steepest cut in Asia, Refinitiv data shows.

Graphic: Change in Asian companies profit estimates

Graphic: Change in Asian companies profit estimates this year https://fingfx.thomsonreuters.com/gfx/mkt/yxmpjlqdnpr/Change%20in%20Asian%20companies%20profit%20estimates%20this%20year.jpg

With over 700,000 coronavirus cases, India has overtaken Russia to record the world's third-highest number of infections, just behind the United States and Brazil.

Analysts lowered their forward 12-month earnings estimate for Indonesian firms by about 8% and for Japanese firms by 4.9%.

Among sectors, industrials and consumer discretionary sectors faced the biggest cut in forecasts.

Graphic: Asian companies' sector-wise profit estimates change https://fingfx.thomsonreuters.com/gfx/mkt/xlbpgomeqpq/Asian%20companies%20sector%20wise%20profit%20estimates%20change.jpg

Graphic: Asian companies sector-wise profit estimates change this year https://fingfx.thomsonreuters.com/gfx/mkt/rlgpdlqympo/Asian%20companies%20sector%20wise%20profit%20estimates%20change%20this%20year.jpg

(Reporting by Gaurav Dogra and Patturaja Murugbaoopathy in Bengaluru; Editing by Himani Sarkar)